Personal credit data processing method and device

A data processing and data technology, applied in the field of Internet technology and big data processing, can solve the problems of difficult and fast acquisition, lack of fair standards, low credibility, etc., and achieve the effect of objective evaluation results

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

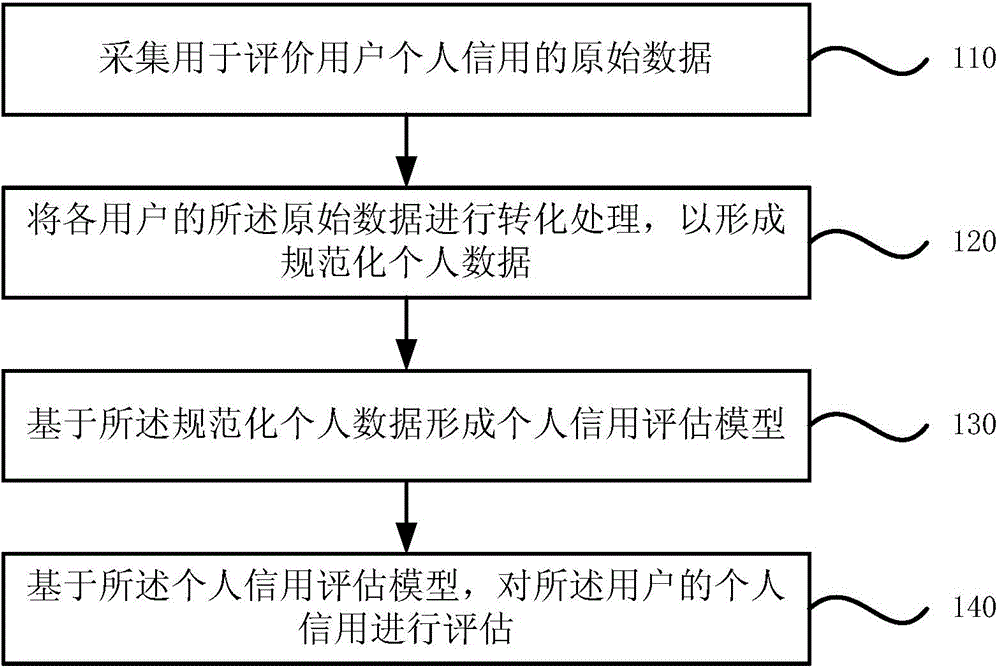

[0023] figure 1 It is a flow chart of a method for processing personal credit data provided by Embodiment 1 of the present invention. This embodiment is applicable to collecting various personal data of users and using them to evaluate personal credit. The method can be executed by a personal credit data processing device, and the device can be implemented in the form of hardware and / or software. The method specifically includes the following:

[0024] S110. Collecting raw data for evaluating the user's personal credit;

[0025] The above operations can be to obtain various data that can be used to evaluate the user's personal credit from a variety of data sources and in a variety of collection methods, which can be used as raw data. Data sources, collection methods, and data content can all be set based on evaluation needs, and can also be updated and added based on evaluation effects and technological development. The specific content will be described in detail later in t...

