Finance modeling optimization method based on information self-circulation

An optimization method and self-circulation technology, applied in finance, instruments, data processing applications, etc., can solve problems such as perfecting models, achieve short-term, low-cost, and avoid difficulties

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

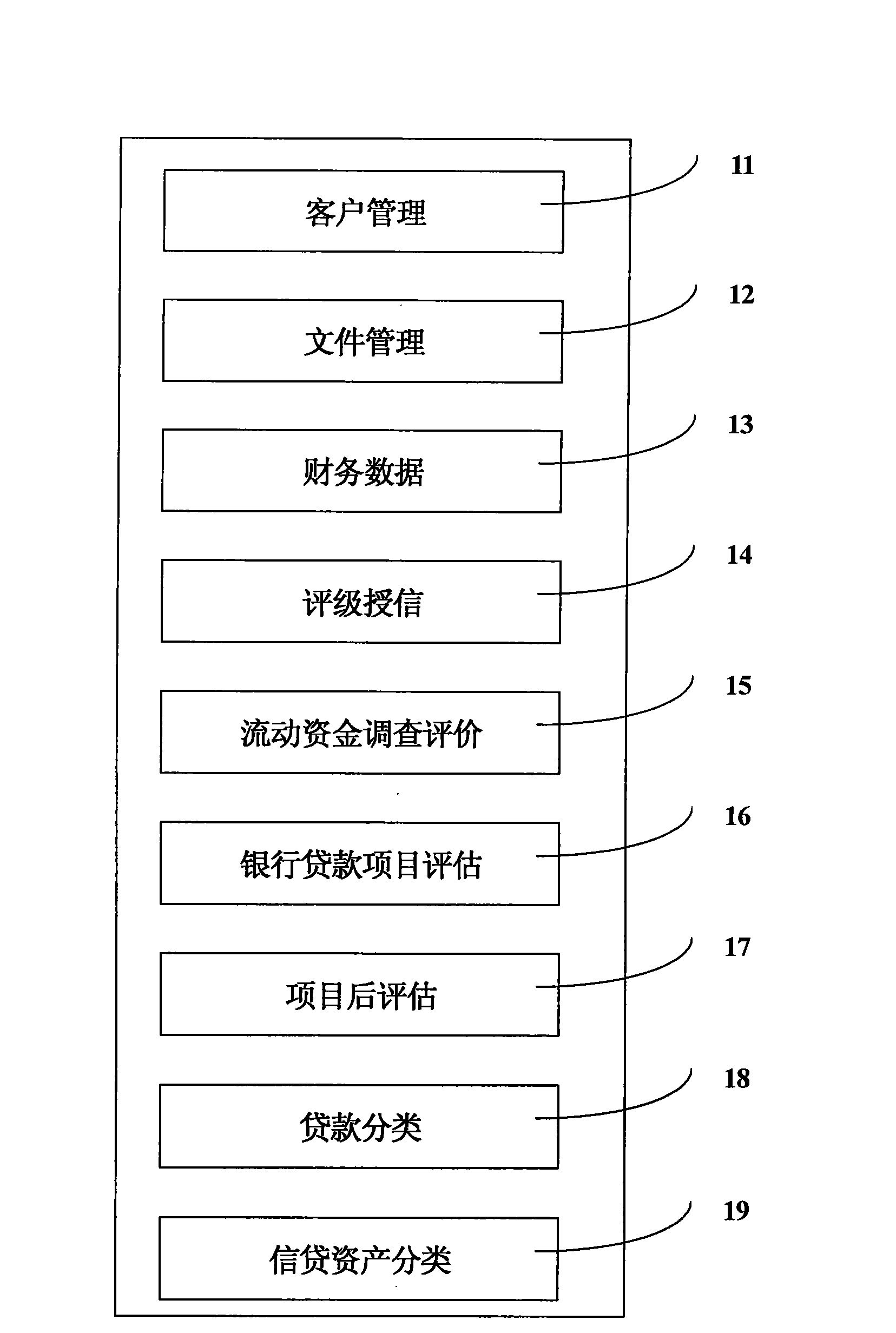

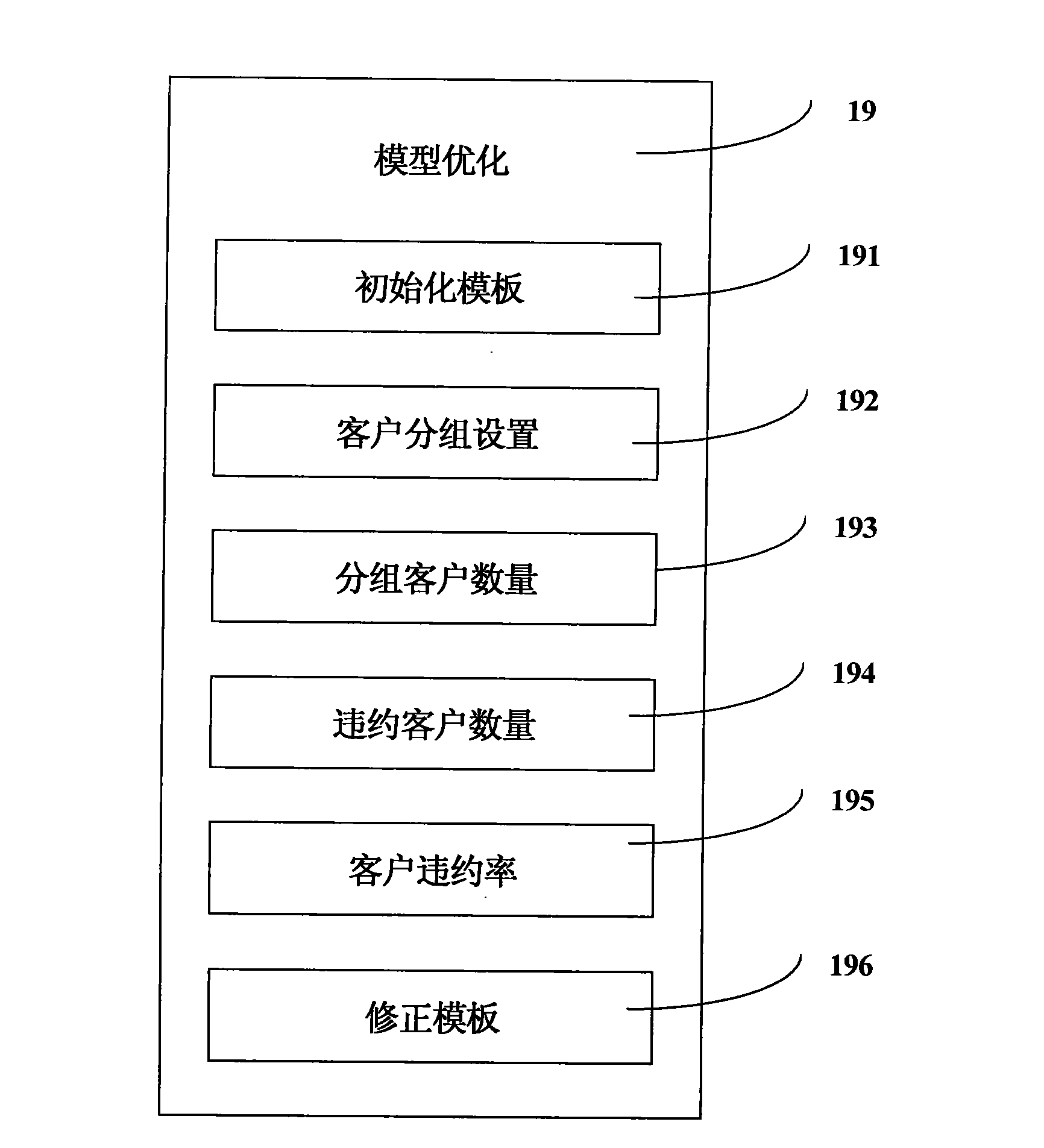

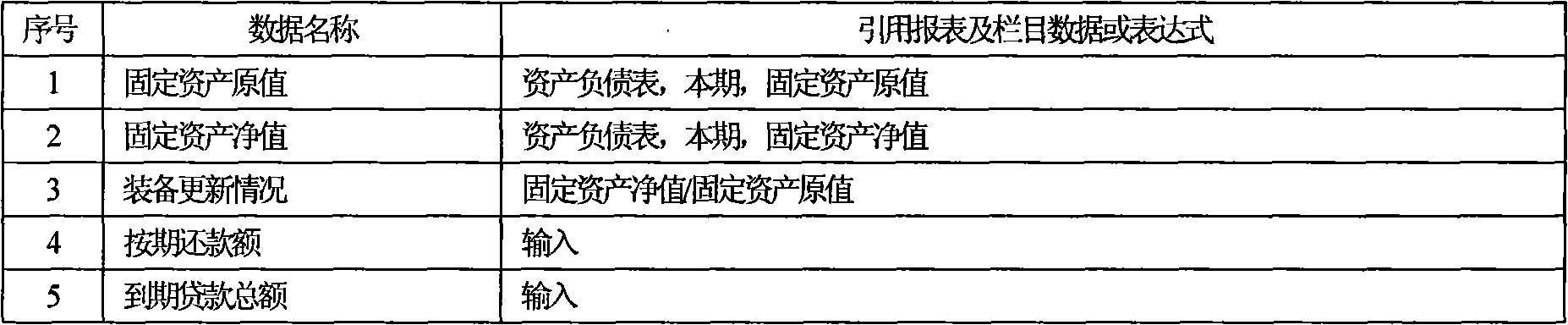

[0022] The financial modeling optimization method based on self-circulation of information is special in that it includes the following steps: Step ①, establishing an initial model of risk measurement as the initial model. Step ②, collect customer information according to the data required by the model. Step ③, apply the model and customer information to measure the risk of each customer. In step ④, customers are grouped according to the risk value measured by each customer. Step ⑤, statistics the default rate of each group of customers. Step ⑥, compare the default rate of each group of customers with the default probability defined by each group of customers, and judge whether the model is consistent with the measurement results. If not, repeat steps ③~⑥ and modify the risk measurement model until the result measured by the model until it matches the definition.

[0023] Specifically, the establishment of the initial risk measurement model described in step ① is an essenti...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com