Policy And Compliance: Recycled Content Targets And Mass Balance Accounting

AUG 22, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Recycled Content Policy Evolution and Objectives

The concept of recycled content targets has evolved significantly over the past decades, transforming from voluntary industry initiatives to increasingly stringent regulatory requirements. In the 1970s and 1980s, recycled content was primarily promoted through voluntary programs and eco-labels, with minimal government intervention. The 1990s witnessed the emergence of the first government procurement policies favoring products with recycled content, particularly in paper products and construction materials.

The early 2000s marked a pivotal shift as governments began implementing more structured policies to address growing waste management challenges. The European Union's Packaging and Packaging Waste Directive (94/62/EC), subsequently amended multiple times, established progressive targets for recycling rates and gradually introduced the concept of minimum recycled content requirements.

A significant acceleration occurred post-2015, coinciding with increased public awareness of plastic pollution and circular economy principles. The EU Plastics Strategy (2018) set voluntary targets for incorporating recycled plastics into new products, while the Single-Use Plastics Directive (2019) mandated 25% recycled content in PET bottles by 2025, increasing to 30% by 2030 for all plastic bottles.

The United Kingdom's Plastic Packaging Tax, implemented in April 2022, represents another evolutionary step by imposing financial penalties on packaging containing less than 30% recycled content. Similarly, California's pioneering legislation SB 270 required minimum recycled content in certain plastic bags, while more recent legislation (AB 793) established progressive recycled content requirements for plastic beverage containers.

The primary objectives of these evolving policies include reducing virgin material consumption, decreasing greenhouse gas emissions associated with raw material extraction and processing, stimulating demand for recycled materials to strengthen recycling markets, and accelerating the transition toward circular economy models. Additionally, these policies aim to drive innovation in recycling technologies and product design.

Mass balance accounting has emerged as a critical methodology within this policy landscape, offering a systematic approach to track recycled content through complex production chains. This accounting method allows manufacturers to verify compliance with recycled content targets while accommodating the technical and economic challenges of incorporating recycled materials into high-quality products.

Looking forward, policy evolution is trending toward harmonized international standards, increased verification requirements, and the expansion of recycled content mandates across additional product categories and material types, reflecting a global commitment to resource efficiency and circular material flows.

The early 2000s marked a pivotal shift as governments began implementing more structured policies to address growing waste management challenges. The European Union's Packaging and Packaging Waste Directive (94/62/EC), subsequently amended multiple times, established progressive targets for recycling rates and gradually introduced the concept of minimum recycled content requirements.

A significant acceleration occurred post-2015, coinciding with increased public awareness of plastic pollution and circular economy principles. The EU Plastics Strategy (2018) set voluntary targets for incorporating recycled plastics into new products, while the Single-Use Plastics Directive (2019) mandated 25% recycled content in PET bottles by 2025, increasing to 30% by 2030 for all plastic bottles.

The United Kingdom's Plastic Packaging Tax, implemented in April 2022, represents another evolutionary step by imposing financial penalties on packaging containing less than 30% recycled content. Similarly, California's pioneering legislation SB 270 required minimum recycled content in certain plastic bags, while more recent legislation (AB 793) established progressive recycled content requirements for plastic beverage containers.

The primary objectives of these evolving policies include reducing virgin material consumption, decreasing greenhouse gas emissions associated with raw material extraction and processing, stimulating demand for recycled materials to strengthen recycling markets, and accelerating the transition toward circular economy models. Additionally, these policies aim to drive innovation in recycling technologies and product design.

Mass balance accounting has emerged as a critical methodology within this policy landscape, offering a systematic approach to track recycled content through complex production chains. This accounting method allows manufacturers to verify compliance with recycled content targets while accommodating the technical and economic challenges of incorporating recycled materials into high-quality products.

Looking forward, policy evolution is trending toward harmonized international standards, increased verification requirements, and the expansion of recycled content mandates across additional product categories and material types, reflecting a global commitment to resource efficiency and circular material flows.