Embodiment 2

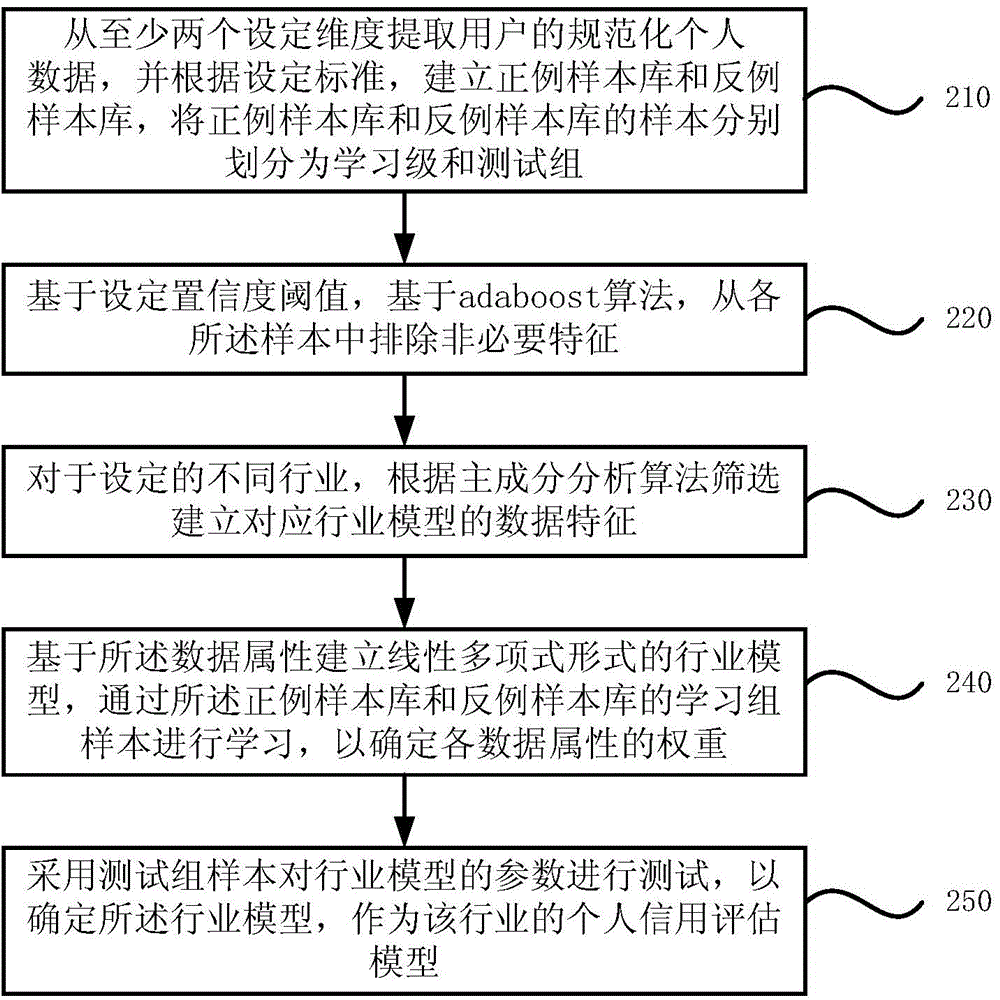

[0086] figure 2 A flow chart of a method for processing personal credit data provided by Embodiment 2 of the present invention. Based on the foregoing embodiments, the method further provides an implementation plan for forming a personal credit evaluation model based on the standardized personal data, including the following:

[0087] S210. Extract the user's standardized personal data from at least two set dimensions, and establish a positive sample library and a negative sample library according to the set standards, and divide the samples of the positive sample library and the negative sample library into learning level and test respectively. Group;

[0088] The user's standardized personal data can be bound to the user's personal unique ID number, and a positive and negative sample library with complete data can be established.

[0089] Taking the lawyer industry as an example, first of all, through raw data collection and data conversion processing, standardized persona...

Embodiment 3

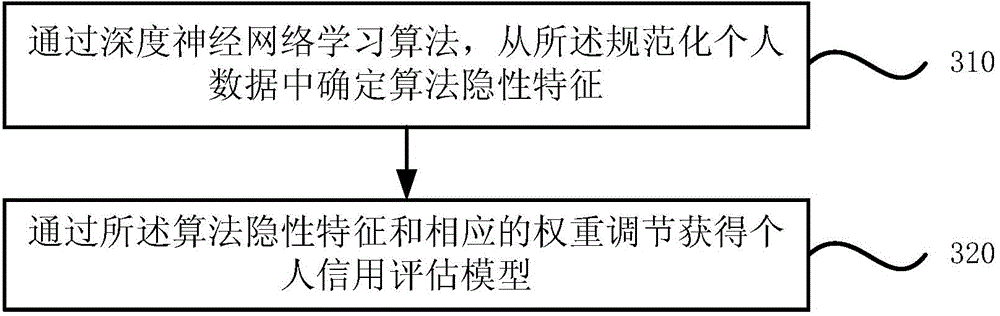

[0100] image 3 A flow chart of a method for processing personal credit data provided by Embodiment 3 of the present invention. Based on the foregoing embodiments, the method further provides an implementation scheme for forming a personal credit evaluation model based on the standardized personal data, including the following:

[0101] S310. Determine the hidden features of the algorithm from the normalized personal data through the deep neural network learning algorithm;

[0102] Algorithmic recessive features, also known as high-dimensional features, are determined based on the low-dimensional features of normalized personal data, which can be used by the algorithm to distinguish the results, and belong to the intermediate features that the learning algorithm relies on. The hidden features of the algorithm can be identified and determined by the deep neural network learning algorithm based on massive calculations based on massive normalized personal data.

[0103] S320. Ob...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com