Management system of evaluation, mortgage, loan and tax for housing transaction

A management system and housing technology, applied in the fields of mortgage, housing sales evaluation, loan and tax management system, can solve the problems of bank loan bad debt risk, transaction information asymmetry, etc., to enhance tax collection, reduce loan risk, improve The effect of work efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

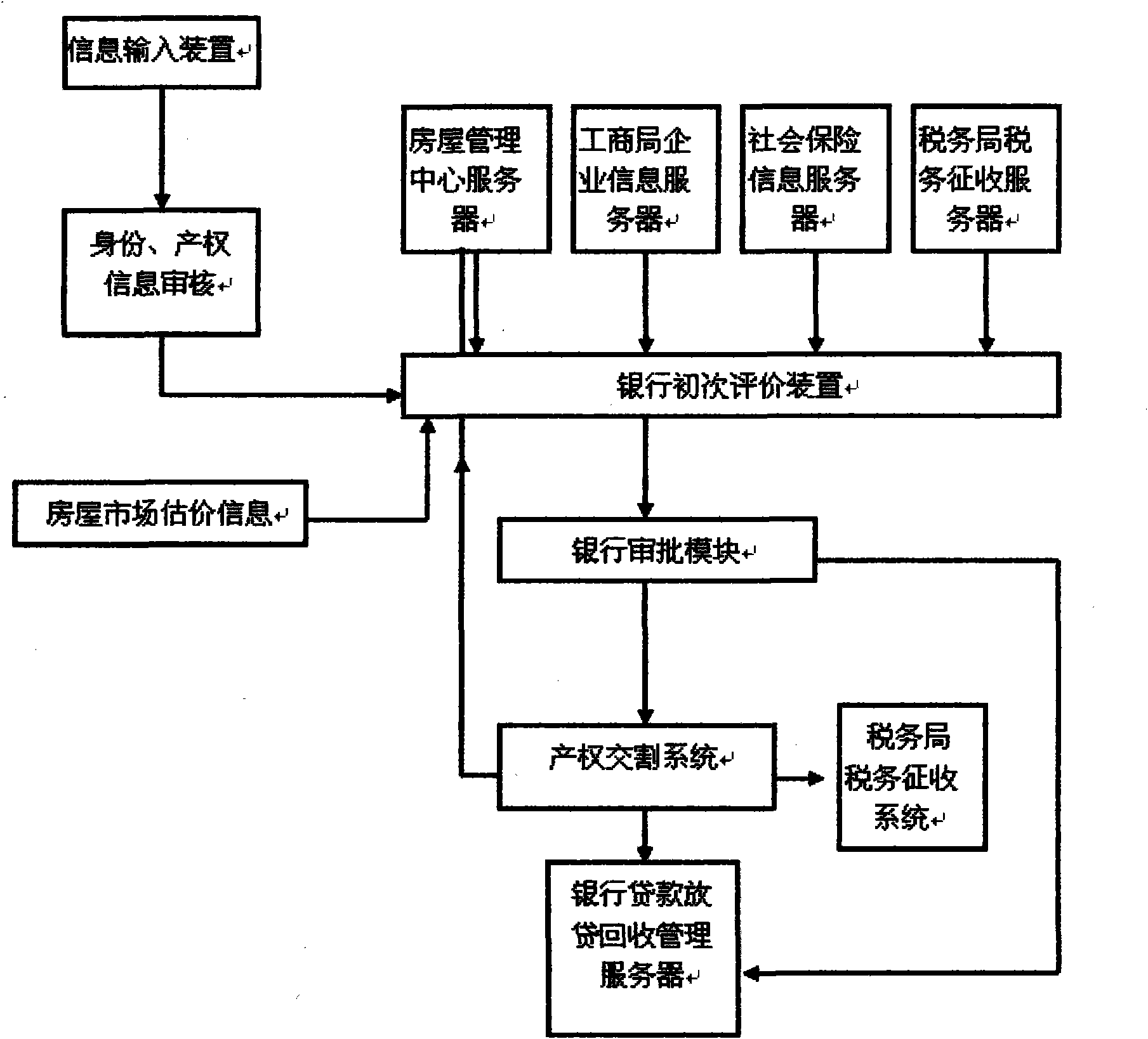

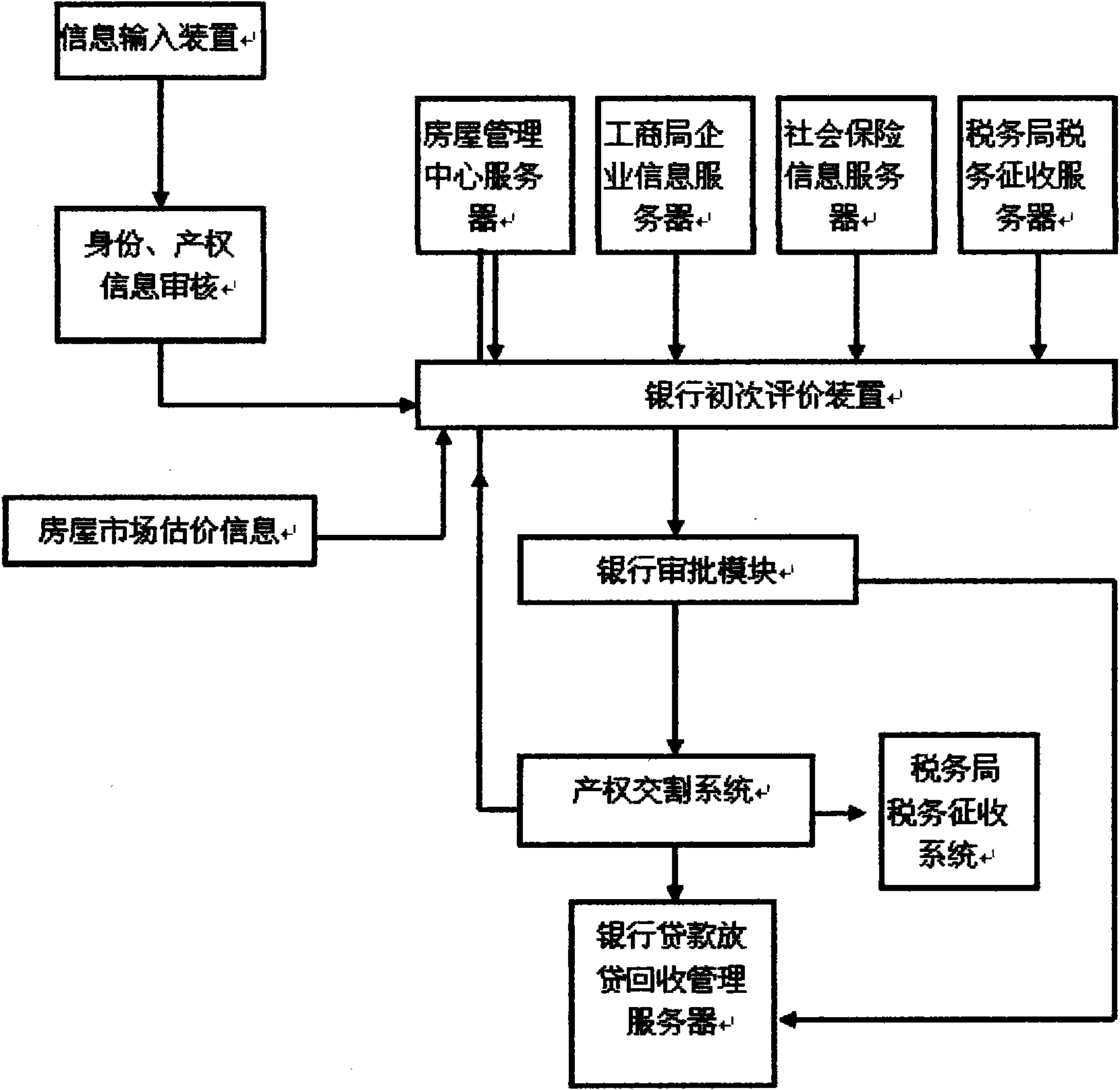

[0017] Combine below figure 1 , the present invention is further described:

[0018] An evaluation, mortgage, loan and tax management system for house sales, mainly including an information input device, a bank's initial evaluation device, a property rights delivery system, and a tax collection system for the tax bureau. Banks or guarantee companies or housing intermediaries input house purchase and sale information The above-mentioned information input device, after the information is input, the information of the house buyer and the house seller is reviewed through the verification of identity and property rights information;

[0019] The approved information is transmitted to the bank's initial evaluation device, and the bank's initial evaluation device reads the house, the buyer's enterprise information, Credit information, social security information and tax payment information;

[0020] The bank's initial evaluation device obtains the housing market valuation P based o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com