Real estate loan business risk assessment method and device

A risk assessment, real estate technology, applied in instruments, complex mathematical operations, finance and other directions, can solve the problems of dynamic assessment of the loss given default rate of real estate loan business, and unable to dynamically assess the loss given default of real estate loan business, etc., so as to realize the risk of default. , to achieve the effect of dynamic evaluation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0019] In order to make the purposes, technical solutions and advantages of the embodiments of the present invention more clearly understood, the embodiments of the present invention will be further described in detail below with reference to the accompanying drawings. Here, the exemplary embodiments of the present invention and their descriptions are used to explain the present invention, but not to limit the present invention.

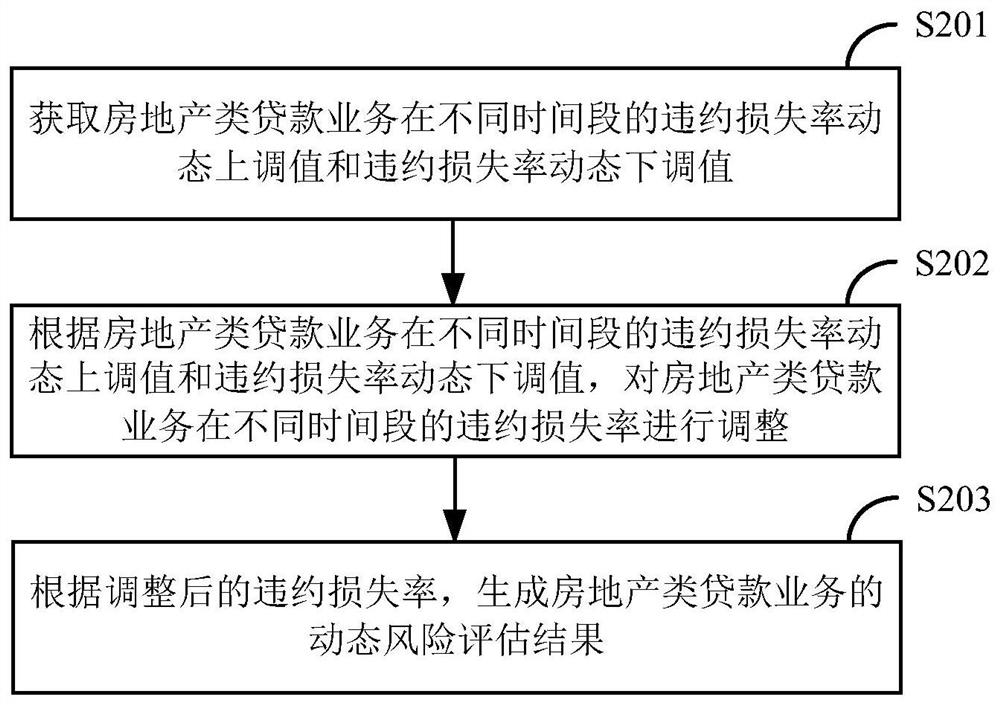

[0020] An embodiment of the present invention provides a real estate loan business risk assessment method, figure 1 It is a flowchart of a risk assessment method for real estate loan business provided in the embodiment of the present invention, such as figure 1 As shown, the method includes the following steps:

[0021] S101. Collect dynamic attribute information of the real estate mortgaged by the real estate loan business in different time periods, wherein the dynamic attribute information includes: one or more attribute information that affect ch...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com