Market Demand Analysis for Recycled Materials

The global market for recycled materials has experienced significant growth over the past decade, driven by increasing environmental awareness, regulatory pressures, and corporate sustainability commitments. Current market analysis indicates that the demand for recycled content in products continues to rise across multiple sectors, with particularly strong growth in packaging, construction, automotive, and textile industries.

Consumer packaged goods companies have emerged as major drivers of recycled material demand, with many global brands publicly committing to ambitious recycled content targets. For instance, several leading beverage companies have pledged to incorporate between 25% and 50% recycled content in their packaging by 2025, creating substantial market pull for recycled PET and other plastics.

The construction sector represents another significant market for recycled materials, with growing demand for recycled concrete aggregates, reclaimed wood, and recycled steel. This sector's demand is largely influenced by green building certifications and sustainable procurement policies that incentivize the use of recycled content.

Market research indicates that price premiums for recycled materials vary significantly by material type and quality. High-quality recycled plastics can command premiums of 10-30% over virgin materials in certain applications, though these premiums fluctuate based on oil prices and supply chain dynamics. The willingness to pay these premiums is increasingly evident among brands seeking to meet sustainability commitments and regulatory requirements.

Regional variations in demand are notable, with European markets generally showing stronger demand for recycled content due to more advanced regulatory frameworks. The implementation of the European Plastic Tax and other similar measures has accelerated demand for recycled plastics specifically. North American markets are catching up, while Asian markets show varied adoption rates with Japan and South Korea leading regional demand.

Supply constraints remain a significant factor affecting market dynamics. Collection infrastructure limitations, contamination issues, and processing capacity bottlenecks create challenges in meeting the growing demand for high-quality recycled materials. This supply-demand imbalance has led to increased investment in recycling technologies and infrastructure.

Mass balance accounting has emerged as a critical methodology for tracking recycled content in complex supply chains, allowing companies to make credible claims about recycled content while managing the practical limitations of physical segregation. The market increasingly values transparent accounting systems that can verify recycled content claims, with third-party certification schemes gaining prominence.

Future market projections suggest continued growth in demand for recycled materials, with compound annual growth rates estimated between 5-8% for most recycled commodities over the next five years. This growth trajectory is expected to accelerate as more regions implement recycled content mandates and as technological innovations improve the quality and cost-effectiveness of recycled materials.

Consumer packaged goods companies have emerged as major drivers of recycled material demand, with many global brands publicly committing to ambitious recycled content targets. For instance, several leading beverage companies have pledged to incorporate between 25% and 50% recycled content in their packaging by 2025, creating substantial market pull for recycled PET and other plastics.

The construction sector represents another significant market for recycled materials, with growing demand for recycled concrete aggregates, reclaimed wood, and recycled steel. This sector's demand is largely influenced by green building certifications and sustainable procurement policies that incentivize the use of recycled content.

Market research indicates that price premiums for recycled materials vary significantly by material type and quality. High-quality recycled plastics can command premiums of 10-30% over virgin materials in certain applications, though these premiums fluctuate based on oil prices and supply chain dynamics. The willingness to pay these premiums is increasingly evident among brands seeking to meet sustainability commitments and regulatory requirements.

Regional variations in demand are notable, with European markets generally showing stronger demand for recycled content due to more advanced regulatory frameworks. The implementation of the European Plastic Tax and other similar measures has accelerated demand for recycled plastics specifically. North American markets are catching up, while Asian markets show varied adoption rates with Japan and South Korea leading regional demand.

Supply constraints remain a significant factor affecting market dynamics. Collection infrastructure limitations, contamination issues, and processing capacity bottlenecks create challenges in meeting the growing demand for high-quality recycled materials. This supply-demand imbalance has led to increased investment in recycling technologies and infrastructure.

Mass balance accounting has emerged as a critical methodology for tracking recycled content in complex supply chains, allowing companies to make credible claims about recycled content while managing the practical limitations of physical segregation. The market increasingly values transparent accounting systems that can verify recycled content claims, with third-party certification schemes gaining prominence.

