Roadmap To Commercial Polyolefin Upcycling At Million-Ton Scale

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Polyolefin Upcycling Background and Objectives

Polyolefins, primarily polyethylene (PE) and polypropylene (PP), represent the largest fraction of global plastic production, accounting for over 60% of all plastics manufactured annually. With global production exceeding 200 million tons per year, these materials have become ubiquitous in packaging, consumer goods, automotive components, and countless other applications due to their versatility, durability, and low cost.

Despite their utility, polyolefins present significant environmental challenges. Their chemical stability—the very property that makes them useful—also renders them highly resistant to natural degradation. Conventional recycling methods for polyolefins face numerous limitations, including contamination issues, degradation of material properties after recycling, and economic inefficiencies that have historically limited recycling rates to below 10% globally.

The concept of upcycling represents a paradigm shift in plastic waste management. Unlike traditional recycling, which often results in downcycled products of lesser value, upcycling aims to convert waste polyolefins into higher-value products through chemical transformation. This approach addresses the fundamental limitations of mechanical recycling by breaking down polymers to their molecular building blocks or converting them into entirely new valuable chemicals.

Recent technological breakthroughs in catalysis, process engineering, and polymer science have opened new pathways for polyolefin upcycling. These advances include selective catalytic deconstruction, microwave-assisted pyrolysis, solvent-based purification techniques, and novel biological degradation methods. These technologies have demonstrated promising results at laboratory and pilot scales, achieving higher conversion efficiencies and product selectivity than previously possible.

The primary objective of this technical research is to evaluate the feasibility of scaling polyolefin upcycling technologies to process millions of tons annually—a scale that would meaningfully impact global plastic waste challenges. This ambitious target requires not only technological innovation but also economic viability, infrastructure development, and regulatory alignment.

Secondary objectives include identifying the most promising technological pathways for large-scale implementation, assessing the economic and environmental impacts of different approaches, mapping the necessary ecosystem of collection, sorting, and processing infrastructure, and outlining a strategic roadmap for commercial deployment within the next decade.

The ultimate goal is to transform plastic waste from an environmental liability into a valuable resource stream, creating a circular economy for polyolefins that reduces virgin plastic production, minimizes waste, and generates economic value while addressing one of the most pressing environmental challenges of our time.

Despite their utility, polyolefins present significant environmental challenges. Their chemical stability—the very property that makes them useful—also renders them highly resistant to natural degradation. Conventional recycling methods for polyolefins face numerous limitations, including contamination issues, degradation of material properties after recycling, and economic inefficiencies that have historically limited recycling rates to below 10% globally.

The concept of upcycling represents a paradigm shift in plastic waste management. Unlike traditional recycling, which often results in downcycled products of lesser value, upcycling aims to convert waste polyolefins into higher-value products through chemical transformation. This approach addresses the fundamental limitations of mechanical recycling by breaking down polymers to their molecular building blocks or converting them into entirely new valuable chemicals.

Recent technological breakthroughs in catalysis, process engineering, and polymer science have opened new pathways for polyolefin upcycling. These advances include selective catalytic deconstruction, microwave-assisted pyrolysis, solvent-based purification techniques, and novel biological degradation methods. These technologies have demonstrated promising results at laboratory and pilot scales, achieving higher conversion efficiencies and product selectivity than previously possible.

The primary objective of this technical research is to evaluate the feasibility of scaling polyolefin upcycling technologies to process millions of tons annually—a scale that would meaningfully impact global plastic waste challenges. This ambitious target requires not only technological innovation but also economic viability, infrastructure development, and regulatory alignment.

Secondary objectives include identifying the most promising technological pathways for large-scale implementation, assessing the economic and environmental impacts of different approaches, mapping the necessary ecosystem of collection, sorting, and processing infrastructure, and outlining a strategic roadmap for commercial deployment within the next decade.

The ultimate goal is to transform plastic waste from an environmental liability into a valuable resource stream, creating a circular economy for polyolefins that reduces virgin plastic production, minimizes waste, and generates economic value while addressing one of the most pressing environmental challenges of our time.

