Stock or stock investment portfolio volatility prediction method and device

A volatility and stock technology, applied in the field of information processing, can solve problems such as long calculation time and inaccuracy, and achieve the effect of reducing calculation time and high calculation accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

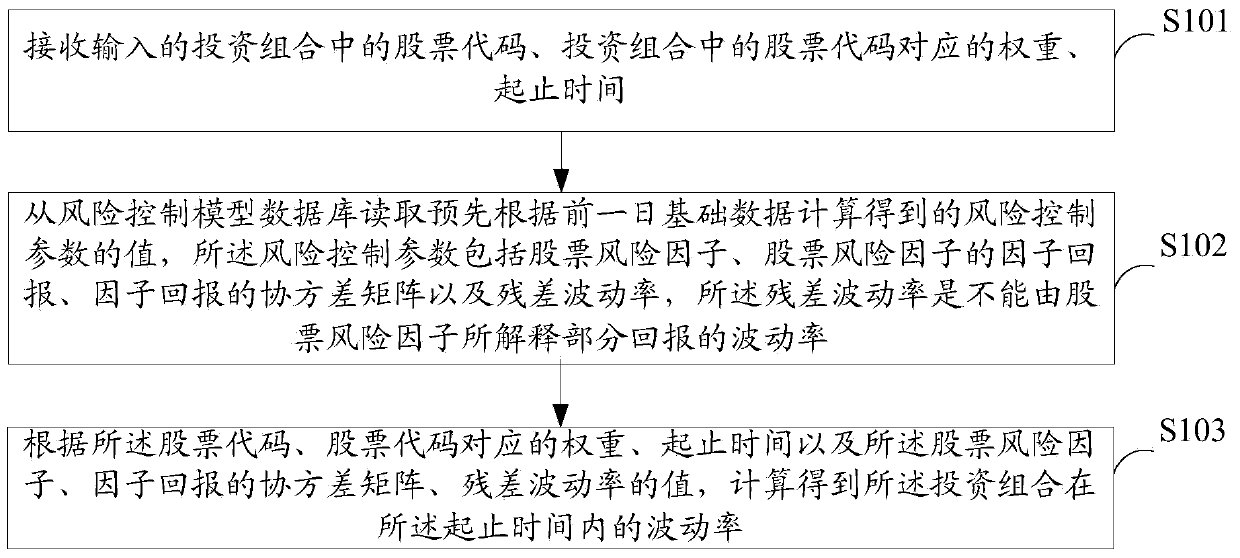

[0028] figure 1 It shows the implementation process of the method for predicting the volatility of stocks or stock portfolios provided by Embodiment 1 of the present invention, and is described in detail as follows:

[0029] In step S101, the stock codes in the investment portfolio, the weights corresponding to the stock codes in the investment portfolio, and the start and end times are received.

[0030] In this embodiment, when an investor constructs an investment portfolio, the stock code of each stock in the investment portfolio to be constructed can be input to the forecasting device of the stock or stock portfolio volatility through input devices such as a keyboard or a touch screen. The weight corresponding to the stock code, and the start and end time of the volatility that needs to be predicted. The investment portfolio may include one stock or multiple stocks, which is not limited in this embodiment.

[0031] In step S102, read from the risk control model database ...