Future market projections suggest continued growth in demand for recycled materials, with compound annual growth rates estimated between 5-8% for most recycled commodities over the next five years. This growth trajectory is expected to accelerate as more regions implement recycled content mandates and as technological innovations improve the quality and cost-effectiveness of recycled materials.

Current Challenges in Recycled Content Verification

The verification of recycled content in products presents significant challenges for both industry and regulatory bodies. Current methodologies lack standardization across different sectors and regions, creating inconsistencies in measurement and reporting. Physical testing methods such as tracer technologies and spectroscopic analysis can identify recycled materials but often struggle with accuracy when dealing with complex material blends or heavily processed recycled content.

Documentation-based verification systems rely heavily on chain of custody records, which are vulnerable to fraud and error propagation throughout supply chains. This becomes particularly problematic in global supply networks where materials cross multiple jurisdictions with varying documentation standards and regulatory requirements. The absence of harmonized international standards further complicates verification efforts.

Mass balance accounting, while increasingly adopted, faces implementation challenges related to system boundaries definition and allocation methodologies. Organizations interpret mass balance principles differently, leading to incomparable claims across products and companies. The time period over which mass balance calculations are performed (monthly, quarterly, or annually) significantly impacts reported recycled content percentages, creating potential for manipulation.

Technical limitations in distinguishing between pre-consumer and post-consumer recycled content add another layer of complexity. Many regulations and corporate commitments specifically target post-consumer recycled content, yet verification technologies cannot reliably differentiate between these sources. This creates a verification gap that undermines policy effectiveness.

Cost considerations present substantial barriers, particularly for small and medium enterprises. Comprehensive verification systems involving third-party certification, laboratory testing, and supply chain auditing can be prohibitively expensive. This creates market inequities where only larger corporations can afford robust verification processes, potentially distorting competition.

Digital solutions like blockchain show promise but remain in early implementation stages. While these technologies could enhance traceability and verification, they require significant infrastructure investment and industry-wide adoption to be effective. Current blockchain implementations suffer from interoperability issues between different platforms and protocols.

Consumer trust in recycled content claims is eroding due to greenwashing concerns and inconsistent verification standards. This trust deficit threatens to undermine broader sustainability initiatives and reduce consumer willingness to pay premiums for products with recycled content. Rebuilding this trust requires transparent, credible verification systems that consumers can easily understand and access.

Documentation-based verification systems rely heavily on chain of custody records, which are vulnerable to fraud and error propagation throughout supply chains. This becomes particularly problematic in global supply networks where materials cross multiple jurisdictions with varying documentation standards and regulatory requirements. The absence of harmonized international standards further complicates verification efforts.

Mass balance accounting, while increasingly adopted, faces implementation challenges related to system boundaries definition and allocation methodologies. Organizations interpret mass balance principles differently, leading to incomparable claims across products and companies. The time period over which mass balance calculations are performed (monthly, quarterly, or annually) significantly impacts reported recycled content percentages, creating potential for manipulation.

Technical limitations in distinguishing between pre-consumer and post-consumer recycled content add another layer of complexity. Many regulations and corporate commitments specifically target post-consumer recycled content, yet verification technologies cannot reliably differentiate between these sources. This creates a verification gap that undermines policy effectiveness.

Cost considerations present substantial barriers, particularly for small and medium enterprises. Comprehensive verification systems involving third-party certification, laboratory testing, and supply chain auditing can be prohibitively expensive. This creates market inequities where only larger corporations can afford robust verification processes, potentially distorting competition.

Digital solutions like blockchain show promise but remain in early implementation stages. While these technologies could enhance traceability and verification, they require significant infrastructure investment and industry-wide adoption to be effective. Current blockchain implementations suffer from interoperability issues between different platforms and protocols.