Market Demand Analysis for Recycled Polyolefins

The global market for recycled polyolefins has experienced significant growth in recent years, driven by increasing environmental concerns, regulatory pressures, and corporate sustainability commitments. Polyolefins, primarily polyethylene (PE) and polypropylene (PP), represent approximately 60% of global plastic production, with annual production exceeding 170 million tons. However, only about 14% of plastic packaging is currently collected for recycling globally, indicating substantial room for market expansion.

Consumer demand for sustainable products has created a strong pull for recycled polyolefin materials. Major brands across various sectors including packaging, automotive, and consumer goods have announced ambitious targets to incorporate recycled content in their products. For instance, numerous beverage companies have committed to using 25-50% recycled content in their packaging by 2025, creating a substantial demand driver for high-quality recycled polyolefins.

The market value for recycled polyolefins is projected to grow at a compound annual growth rate (CAGR) of 6.5-7.5% through 2030, significantly outpacing the growth rate of virgin polyolefins. This growth is particularly pronounced in developed markets like Europe and North America, where regulatory frameworks increasingly mandate recycled content and place restrictions on single-use plastics.

Price premiums for high-quality recycled polyolefins have emerged as supply struggles to meet demand. Food-grade recycled polyethylene and polypropylene can command premiums of 30-40% over virgin materials in certain markets, creating strong economic incentives for technological innovation in polyolefin upcycling.

Regional differences in market development are notable. Europe leads in recycled polyolefin adoption due to its advanced regulatory framework, including the European Plastic Pact and Circular Economy Action Plan. North America shows strong growth potential driven by corporate sustainability initiatives, while Asia-Pacific represents the fastest-growing market as countries like China implement more stringent waste management policies.

Key market segments for recycled polyolefins include packaging (representing approximately 40% of demand), construction materials, automotive components, and consumer goods. The packaging sector, particularly food and beverage packaging, demands the highest quality recycled materials that can meet stringent safety requirements.

Market barriers include collection infrastructure limitations, contamination issues affecting quality, and technical challenges in producing recycled polyolefins that match virgin material performance. These challenges underscore the need for advanced upcycling technologies capable of processing mixed plastic waste streams at scale, highlighting the significant market opportunity for innovations that can overcome these limitations.

Consumer demand for sustainable products has created a strong pull for recycled polyolefin materials. Major brands across various sectors including packaging, automotive, and consumer goods have announced ambitious targets to incorporate recycled content in their products. For instance, numerous beverage companies have committed to using 25-50% recycled content in their packaging by 2025, creating a substantial demand driver for high-quality recycled polyolefins.

The market value for recycled polyolefins is projected to grow at a compound annual growth rate (CAGR) of 6.5-7.5% through 2030, significantly outpacing the growth rate of virgin polyolefins. This growth is particularly pronounced in developed markets like Europe and North America, where regulatory frameworks increasingly mandate recycled content and place restrictions on single-use plastics.

Price premiums for high-quality recycled polyolefins have emerged as supply struggles to meet demand. Food-grade recycled polyethylene and polypropylene can command premiums of 30-40% over virgin materials in certain markets, creating strong economic incentives for technological innovation in polyolefin upcycling.

Regional differences in market development are notable. Europe leads in recycled polyolefin adoption due to its advanced regulatory framework, including the European Plastic Pact and Circular Economy Action Plan. North America shows strong growth potential driven by corporate sustainability initiatives, while Asia-Pacific represents the fastest-growing market as countries like China implement more stringent waste management policies.

Key market segments for recycled polyolefins include packaging (representing approximately 40% of demand), construction materials, automotive components, and consumer goods. The packaging sector, particularly food and beverage packaging, demands the highest quality recycled materials that can meet stringent safety requirements.

Market barriers include collection infrastructure limitations, contamination issues affecting quality, and technical challenges in producing recycled polyolefins that match virgin material performance. These challenges underscore the need for advanced upcycling technologies capable of processing mixed plastic waste streams at scale, highlighting the significant market opportunity for innovations that can overcome these limitations.

Global Polyolefin Upcycling Status and Barriers

Polyolefins, primarily polyethylene (PE) and polypropylene (PP), constitute over 50% of global plastic production, with annual output exceeding 170 million tons. Despite their widespread use, the current global recycling rate for polyolefins remains dismally low at approximately 14-18%. This creates an urgent environmental challenge as these materials persist in landfills and oceans for hundreds of years.