Embodiment 2

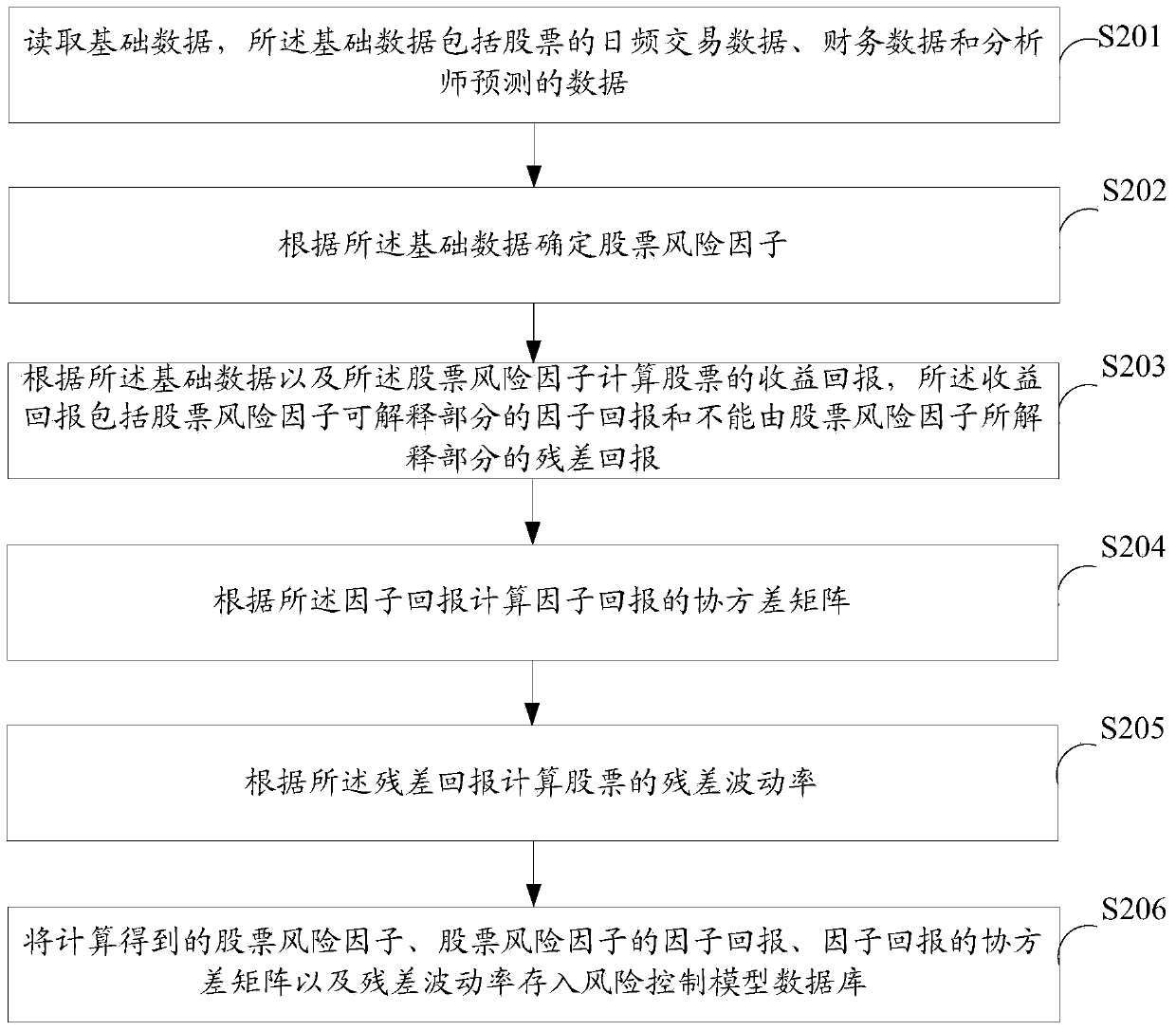

[0047] figure 2 It shows the implementation flow of the calculation of the value of the risk control parameter provided by the second embodiment of the present invention, which is described in detail as follows:

[0048] In step S201, basic data is read, and the basic data includes daily stock trading data, financial data, and data predicted by analysts.

[0049] In this embodiment, the basic data includes daily stock trading data, financial data and analyst forecast data. When reading the basic data, the basic data can be directly read from the basic database.

[0050] In order to improve the efficiency of data extraction, when the basic data is read for the first time in this embodiment, the basic data is directly read from the basic database, and then the read basic data is stored in a local cache file; When reading the basic data, the local cache method is used to read the basic data from the locally cached files. This can reduce the data interaction between the stock ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com