Consumer trust in recycled content claims is eroding due to greenwashing concerns and inconsistent verification standards. This trust deficit threatens to undermine broader sustainability initiatives and reduce consumer willingness to pay premiums for products with recycled content. Rebuilding this trust requires transparent, credible verification systems that consumers can easily understand and access.

Existing Mass Balance Accounting Methodologies

01 Mass balance accounting methods for recycled content

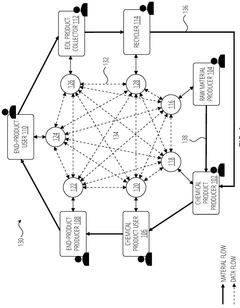

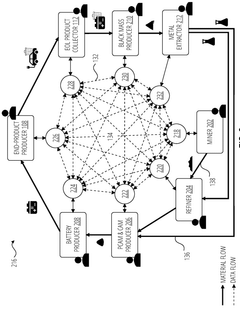

Mass balance accounting is a methodology used to track and verify the amount of recycled content in products. This approach allows manufacturers to claim recycled content based on the proportion of recycled materials entering their production processes, even when the recycled and virgin materials are physically mixed. The method involves tracking material flows, allocating recycled content proportionally, and providing documentation to support recycled content claims.- Mass balance accounting methodologies for recycled content: Mass balance accounting is a methodology used to track and verify the amount of recycled content in products. It allows manufacturers to allocate recycled content across product lines based on input materials, even when physical segregation is not possible. This approach enables companies to make credible claims about recycled content percentages while maintaining product quality and performance. The methodology includes tracking systems, verification protocols, and documentation requirements to ensure transparency and accuracy in recycled content reporting.

- Regulatory frameworks for recycled content targets: Various regulatory frameworks have been established to set mandatory or voluntary recycled content targets across different industries. These frameworks include certification systems, compliance mechanisms, and reporting requirements to ensure that manufacturers meet specified recycled content percentages. The regulations often include phase-in periods, industry-specific targets, and verification protocols to validate recycled content claims. These frameworks aim to reduce virgin material consumption and promote circular economy principles through standardized approaches to measuring and reporting recycled content.

- Technologies for incorporating recycled materials in manufacturing: Advanced technologies have been developed to facilitate the incorporation of recycled materials into manufacturing processes while maintaining product quality. These technologies include improved sorting and purification methods, compatibilization techniques for mixed recycled materials, and process modifications to accommodate recycled content variability. Innovations in this area focus on overcoming technical challenges associated with recycled material inconsistency, contamination, and degradation to enable higher recycled content percentages without compromising product performance or manufacturing efficiency.

- Digital tracking systems for recycled content verification: Digital tracking systems have been developed to monitor and verify recycled content throughout supply chains. These systems utilize technologies such as blockchain, digital certificates, and automated data collection to create transparent and tamper-proof records of recycled material flows. Such systems enable real-time tracking of recycled content, facilitate mass balance accounting, and provide verifiable documentation for regulatory compliance and consumer-facing claims. The digital approach enhances the credibility of recycled content claims while reducing administrative burden associated with manual tracking and verification processes.

- Industry-specific approaches to recycled content implementation: Different industries have developed specialized approaches to implementing recycled content targets based on their unique material requirements and manufacturing constraints. These sector-specific methodologies include customized mass balance accounting rules, industry-specific certification standards, and tailored testing protocols to verify recycled content. Industries such as packaging, textiles, construction, and electronics have established collaborative initiatives to develop practical approaches for increasing recycled content while addressing technical challenges specific to their products and processes.