The current global landscape of polyolefin upcycling reveals significant regional disparities. Europe leads with the most advanced regulatory framework and infrastructure, achieving recycling rates of about 30% for polyolefin packaging. North America follows with moderate progress but lacks comprehensive national policies, while Asia presents a mixed picture with advanced systems in Japan and South Korea contrasting with developing infrastructure in China and Southeast Asia.

Mechanical recycling dominates the current polyolefin recycling market, processing approximately 20 million tons annually. However, this approach faces severe limitations including material degradation after 3-5 recycling cycles, contamination issues, and color restrictions. These constraints have created a ceiling effect, preventing significant expansion beyond current rates without technological breakthroughs.

Chemical recycling technologies, including pyrolysis, gasification, and solvolysis, offer promising alternatives for upcycling polyolefins but remain largely at pilot or demonstration scale. Globally, less than 1 million tons of capacity exists for chemical recycling of polyolefins, highlighting the substantial gap between current capabilities and the scale needed for meaningful impact.

Several critical barriers impede the advancement to million-ton scale polyolefin upcycling. Technical challenges include catalyst deactivation in chemical processes, energy intensity of conversion methods, and difficulties in handling mixed plastic waste streams. Economic barriers are equally significant, with virgin polyolefin production costs remaining 20-30% lower than recycled alternatives, creating unfavorable market dynamics.

Infrastructure limitations present another substantial obstacle. Collection systems capture only 40-60% of post-consumer polyolefins in developed economies and much less in developing regions. Sorting technologies struggle with multi-layer and mixed plastic identification, while contamination from additives, labels, and food residues compromises quality.

Regulatory frameworks vary widely across regions, creating market uncertainty. While the EU's Circular Economy Action Plan and Single-Use Plastics Directive provide progressive models, many regions lack coherent policies to drive investment in advanced recycling infrastructure. This regulatory inconsistency hampers the development of global solutions and technology transfer.

The current global landscape of polyolefin upcycling reveals significant regional disparities. Europe leads with the most advanced regulatory framework and infrastructure, achieving recycling rates of about 30% for polyolefin packaging. North America follows with moderate progress but lacks comprehensive national policies, while Asia presents a mixed picture with advanced systems in Japan and South Korea contrasting with developing infrastructure in China and Southeast Asia.

Mechanical recycling dominates the current polyolefin recycling market, processing approximately 20 million tons annually. However, this approach faces severe limitations including material degradation after 3-5 recycling cycles, contamination issues, and color restrictions. These constraints have created a ceiling effect, preventing significant expansion beyond current rates without technological breakthroughs.

Chemical recycling technologies, including pyrolysis, gasification, and solvolysis, offer promising alternatives for upcycling polyolefins but remain largely at pilot or demonstration scale. Globally, less than 1 million tons of capacity exists for chemical recycling of polyolefins, highlighting the substantial gap between current capabilities and the scale needed for meaningful impact.

Several critical barriers impede the advancement to million-ton scale polyolefin upcycling. Technical challenges include catalyst deactivation in chemical processes, energy intensity of conversion methods, and difficulties in handling mixed plastic waste streams. Economic barriers are equally significant, with virgin polyolefin production costs remaining 20-30% lower than recycled alternatives, creating unfavorable market dynamics.

Infrastructure limitations present another substantial obstacle. Collection systems capture only 40-60% of post-consumer polyolefins in developed economies and much less in developing regions. Sorting technologies struggle with multi-layer and mixed plastic identification, while contamination from additives, labels, and food residues compromises quality.

Regulatory frameworks vary widely across regions, creating market uncertainty. While the EU's Circular Economy Action Plan and Single-Use Plastics Directive provide progressive models, many regions lack coherent policies to drive investment in advanced recycling infrastructure. This regulatory inconsistency hampers the development of global solutions and technology transfer.

