Loan credit granting platform and credit granting method thereof, credit granting equipment and readable storage medium

A technology for lending and lending parties, applied in the financial field, can solve problems such as financial platform economic loss, risk of increasing credit, and loan user evaluation lag, and achieve the effects of avoiding economic loss, improving accuracy, and reducing risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0048] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

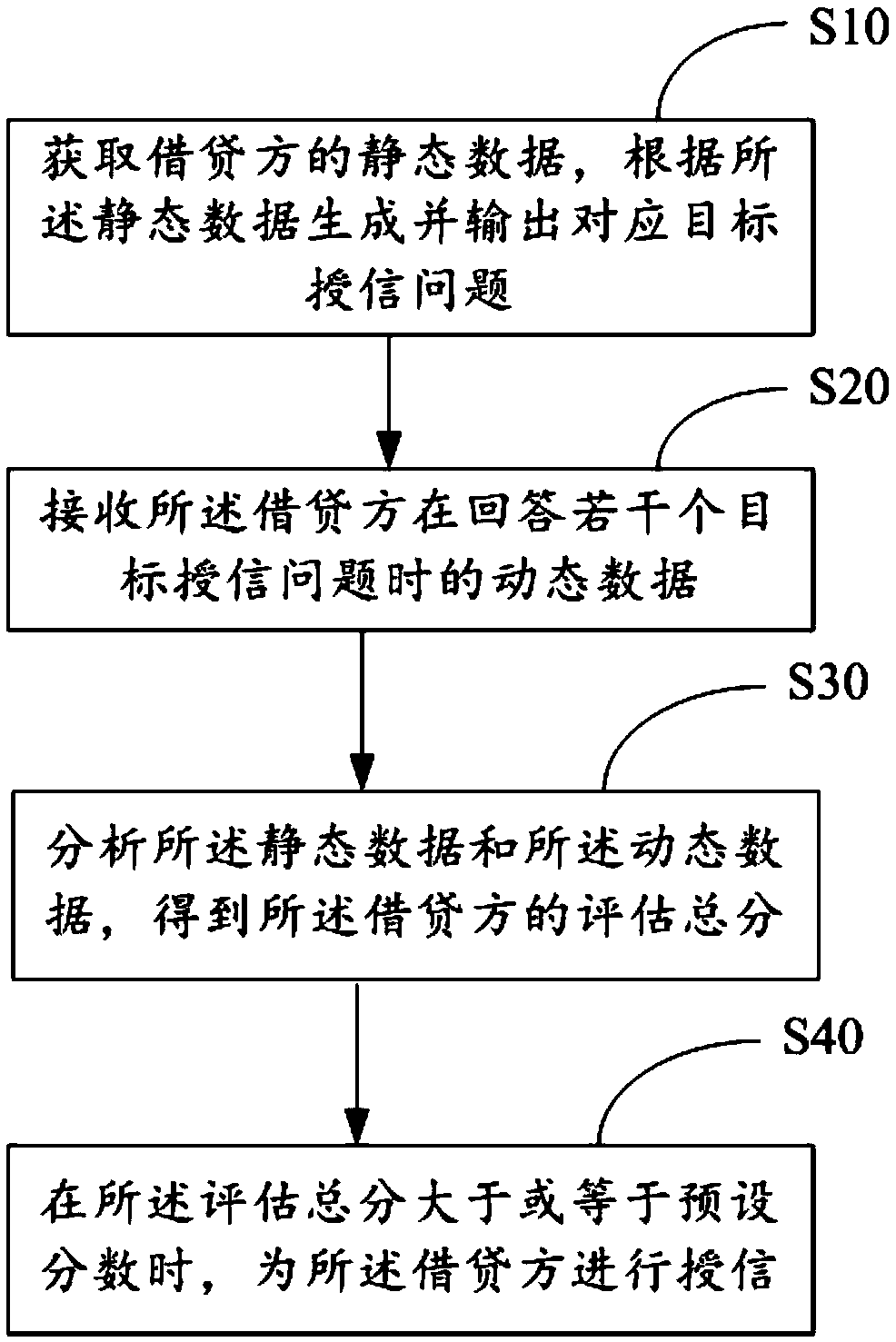

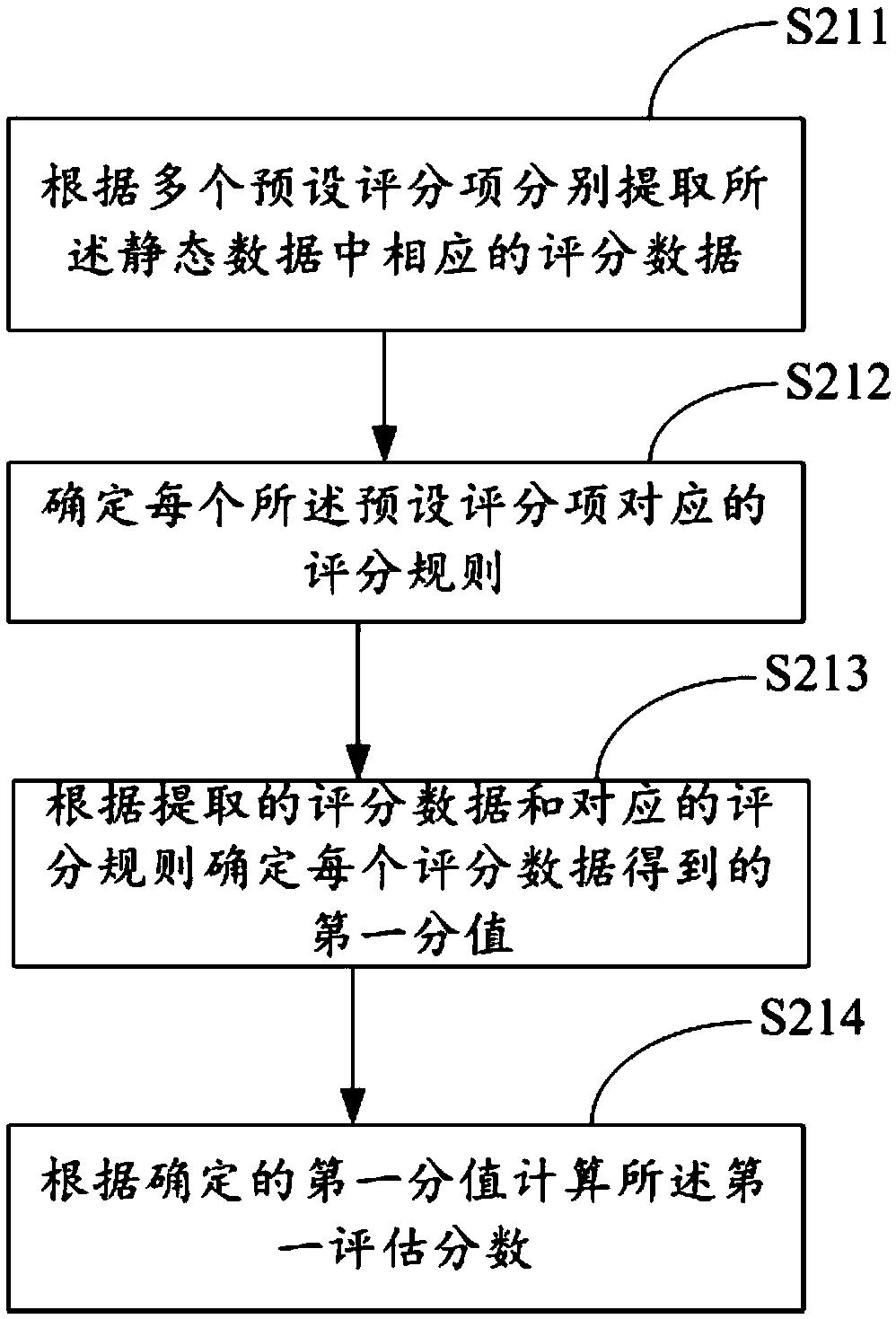

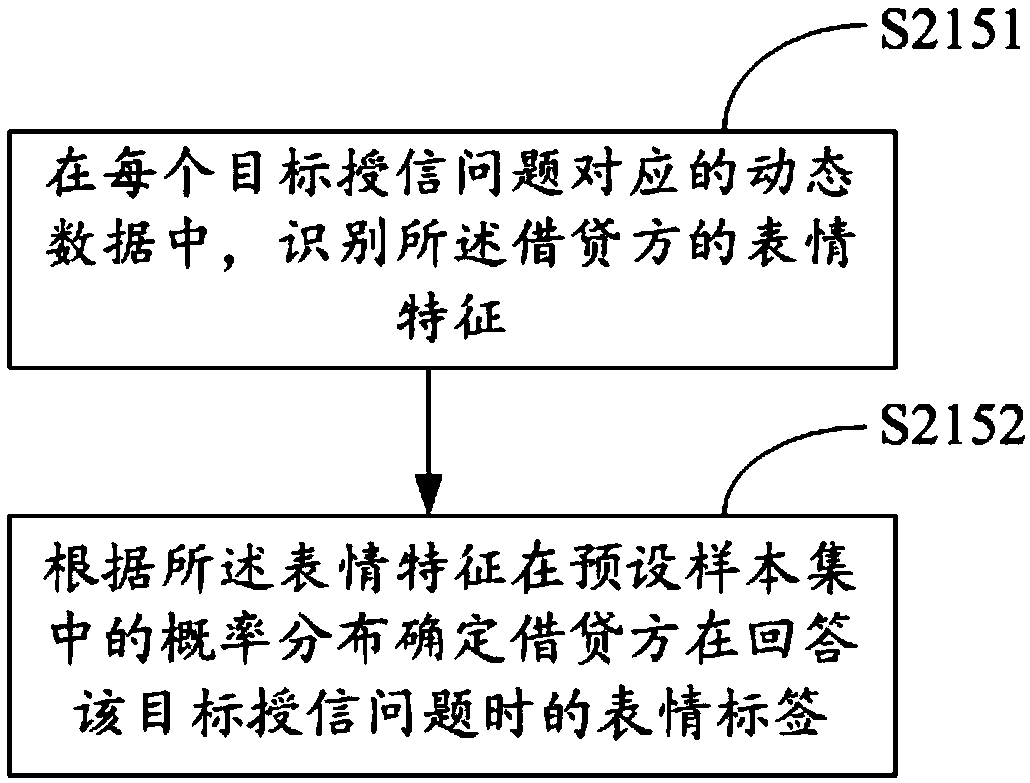

[0049] The main solution of the embodiment of the present invention is: obtain the static data of the lender, generate and output the corresponding target credit question according to the static data; receive the dynamic data when the lender answers several target credit questions; analyze the static data and the dynamic data to obtain the total assessment score of the lender; when the total assessment score is greater than or equal to a preset score, credit is granted to the lender.

[0050] Due to the existing technology, only the static data of loan user history is used to evaluate loan users, which has a certain lag and one-sidedness.

[0051] The present invention provides the above-mentioned solution to improve the accuracy of risk assessment for lending users, reduce the risk of lending credit, and avoid unnece...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com