Method of issuing multi-tax-rate value-added tax invoice for sale bill without tax amount and system thereof

A technology of sales slips and value-added tax, which is applied in invoicing/invoicing, instruments, finance, etc. It can solve problems such as inconsistencies in data verification relations, inability to issue invoices normally, and discrepancies, so as to strengthen invoice management and promote legal and standardized operations. Effect of invoicing and risk reduction

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] Specific embodiments of the present invention will be described in detail below in conjunction with the accompanying drawings. It should be understood that the specific embodiments described here are only used to illustrate and explain the present invention, and are not intended to limit the present invention.

[0023] Multiple tax rates refer to the fact that there can be multiple tax rates for the product details on a value-added tax invoice; the tax-free sales slip is a type of corporate sales slip, and the tax amount actually issued in the invoice is used in financial management, and the enterprise does not need to issue a tax amount on the invoice. Taxes are calculated on the bill of sale before the sale. The characteristic of this kind of sales slip data is that neither the tax rate nor the tax amount is marked in the sales slip master data; different tax rates are marked in the sales slip detail data, but the tax amount is not marked.

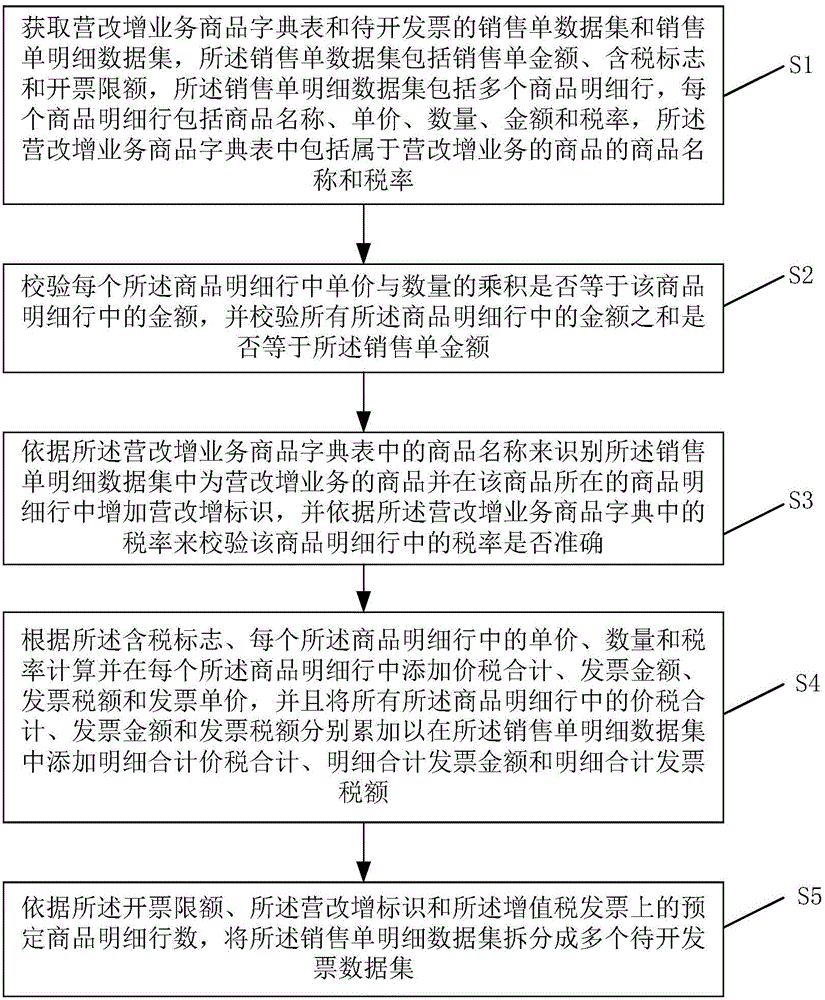

[0024] Such as figure 1 ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com