Current Industrial-Scale Polyolefin Upcycling Solutions

01 Chemical recycling technologies for polyolefin upcycling

Chemical recycling processes convert polyolefin waste into valuable chemical feedstocks through methods like pyrolysis, catalytic cracking, and depolymerization. These technologies break down polymer chains into smaller molecules that can be used as raw materials for new plastic production or other chemical applications. Commercial-scale implementations focus on optimizing reaction conditions, catalyst systems, and purification methods to ensure economic viability and product quality.- Chemical recycling processes for polyolefin upcycling: Chemical recycling processes convert polyolefin waste into valuable chemicals or fuels through methods such as pyrolysis, catalytic cracking, and depolymerization. These processes break down polymer chains into smaller molecules that can be used as feedstock for new materials or energy production. Chemical recycling offers advantages for handling mixed or contaminated plastic waste that is difficult to process through mechanical recycling, making it suitable for commercial-scale operations.

- Mechanical recycling and processing equipment for commercial scale: Mechanical recycling systems for polyolefin upcycling at commercial scale involve specialized equipment for sorting, washing, grinding, and reforming plastic waste. These systems typically include conveyor belts, shredders, washing tanks, extruders, and pelletizers designed to handle large volumes of plastic waste efficiently. The equipment is engineered to maintain consistent quality output while processing variable input materials, with automation features to optimize operational efficiency and reduce labor costs.

- Additives and compatibilizers for improved recycled polyolefin properties: Specialized additives and compatibilizers are used to enhance the properties of recycled polyolefins, addressing issues such as thermal degradation, mechanical property loss, and incompatibility between different polymer types. These formulations may include antioxidants, UV stabilizers, chain extenders, and coupling agents that improve the processability and performance of recycled materials. By incorporating these additives, recycled polyolefins can achieve properties comparable to virgin materials, expanding their potential applications in commercial products.

- Integrated systems for polyolefin waste sorting and processing: Integrated commercial-scale systems combine multiple technologies for efficient polyolefin waste management, including automated sorting, cleaning, and processing stages. These systems often incorporate sensor-based sorting technologies such as near-infrared spectroscopy, X-ray fluorescence, or artificial intelligence to accurately separate different types of plastics. The integration of various processing steps in a single facility improves operational efficiency, reduces transportation costs, and ensures consistent quality of recycled materials.

- Business models and supply chain solutions for commercial polyolefin upcycling: Successful commercial-scale polyolefin upcycling requires innovative business models and supply chain solutions to ensure economic viability. These approaches include circular economy partnerships between plastic producers, consumers, and recyclers; deposit-return schemes to ensure consistent waste collection; and blockchain-based tracking systems to verify recycled content. Additionally, co-location of recycling facilities with manufacturing plants can reduce logistics costs and carbon footprint, while creating stable markets for recycled materials through long-term supply agreements.

02 Mechanical recycling and processing equipment for commercial-scale operations

Mechanical recycling systems for polyolefin upcycling involve specialized equipment for sorting, washing, grinding, and reprocessing plastic waste. Commercial-scale operations require robust machinery capable of handling large volumes while maintaining consistent output quality. These systems often incorporate advanced sorting technologies, efficient washing processes, and extrusion equipment designed specifically for recycled materials to ensure the resulting products meet industry specifications.Expand Specific Solutions03 Additives and compatibilizers for improving recycled polyolefin properties

Various additives and compatibilizers can be incorporated into recycled polyolefins to enhance their mechanical properties, thermal stability, and processability. These formulations help overcome the degradation issues common in recycled materials and enable the production of higher-value products. Commercial-scale implementations focus on optimizing additive packages that can effectively stabilize mixed plastic waste streams and improve the quality of the resulting materials to meet market requirements.Expand Specific Solutions04 Integrated systems for polyolefin waste collection and processing

Integrated systems combine waste collection, sorting, and processing technologies to create efficient polyolefin upcycling operations at commercial scale. These systems incorporate multiple stages including collection infrastructure, automated sorting facilities, and processing plants designed to handle specific types of polyolefin waste. The integration of these components allows for more efficient resource utilization and higher throughput, making commercial-scale polyolefin upcycling economically viable.Expand Specific Solutions05 Novel applications and markets for upcycled polyolefin materials

Developing new applications and markets for upcycled polyolefin materials is crucial for commercial-scale operations. Innovations in this area include transforming recycled polyolefins into high-value products such as specialty polymers, composite materials, and construction products. Commercial strategies focus on identifying market opportunities where recycled content adds value, developing products that meet performance requirements, and establishing supply chains that can reliably deliver consistent quality materials derived from waste polyolefins.Expand Specific Solutions