02 Recycled content certification and verification systems

Various certification and verification systems have been developed to validate recycled content claims in products. These systems typically involve third-party auditing, chain of custody documentation, and standardized calculation methodologies. They help ensure transparency and credibility in recycled content claims, providing consumers and regulators with confidence that products meet specified recycled content targets.Expand Specific Solutions03 Polymer recycling technologies for meeting recycled content targets

Advanced polymer recycling technologies have been developed to increase the feasibility of incorporating recycled content in plastic products. These technologies include mechanical recycling, chemical recycling, and advanced sorting methods that improve the quality of recycled materials. By enhancing the properties of recycled polymers, these technologies enable manufacturers to incorporate higher percentages of recycled content while maintaining product performance.Expand Specific Solutions04 Digital tracking systems for recycled content verification

Digital technologies, including blockchain and other distributed ledger technologies, are being employed to track and verify recycled content throughout supply chains. These systems create immutable records of material flows, enabling more accurate and transparent accounting of recycled content. Digital tracking helps prevent double-counting of recycled materials and provides a secure method for documenting compliance with recycled content targets.Expand Specific Solutions05 Regulatory frameworks for recycled content targets

Governments and regulatory bodies are establishing frameworks that mandate minimum recycled content in various products. These frameworks include reporting requirements, compliance mechanisms, and sometimes financial incentives or penalties. The regulations aim to drive market demand for recycled materials, reduce virgin material consumption, and promote circular economy principles by setting progressive recycled content targets across different industries.Expand Specific Solutions

Key Stakeholders in Recycled Content Certification

The recycled content targets and mass balance accounting landscape is evolving rapidly, with the market currently in a growth phase as sustainability regulations intensify globally. The market size is expanding significantly, driven by corporate commitments and consumer demand for sustainable products. Technologically, companies demonstrate varying maturity levels: chemical industry leaders like BASF and Borealis have advanced mass balance accounting systems; technology firms including IBM, Google, and Microsoft are developing tracking solutions; while manufacturers such as Samsung, Ford, and ASICS are implementing compliance frameworks. The competitive environment features collaboration between sectors, with chemical companies partnering with technology providers to create verifiable recycled content tracking systems that meet increasingly stringent regulatory requirements.

BASF Corp.

Technical Solution: BASF has developed ChemCycling™, a chemical recycling technology that converts plastic waste into pyrolysis oil which serves as feedstock for new chemical production. Their mass balance approach allows them to allocate recycled content to specific products while maintaining quality standards. The system tracks recycled materials through complex value chains, with third-party certification from organizations like REDcert2 and ISCC PLUS. BASF's certified mass balance accounting methodology enables customers to claim specific percentages of recycled content in final products, helping meet regulatory requirements and sustainability goals. Their digital tracking system provides transparent documentation of recycled content throughout the production process, supporting compliance reporting and verification[1][3].

Strengths: Industry-leading chemical recycling technology with established certification systems; comprehensive digital tracking capabilities for mass balance accounting. Weaknesses: Chemical recycling has higher energy requirements than mechanical recycling; mass balance approach requires complex verification systems that may be challenging for smaller supply chain partners.

Borealis GmbH

Technical Solution: Borealis has pioneered the Borcycle™ technology platform for mechanical recycling of polyolefins and the Borecycle™ mass balance approach for chemically recycled feedstock. Their EverMinds™ circular economy platform incorporates sophisticated mass balance accounting systems that track recycled content through complex production processes. Borealis employs blockchain-based digital solutions to verify and document the flow of recycled materials across their value chain, ensuring transparency and compliance with regulations like the EU Single-Use Plastics Directive. Their mass balance methodology has received ISCC PLUS certification, allowing for credible recycled content claims. The company's digital tracking system enables precise allocation of recycled content percentages to specific products while maintaining material quality specifications[2][4].

Strengths: Comprehensive portfolio combining both mechanical and chemical recycling technologies; advanced blockchain-based verification systems. Weaknesses: Implementation requires significant investment in digital infrastructure; reconciling different regional compliance standards remains challenging.

Critical Standards and Verification Protocols

Balancing of recyclable material amounts in product ecosystems

PatentWO2025108866A1

Innovation

- A computer-implemented method and apparatus for allocating recyclable material amounts associated with a material owner to virtual material accounts, and subsequently allocating these materials to produced chemical products by generating chemical product passports that include data related to the allocated recyclable materials.

