Internal-data-mining-based method and system for loan client obtaining, loan origination and management for commercial banks

An internal data and banking technology, applied in data processing applications, electronic digital data processing, special data processing applications, etc., can solve the problems affecting the accuracy of commercial bank loan evaluation, limited data dimensions, and lack of formation, to support the stability of enterprises Manage and evaluate the effects of science

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

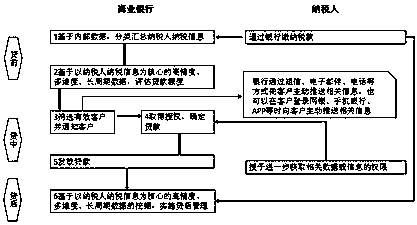

[0015] The specific implementation of the present invention includes: before lending, based on internal data, taxpayer tax payment information is classified and summarized; based on high-precision, multi-dimensional, long-term data with taxpayer tax payment information as the core, loan amount is evaluated. During the loan process, based on the evaluation based on the loan amount, the effective customers are screened and the customers are notified; the loan amount is determined based on other information authorized by the customer; and the loan is issued based on online and other channels. After the loan, based on the mining of high-precision, multi-dimensional, and long-term data centered on the taxpayer's tax information, the post-loan management is implemented.

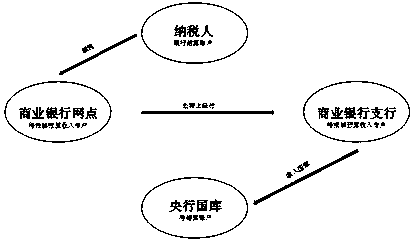

[0016] On the basis of internal data, classifying and summarizing taxpayer tax information. Specifically, it refers to: According to the "Administrative Measures for Commercial Banks and Credit Cooperatives Acting ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com