Leading Companies and Consortiums in Polyolefin Upcycling

The polyolefin upcycling market is in its early growth phase, transitioning from pilot projects to commercial-scale operations, with significant potential to address plastic waste challenges at million-ton scale. Current global market size is relatively small but projected to expand rapidly as circular economy initiatives gain momentum. Technology maturity varies across the competitive landscape, with major petrochemical companies leading innovation. Dow Global Technologies, ExxonMobil Chemical, SABIC, and LyondellBasell (via Basell Poliolefine) have established advanced catalytic and thermal conversion technologies. Chinese players including Sinopec are investing heavily in chemical recycling infrastructure. Academic-industry partnerships involving institutions like Oxford University, Purdue Research Foundation, and Cornell University are accelerating breakthrough technologies for more efficient polyolefin degradation and conversion processes.

Dow Global Technologies LLC

Technical Solution: Dow has developed a comprehensive polyolefin upcycling technology suite centered around advanced recycling processes. Their approach combines mechanical and chemical recycling methods, with particular focus on their proprietary thermal and catalytic conversion technologies. Dow's RETAIN™ technology enables the compatibilization of mixed plastic waste streams, allowing for the incorporation of post-consumer recycled (PCR) content into high-performance applications. Their advanced recycling initiatives include pyrolysis oil conversion to circular feedstocks and molecular recycling technologies that break down polyolefins into their original monomers or valuable chemical intermediates. Dow has established strategic partnerships across the value chain, including waste management companies and brand owners, to create closed-loop systems. Their Texas and European facilities have been modified to process pyrolysis oil derived from plastic waste, with commercial-scale implementation already underway.

Strengths: Extensive polymer science expertise, established global manufacturing infrastructure, and strong downstream partnerships enabling rapid scaling. Their integrated approach combining multiple recycling technologies provides flexibility for different waste streams. Weaknesses: Higher capital investment requirements compared to purely mechanical recycling approaches, and potential challenges in securing consistent quality waste feedstock at scale.

ExxonMobil Chemical Patents, Inc.

Technical Solution: ExxonMobil has developed an advanced recycling technology platform focused on molecular conversion of plastic waste into virgin-quality raw materials. Their proprietary Exxtend™ technology for advanced recycling uses thermal decomposition processes to break down mixed plastic waste into molecular building blocks. These can then be reintroduced into their manufacturing processes to create virgin-quality polymers. ExxonMobil has invested in expanding their advanced recycling capabilities at their Baytown, Texas facility, which is one of the largest advanced plastic recycling facilities in North America, with capacity to process more than 80 million pounds of plastic waste annually. The company has also developed specialized catalysts that enhance the efficiency of the conversion process, improving yields and reducing energy requirements. Their technology can process difficult-to-recycle plastics including multilayer films and contaminated polyolefins that traditional mechanical recycling cannot handle effectively.

Strengths: Extensive petrochemical infrastructure that can be leveraged for recycling operations, proprietary catalyst technology improving conversion efficiency, and global scale that enables significant impact when fully deployed. Weaknesses: Heavy reliance on thermal processes that have higher energy requirements compared to some competing technologies, and potential challenges in achieving cost parity with virgin materials without regulatory support.

Key Patents and Breakthroughs in Polyolefin Transformation

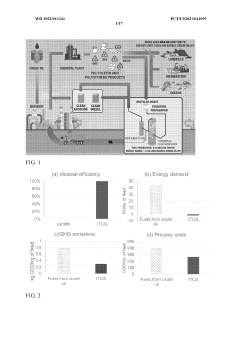

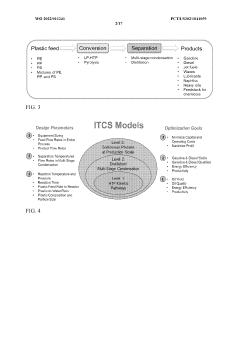

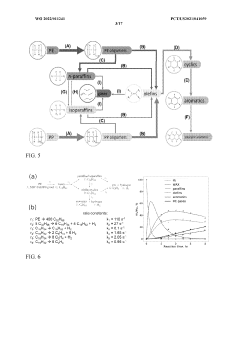

Integrated continuous conversion and separation methods for upcycling mixed plastic waste to clean gasoline and diesel fuels and other products

PatentWO2022011241A1

Innovation

- Integrated Conversion and Separation (ITCS) methods involving hydrothermal processing followed by separation, which produce gasoline and diesel fuels with high yields and low energy input, eliminating the need for catalysts and reducing greenhouse gas emissions by 60% compared to conventional methods.