Cross-Industry Implementation Strategies

The implementation of recycled content targets and mass balance accounting requires strategic approaches that transcend individual industry boundaries. Successful cross-industry implementation strategies focus on creating collaborative frameworks that enable diverse sectors to adopt consistent methodologies while addressing their unique operational challenges.

Standardization of accounting protocols represents a critical foundation for cross-industry implementation. Industries ranging from packaging and textiles to electronics and automotive can benefit from harmonized calculation methods that provide comparable metrics across supply chains. This standardization facilitates clearer communication between upstream and downstream partners, enabling more effective tracking of recycled content throughout product lifecycles.

Digital infrastructure development serves as another essential implementation strategy. Blockchain and distributed ledger technologies offer promising solutions for creating transparent, tamper-proof records of material flows across multiple industry participants. These technologies can bridge information gaps between disparate sectors, creating a common language for recycled content verification that transcends traditional industry boundaries.

Industry consortia and multi-stakeholder platforms have emerged as effective vehicles for cross-sector collaboration. Organizations like the Ellen MacArthur Foundation's Plastics Pact and the World Business Council for Sustainable Development have successfully brought together companies from packaging, retail, waste management, and chemical sectors to develop shared approaches to recycled content accounting and target-setting.

Knowledge transfer mechanisms between mature and emerging industries accelerate implementation timelines. Sectors with established recycled content programs, such as paper and aluminum, can provide valuable implementation insights to industries newer to these practices, such as textiles and electronics. Formal mentorship programs and case study repositories facilitate this cross-pollination of expertise.

Regulatory alignment strategies help companies navigate the complex landscape of recycled content requirements across different jurisdictions and sectors. Cross-industry implementation benefits from coordinated approaches to compliance, particularly for companies operating in multiple sectors with varying regulatory frameworks. Industry associations increasingly develop guidance documents that translate broad policy mandates into sector-specific implementation roadmaps.

Supply chain integration represents perhaps the most challenging yet rewarding aspect of cross-industry implementation. Vertical collaboration between material suppliers, manufacturers, brands, and waste management companies creates closed-loop systems that optimize recycled content utilization across traditional industry boundaries. These integrated approaches often yield innovative business models that transform waste streams from one industry into valuable inputs for another.

Standardization of accounting protocols represents a critical foundation for cross-industry implementation. Industries ranging from packaging and textiles to electronics and automotive can benefit from harmonized calculation methods that provide comparable metrics across supply chains. This standardization facilitates clearer communication between upstream and downstream partners, enabling more effective tracking of recycled content throughout product lifecycles.

Digital infrastructure development serves as another essential implementation strategy. Blockchain and distributed ledger technologies offer promising solutions for creating transparent, tamper-proof records of material flows across multiple industry participants. These technologies can bridge information gaps between disparate sectors, creating a common language for recycled content verification that transcends traditional industry boundaries.

Industry consortia and multi-stakeholder platforms have emerged as effective vehicles for cross-sector collaboration. Organizations like the Ellen MacArthur Foundation's Plastics Pact and the World Business Council for Sustainable Development have successfully brought together companies from packaging, retail, waste management, and chemical sectors to develop shared approaches to recycled content accounting and target-setting.

Knowledge transfer mechanisms between mature and emerging industries accelerate implementation timelines. Sectors with established recycled content programs, such as paper and aluminum, can provide valuable implementation insights to industries newer to these practices, such as textiles and electronics. Formal mentorship programs and case study repositories facilitate this cross-pollination of expertise.

Regulatory alignment strategies help companies navigate the complex landscape of recycled content requirements across different jurisdictions and sectors. Cross-industry implementation benefits from coordinated approaches to compliance, particularly for companies operating in multiple sectors with varying regulatory frameworks. Industry associations increasingly develop guidance documents that translate broad policy mandates into sector-specific implementation roadmaps.

