Enterprise credit rating method

An enterprise and credit technology, applied in the field of credit rating of small and medium-sized enterprises, can solve the problems that the financial indicators cannot objectively reflect the financial status of the enterprise, the authenticity cannot be guaranteed, and the objectivity and fairness of the rating results are discounted.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0020] When the application of SME credit rating generally needs to use this model for analysis, more than 100 enterprise data must be selected to ensure the accuracy of the comparison.

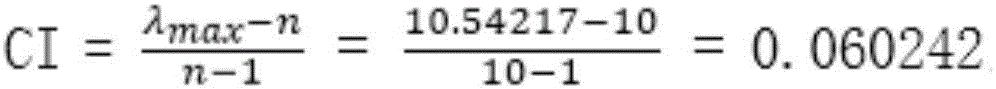

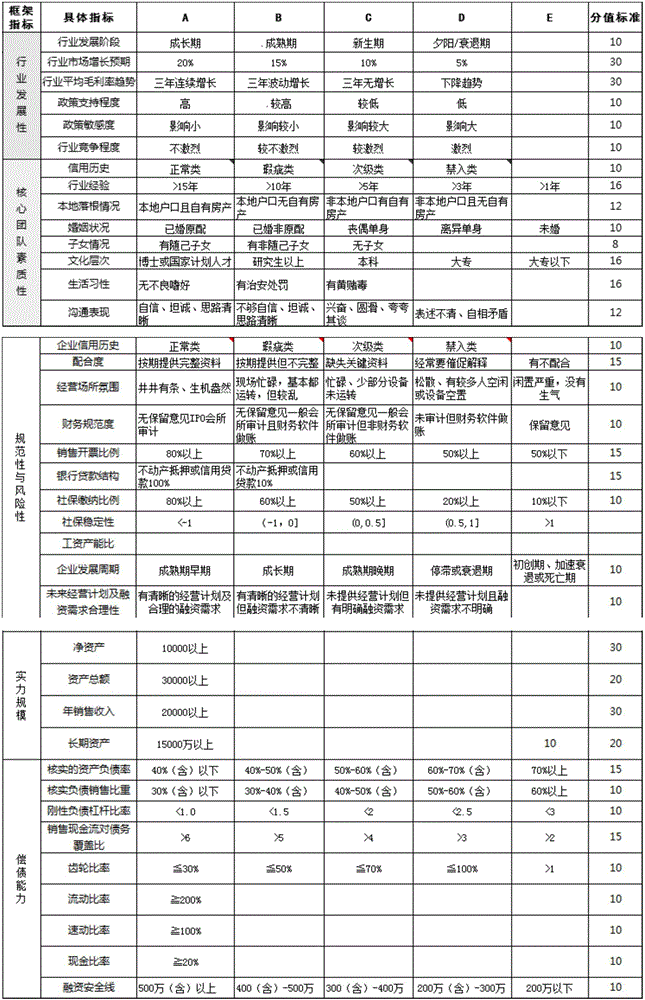

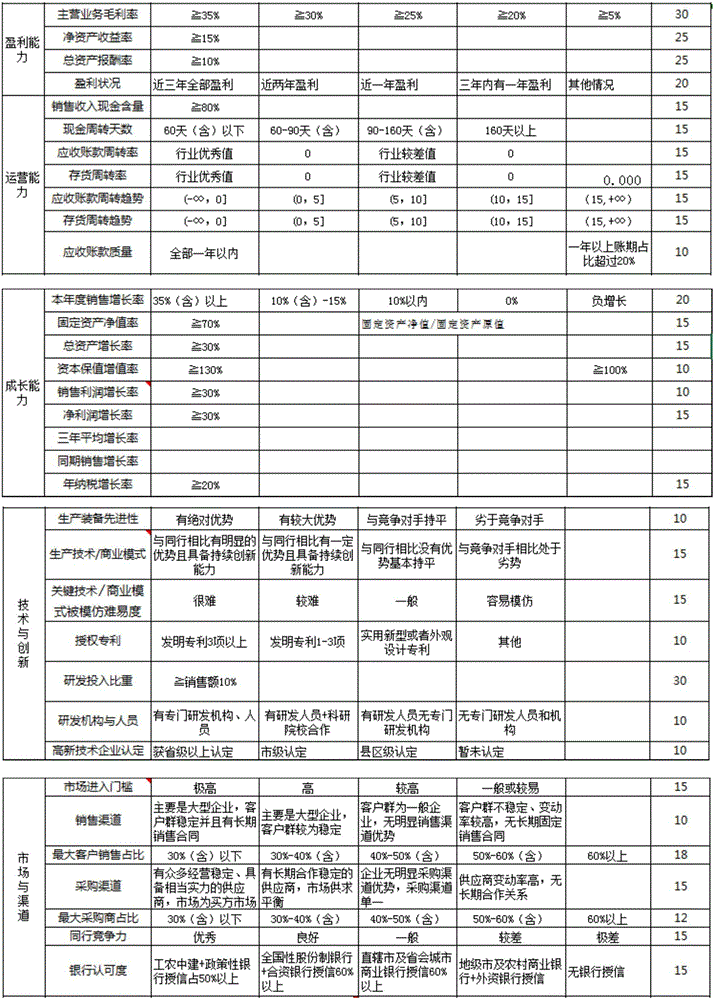

[0021] We believe that the index system of credit rating for SMEs in my country consists of three layers: the first layer is the decision-making layer, which is used to identify the quality of corporate credit; "; the third layer is the detailed index, which is used to support the secondary index. Therefore, the AHP can be used to determine the weight of each indicator; at the same time, the original data required in the AHP is the value of the judgment matrix obtained from the analysis of the collected data in the credit rating work on the basis of theoretical research. The specific implementation steps are as follows:

[0022] Step 1. We believe that the indicators that can be used for relatively comprehensive quantitative analysis of corporate credit status mainly include: industry develop...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com