Economic Viability and Cost Analysis of Large-Scale Implementation

The economic viability of polyolefin upcycling at million-ton scale hinges on several critical factors that must be carefully analyzed to determine feasibility. Current cost structures indicate that virgin polyolefin production remains more economically attractive than recycling operations, with a price differential of approximately $200-400 per ton. This gap presents a significant challenge for widespread commercial adoption of upcycling technologies.

Capital expenditure requirements for establishing million-ton scale facilities range from $500 million to $1.2 billion, depending on the selected technology pathway and regional infrastructure availability. Operating expenses are dominated by feedstock acquisition (30-40%), energy costs (20-25%), and labor (15-20%), with maintenance and catalyst replacement comprising the remainder. Sensitivity analysis reveals that feedstock quality significantly impacts economic outcomes, with contamination levels above 5% potentially increasing processing costs by 30-45%.

Break-even analysis suggests that polyolefin upcycling facilities require 5-8 years to achieve profitability under current market conditions, though this timeline could be shortened to 3-5 years with policy incentives such as carbon taxes or recycled content mandates. The minimum efficient scale appears to be approximately 250,000 tons annually, below which economies of scale are insufficient to compete with virgin production.

Regional economic variations significantly impact implementation feasibility. Areas with high landfill tipping fees ($80-150/ton) such as Europe and Japan offer more favorable economics than regions with abundant landfill capacity and low disposal costs ($20-40/ton) like parts of North America. Labor cost differentials of 300-400% between developed and developing economies further complicate global implementation strategies.

Policy interventions show substantial potential to improve economic viability. Modeling indicates that a carbon price of $50-70 per ton CO2e would equalize costs between virgin and recycled polyolefins. Extended producer responsibility schemes could reduce feedstock costs by 25-35%, while recycled content mandates could create premium markets valued 15-30% above conventional materials.

Integration with existing petrochemical infrastructure presents opportunities to reduce capital requirements by 20-30% through shared utilities, logistics, and processing capabilities. Co-location strategies with waste management facilities could further reduce feedstock transportation costs by 40-60%, significantly improving overall economics.

Capital expenditure requirements for establishing million-ton scale facilities range from $500 million to $1.2 billion, depending on the selected technology pathway and regional infrastructure availability. Operating expenses are dominated by feedstock acquisition (30-40%), energy costs (20-25%), and labor (15-20%), with maintenance and catalyst replacement comprising the remainder. Sensitivity analysis reveals that feedstock quality significantly impacts economic outcomes, with contamination levels above 5% potentially increasing processing costs by 30-45%.

Break-even analysis suggests that polyolefin upcycling facilities require 5-8 years to achieve profitability under current market conditions, though this timeline could be shortened to 3-5 years with policy incentives such as carbon taxes or recycled content mandates. The minimum efficient scale appears to be approximately 250,000 tons annually, below which economies of scale are insufficient to compete with virgin production.

Regional economic variations significantly impact implementation feasibility. Areas with high landfill tipping fees ($80-150/ton) such as Europe and Japan offer more favorable economics than regions with abundant landfill capacity and low disposal costs ($20-40/ton) like parts of North America. Labor cost differentials of 300-400% between developed and developing economies further complicate global implementation strategies.

Policy interventions show substantial potential to improve economic viability. Modeling indicates that a carbon price of $50-70 per ton CO2e would equalize costs between virgin and recycled polyolefins. Extended producer responsibility schemes could reduce feedstock costs by 25-35%, while recycled content mandates could create premium markets valued 15-30% above conventional materials.

Integration with existing petrochemical infrastructure presents opportunities to reduce capital requirements by 20-30% through shared utilities, logistics, and processing capabilities. Co-location strategies with waste management facilities could further reduce feedstock transportation costs by 40-60%, significantly improving overall economics.