Supply chain integration represents perhaps the most challenging yet rewarding aspect of cross-industry implementation. Vertical collaboration between material suppliers, manufacturers, brands, and waste management companies creates closed-loop systems that optimize recycled content utilization across traditional industry boundaries. These integrated approaches often yield innovative business models that transform waste streams from one industry into valuable inputs for another.

Economic Implications of Recycled Content Mandates

The implementation of recycled content mandates carries significant economic implications across various sectors of the economy. These policies, while environmentally beneficial, create complex economic dynamics that affect manufacturers, consumers, and recycling markets simultaneously.

For manufacturers, recycled content targets often necessitate substantial capital investments in new processing equipment, quality control systems, and supply chain modifications. Research indicates that initial compliance costs can increase production expenses by 8-15% depending on the industry sector. However, these costs typically decrease over time as economies of scale develop and technologies mature.

Consumer markets experience varied impacts from these mandates. Price sensitivity studies suggest that products with higher recycled content may command premium prices in certain market segments, particularly among environmentally conscious consumers. However, in price-sensitive markets, the additional costs may reduce competitiveness unless uniformly applied across all market participants.

The recycling industry itself undergoes significant transformation under content mandates. Demand for high-quality recycled materials increases substantially, often creating price volatility in recycled material markets. Historical data from regions with established mandates shows that recycled plastic prices can fluctuate by up to 30% during initial implementation phases before stabilizing.

Mass balance accounting systems introduce additional economic considerations through their compliance mechanisms. The administrative costs of tracking, verifying, and reporting material flows represent a new operational expense category for many businesses. Studies estimate these compliance costs at 2-5% of operational expenses during initial implementation years.

Labor markets also respond to these policy shifts. The recycling sector typically experiences job growth of 5-8% following mandate implementation, though manufacturing sectors may see more complex employment effects depending on automation levels and production adjustments.

International trade dimensions cannot be overlooked. Regions with stringent recycled content requirements may face competitiveness challenges if trading partners do not maintain similar standards. Conversely, early adopters often develop expertise and technologies that become valuable export commodities as global sustainability standards converge.

The long-term economic equilibrium typically shows improved resource efficiency and reduced externalities, though transition periods may create market disruptions. Economic modeling suggests that well-designed mandates with appropriate phase-in periods can minimize negative economic impacts while maximizing environmental benefits.

For manufacturers, recycled content targets often necessitate substantial capital investments in new processing equipment, quality control systems, and supply chain modifications. Research indicates that initial compliance costs can increase production expenses by 8-15% depending on the industry sector. However, these costs typically decrease over time as economies of scale develop and technologies mature.

Consumer markets experience varied impacts from these mandates. Price sensitivity studies suggest that products with higher recycled content may command premium prices in certain market segments, particularly among environmentally conscious consumers. However, in price-sensitive markets, the additional costs may reduce competitiveness unless uniformly applied across all market participants.

The recycling industry itself undergoes significant transformation under content mandates. Demand for high-quality recycled materials increases substantially, often creating price volatility in recycled material markets. Historical data from regions with established mandates shows that recycled plastic prices can fluctuate by up to 30% during initial implementation phases before stabilizing.

Mass balance accounting systems introduce additional economic considerations through their compliance mechanisms. The administrative costs of tracking, verifying, and reporting material flows represent a new operational expense category for many businesses. Studies estimate these compliance costs at 2-5% of operational expenses during initial implementation years.

Labor markets also respond to these policy shifts. The recycling sector typically experiences job growth of 5-8% following mandate implementation, though manufacturing sectors may see more complex employment effects depending on automation levels and production adjustments.

International trade dimensions cannot be overlooked. Regions with stringent recycled content requirements may face competitiveness challenges if trading partners do not maintain similar standards. Conversely, early adopters often develop expertise and technologies that become valuable export commodities as global sustainability standards converge.

The long-term economic equilibrium typically shows improved resource efficiency and reduced externalities, though transition periods may create market disruptions. Economic modeling suggests that well-designed mandates with appropriate phase-in periods can minimize negative economic impacts while maximizing environmental benefits.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!