Quantitative investment strategy design and investment portfolio generation method based on machine learning

A machine learning and strategy technology, applied in the field of intelligent finance, can solve problems such as the inability to accurately meet the real-time investment needs of investors, large differences in investment strategy levels, and limited personal knowledge of strategy researchers, so as to improve investment returns and reduce investment costs. The effect of investment risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

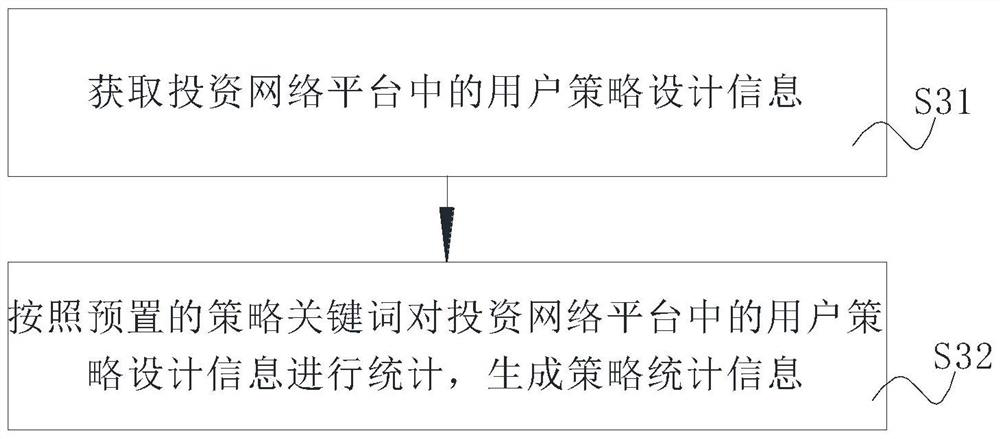

[0051] like Figure 1-Figure 4 As shown, in the first aspect, an embodiment of the present invention provides a method for designing quantitative investment strategies and generating investment portfolios based on machine learning, including the following steps:

[0052] S1. Obtain and construct an investment basic framework model according to the basic information of financial products;

[0053] Further, the above-mentioned method for constructing an investment basic framework model includes:

[0054] S11. Acquire and extract type data, term data, amount data, object data and investment method data in the basic information of the financial product;

[0055] S12 , constructing an investment basic framework model according to various types of data, duration data, amount data, object data and investment method data, using type, duration, amount, object and investment method as basic parameters.

[0056] In some embodiments of the present invention, in order to improve the desi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com