Environmental Impact Assessment and Sustainability Metrics

The environmental impact of polyolefin waste represents one of the most pressing ecological challenges of our time. Current global polyolefin production exceeds 200 million tons annually, with less than 10% being effectively recycled. The implementation of million-ton scale upcycling operations would significantly reduce greenhouse gas emissions associated with virgin plastic production, which currently accounts for approximately 4-8% of global oil consumption.

Life Cycle Assessment (LCA) studies indicate that successful polyolefin upcycling could reduce carbon emissions by 1.5-2.5 tons of CO2 equivalent per ton of plastic processed compared to incineration or landfilling. This translates to potential annual savings of 1.5-2.5 million tons of CO2 equivalent at million-ton operational scale. Additionally, upcycling processes typically consume 40-60% less energy than virgin polyolefin production, representing substantial energy efficiency improvements.

Water conservation metrics are equally compelling, with advanced catalytic upcycling technologies requiring 70-85% less water than conventional manufacturing processes. This water footprint reduction becomes increasingly critical as water scarcity affects more regions globally. Furthermore, diverting polyolefin waste from landfills and oceans directly addresses the microplastic contamination crisis, which has been detected in over 80% of tested marine species.

Sustainability metrics for commercial polyolefin upcycling must incorporate circular economy principles. The circularity index for current mechanical recycling averages only 0.3-0.4 (on a scale where 1.0 represents perfect circularity), while advanced chemical upcycling technologies demonstrate potential indices of 0.7-0.8. This improvement stems from the ability to process contaminated and mixed plastic waste streams that traditional recycling cannot handle.

Economic sustainability indicators reveal that million-ton scale operations could achieve cost parity with virgin materials when oil prices exceed $65-70 per barrel, particularly when environmental externalities are properly accounted for. The social dimension of sustainability metrics should not be overlooked, with potential creation of 5-7 jobs per thousand tons of processed material, representing significant employment opportunities in green chemistry and advanced manufacturing.

Standardized sustainability reporting frameworks such as the Plastic Waste Management Index (PWMI) and Circular Transition Indicators (CTI) are being adapted specifically for polyolefin upcycling operations. These frameworks enable consistent measurement and communication of environmental performance across different technological approaches and geographical contexts, facilitating meaningful comparison and continuous improvement in the sector.

Life Cycle Assessment (LCA) studies indicate that successful polyolefin upcycling could reduce carbon emissions by 1.5-2.5 tons of CO2 equivalent per ton of plastic processed compared to incineration or landfilling. This translates to potential annual savings of 1.5-2.5 million tons of CO2 equivalent at million-ton operational scale. Additionally, upcycling processes typically consume 40-60% less energy than virgin polyolefin production, representing substantial energy efficiency improvements.

Water conservation metrics are equally compelling, with advanced catalytic upcycling technologies requiring 70-85% less water than conventional manufacturing processes. This water footprint reduction becomes increasingly critical as water scarcity affects more regions globally. Furthermore, diverting polyolefin waste from landfills and oceans directly addresses the microplastic contamination crisis, which has been detected in over 80% of tested marine species.

Sustainability metrics for commercial polyolefin upcycling must incorporate circular economy principles. The circularity index for current mechanical recycling averages only 0.3-0.4 (on a scale where 1.0 represents perfect circularity), while advanced chemical upcycling technologies demonstrate potential indices of 0.7-0.8. This improvement stems from the ability to process contaminated and mixed plastic waste streams that traditional recycling cannot handle.

Economic sustainability indicators reveal that million-ton scale operations could achieve cost parity with virgin materials when oil prices exceed $65-70 per barrel, particularly when environmental externalities are properly accounted for. The social dimension of sustainability metrics should not be overlooked, with potential creation of 5-7 jobs per thousand tons of processed material, representing significant employment opportunities in green chemistry and advanced manufacturing.

Standardized sustainability reporting frameworks such as the Plastic Waste Management Index (PWMI) and Circular Transition Indicators (CTI) are being adapted specifically for polyolefin upcycling operations. These frameworks enable consistent measurement and communication of environmental performance across different technological approaches and geographical contexts, facilitating meaningful comparison and continuous improvement in the sector.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!