Tax digital checking method

A tax and financial data technology, applied in the field of informatization audit, can solve problems such as large amount of calculation, inability to automatically summarize into the case database, scattered and unconcentrated data, etc., to achieve the effect of rich analysis data

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

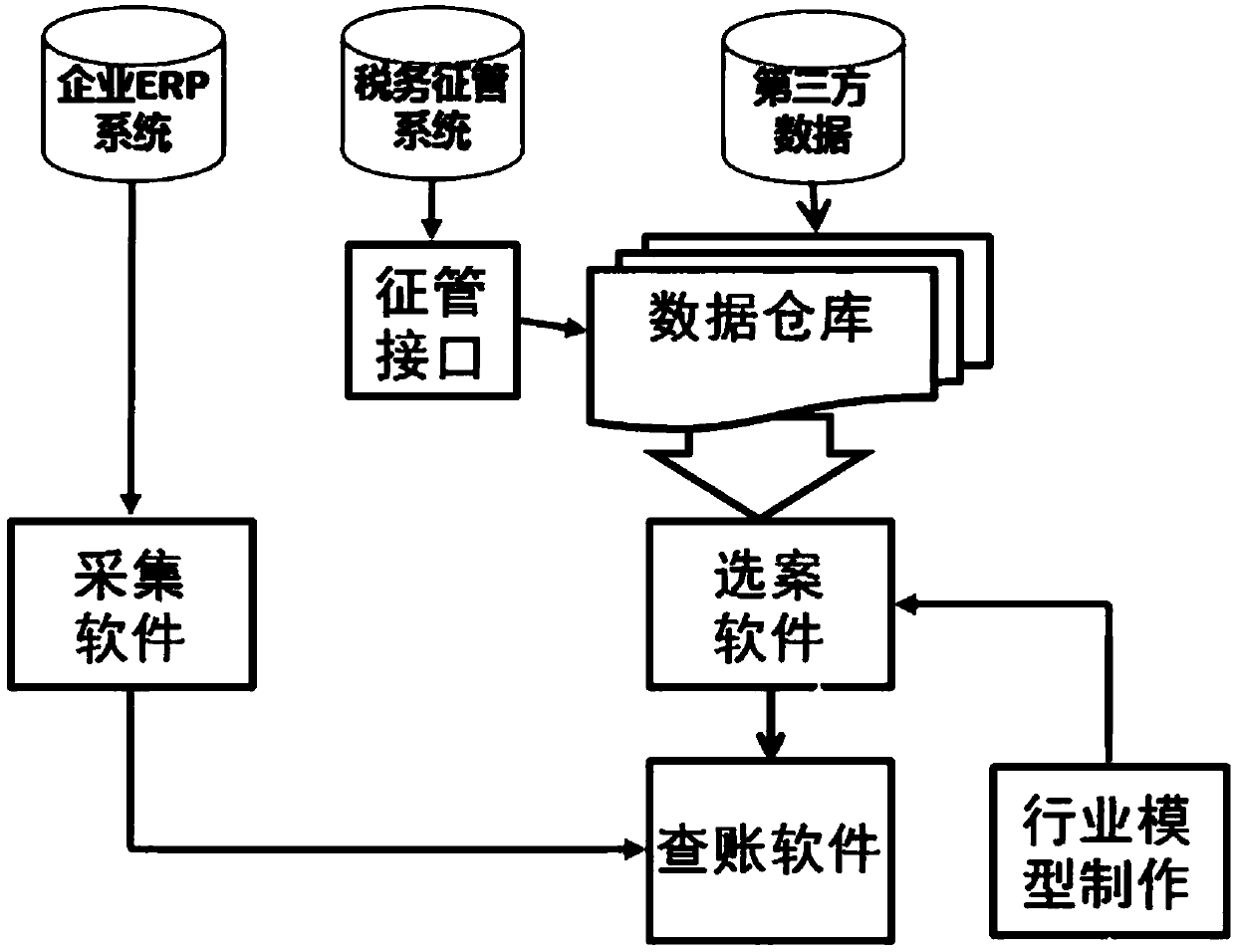

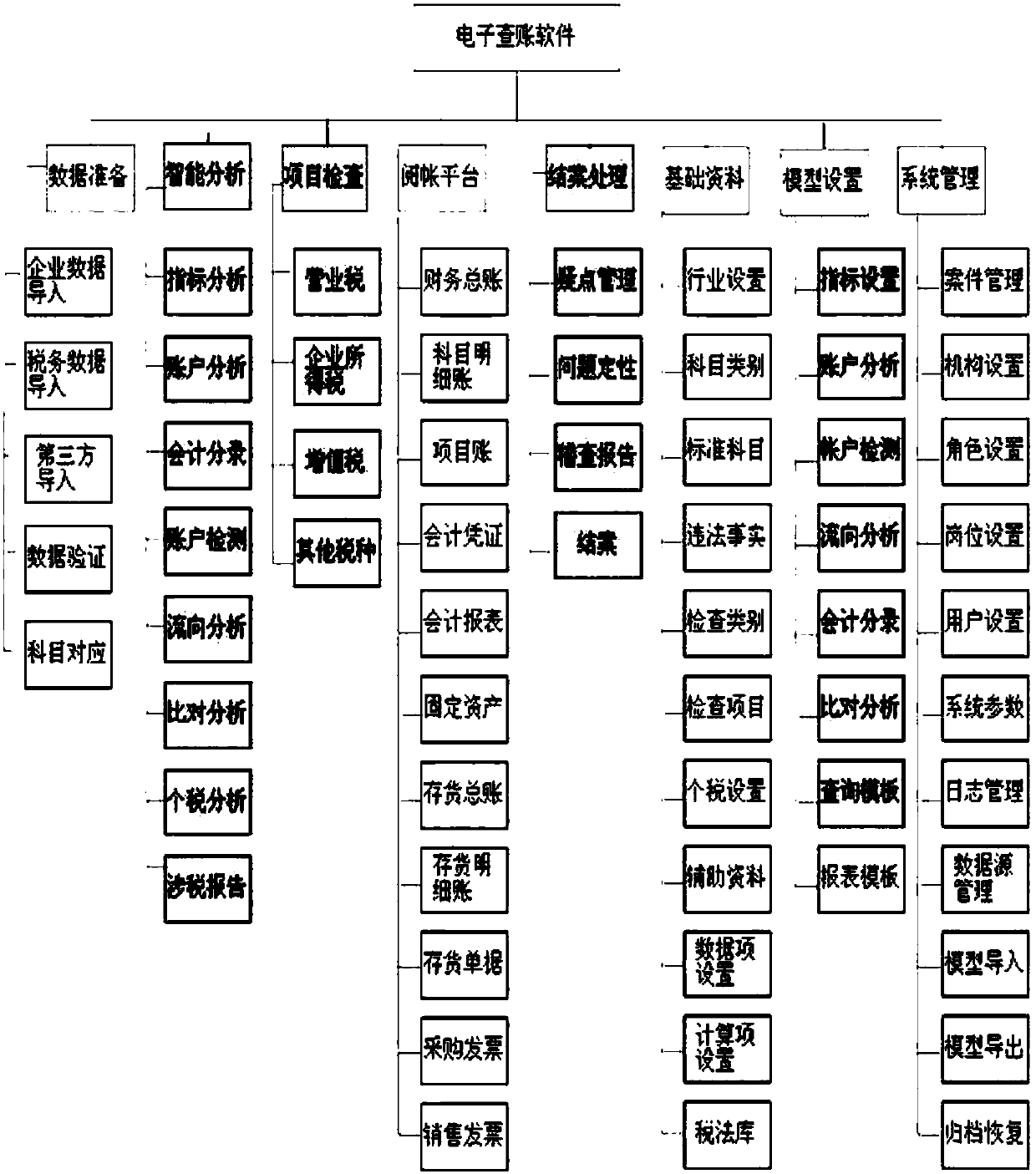

[0022] Now in conjunction with accompanying drawing, invention is described in further detail. These drawings are all simplified schematic diagrams, which only illustrate the basic structure of the invention in a schematic way, so they only show the composition related to the invention.

[0023] A tax digital audit method, including enterprise ERP system, collection software, tax collection and management system, third-party data source, data warehouse, audit software and industry model template;

[0024] The enterprise ERP system collects financial data through collection software;

[0025] The tax collection and management system opens up the collection and management interface;

[0026] Both the third-party data source and the collection and management interface are connected to the data warehouse;

[0027] The data warehouse cooperates with the case selection software to perform case selection operations on the case data in the data warehouse;

[0028] The collection an...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com