User loan willingness prediction method and device and computer system

A prediction method and user technology, applied in the field of machine learning, can solve the problems of uncertain accuracy, limited learning ability, high labor cost, etc., and achieve the effect of improving accuracy and efficiency, avoiding inaccurate prediction, and shortening the time period

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 2

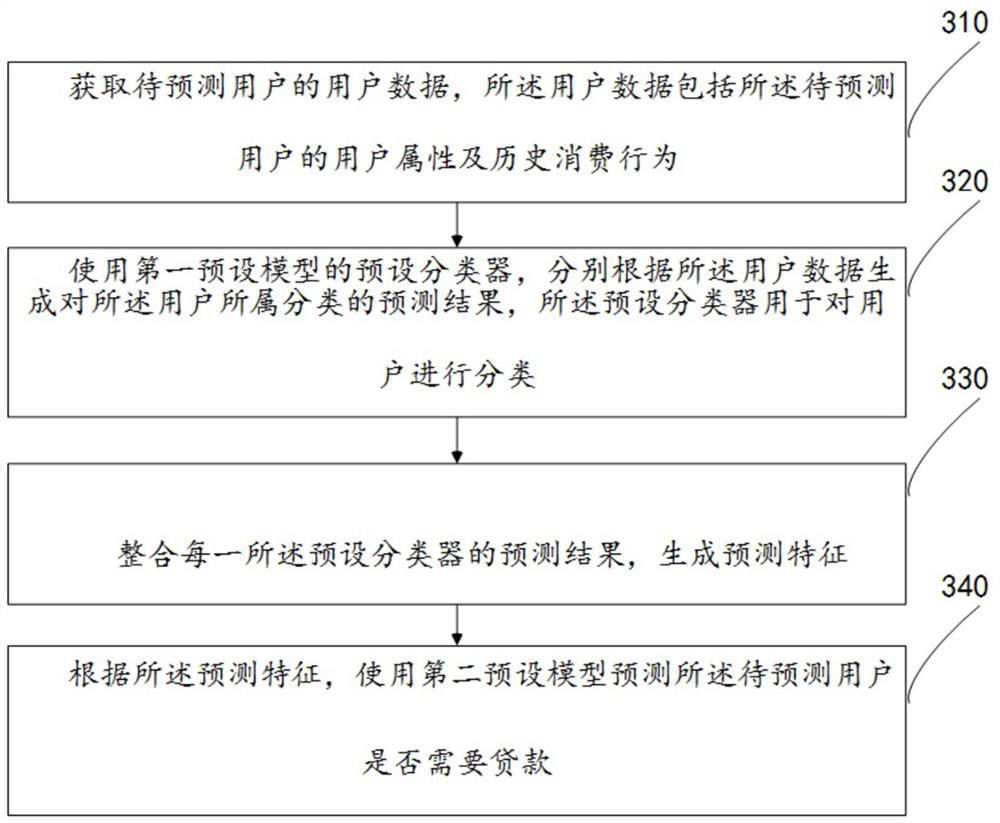

[0071] Corresponding to the above examples, such as image 3 As shown, this application provides a method for predicting the user's willingness to lend, the method comprising:

[0072] 310. Acquire user data of the user to be predicted, where the user data includes user attributes and historical consumption behavior of the user to be predicted;

[0073] 320. Using a plurality of preset classifiers of the first preset model to respectively generate prediction results of the category to which the user to be predicted belongs to according to the user data, the preset classifiers are used to classify the user;

[0074] 330. Integrate the prediction results of each of the preset classifiers to generate prediction features;

[0075] 340. According to the prediction feature, use a second preset model to predict whether the user to be predicted needs a loan.

[0076] Preferably, the method comprises:

[0077] 350. When it is predicted that the user to be predicted needs a loan, det...

Embodiment 3

[0091] Corresponding to the above method embodiment, such as Figure 4 As shown, the present application provides a device for predicting a user's willingness to lend, which includes:

[0092] An acquisition module 410, configured to acquire user data of the user to be predicted, the user data including user attributes and historical consumption behavior of the user to be predicted;

[0093] The processing module 420 is configured to use a plurality of preset classifiers of the first preset model to respectively generate a prediction result of the category to which the user to be predicted belongs to according to the user data, and the preset classifier is used to classify the user ; Integrating the prediction results of each of the preset classifiers to generate a prediction feature; according to the prediction feature, using a second preset model to predict whether the user to be predicted needs a loan.

[0094] Preferably, the device includes a training module 430, configu...

Embodiment 4

[0102] Corresponding to the above method, device, and system, Embodiment 4 of the present application provides a computer system, including: one or more processors; and a memory associated with the one or more processors, and the memory is used to store program instructions , when the program instructions are read and executed by the one or more processors, the following operations are performed:

[0103] Obtaining user data of the user to be predicted, the user data including user attributes and historical consumption behavior of the user to be predicted;

[0104] Using a plurality of preset classifiers of the first preset model to respectively generate prediction results for the category to which the user to be predicted belongs according to the user data, the preset classifiers are used to classify the user;

[0105] Integrating the prediction results of each of the preset classifiers to generate prediction features;

[0106] According to the prediction feature, a second p...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com