How to Benchmark Innovations in Cellophane Design?

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Cellophane Innovation Background and Objectives

Cellophane, a thin transparent sheet made from regenerated cellulose, has been a staple in packaging and industrial applications for over a century. Since its invention in 1908 by Jacques E. Brandenberger, cellophane has undergone numerous innovations to enhance its properties and expand its uses. The evolution of cellophane design has been driven by the need for improved barrier properties, sustainability, and cost-effectiveness.

In recent years, the focus on environmental sustainability has led to increased interest in biodegradable and compostable packaging materials. This shift has reignited research into cellophane as a potential alternative to petroleum-based plastics. The objective of benchmarking innovations in cellophane design is to evaluate and compare new developments in this field, with the aim of identifying superior solutions that meet modern packaging requirements while minimizing environmental impact.

The technological landscape of cellophane innovation encompasses several key areas. These include modifications to the cellulose source material, improvements in the regeneration process, and the incorporation of additives to enhance specific properties. Researchers are exploring various cellulose sources, including agricultural waste and sustainable forestry products, to reduce the environmental footprint of cellophane production.

Advancements in the regeneration process focus on reducing chemical usage and improving energy efficiency. Novel techniques, such as ionic liquid-based processes and enzymatic treatments, are being investigated to create more environmentally friendly production methods. Additionally, the integration of nanotechnology has opened up new possibilities for enhancing cellophane's barrier properties and mechanical strength.

The benchmarking of cellophane innovations aims to establish standardized metrics for evaluating new designs. These metrics typically include barrier properties (moisture, gas, and grease resistance), mechanical strength, transparency, biodegradability, and overall environmental impact. By setting clear benchmarks, researchers and industry professionals can objectively assess the performance of new cellophane formulations and production techniques.

The ultimate goal of this benchmarking effort is to accelerate the development of next-generation cellophane materials that can compete with or surpass the performance of conventional plastics in various applications. This involves not only improving the material properties but also ensuring scalability and cost-effectiveness of production processes. As the demand for sustainable packaging solutions continues to grow, the ability to effectively benchmark cellophane innovations will play a crucial role in driving the adoption of these materials across diverse industries.

In recent years, the focus on environmental sustainability has led to increased interest in biodegradable and compostable packaging materials. This shift has reignited research into cellophane as a potential alternative to petroleum-based plastics. The objective of benchmarking innovations in cellophane design is to evaluate and compare new developments in this field, with the aim of identifying superior solutions that meet modern packaging requirements while minimizing environmental impact.

The technological landscape of cellophane innovation encompasses several key areas. These include modifications to the cellulose source material, improvements in the regeneration process, and the incorporation of additives to enhance specific properties. Researchers are exploring various cellulose sources, including agricultural waste and sustainable forestry products, to reduce the environmental footprint of cellophane production.

Advancements in the regeneration process focus on reducing chemical usage and improving energy efficiency. Novel techniques, such as ionic liquid-based processes and enzymatic treatments, are being investigated to create more environmentally friendly production methods. Additionally, the integration of nanotechnology has opened up new possibilities for enhancing cellophane's barrier properties and mechanical strength.

The benchmarking of cellophane innovations aims to establish standardized metrics for evaluating new designs. These metrics typically include barrier properties (moisture, gas, and grease resistance), mechanical strength, transparency, biodegradability, and overall environmental impact. By setting clear benchmarks, researchers and industry professionals can objectively assess the performance of new cellophane formulations and production techniques.

The ultimate goal of this benchmarking effort is to accelerate the development of next-generation cellophane materials that can compete with or surpass the performance of conventional plastics in various applications. This involves not only improving the material properties but also ensuring scalability and cost-effectiveness of production processes. As the demand for sustainable packaging solutions continues to grow, the ability to effectively benchmark cellophane innovations will play a crucial role in driving the adoption of these materials across diverse industries.

Market Analysis for Advanced Cellophane Products

The global market for advanced cellophane products has been experiencing significant growth in recent years, driven by increasing demand for sustainable packaging solutions and technological advancements in material science. The cellophane industry, once considered traditional, is now undergoing a renaissance with innovations in design and functionality.

Market research indicates that the advanced cellophane sector is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2021 to 2026. This growth is primarily attributed to the rising awareness of environmental issues and the shift towards eco-friendly packaging alternatives. The food and beverage industry remains the largest consumer of advanced cellophane products, accounting for approximately 60% of the market share.

In terms of regional distribution, Asia-Pacific leads the market, followed by North America and Europe. The Asia-Pacific region's dominance is due to the rapid industrialization in countries like China and India, coupled with the increasing adoption of advanced packaging solutions in the food and retail sectors. North America and Europe, on the other hand, are driven by stringent regulations promoting sustainable packaging and consumer preferences for environmentally friendly products.

Key market trends shaping the advanced cellophane industry include the development of bio-based cellophane, enhanced barrier properties, and smart packaging integration. Bio-based cellophane, derived from renewable resources such as wood pulp or cotton linters, is gaining traction due to its reduced environmental impact. Manufacturers are also focusing on improving the barrier properties of cellophane to extend shelf life and maintain product quality, particularly in the food packaging segment.

The integration of smart packaging technologies with cellophane is another emerging trend. This includes the incorporation of QR codes, NFC tags, and temperature-sensitive indicators, enhancing traceability and consumer engagement. Such innovations are opening new avenues for cellophane applications beyond traditional packaging, including in sectors like pharmaceuticals and electronics.

However, the market faces challenges such as competition from alternative packaging materials like bioplastics and the volatility of raw material prices. To overcome these challenges, industry players are investing in research and development to enhance the performance and cost-effectiveness of advanced cellophane products.

In conclusion, the market analysis for advanced cellophane products reveals a promising future, driven by sustainability trends and technological innovations. As the industry continues to evolve, benchmarking innovations in cellophane design will be crucial for companies to maintain a competitive edge and meet the changing demands of consumers and regulatory bodies.

Market research indicates that the advanced cellophane sector is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2021 to 2026. This growth is primarily attributed to the rising awareness of environmental issues and the shift towards eco-friendly packaging alternatives. The food and beverage industry remains the largest consumer of advanced cellophane products, accounting for approximately 60% of the market share.

In terms of regional distribution, Asia-Pacific leads the market, followed by North America and Europe. The Asia-Pacific region's dominance is due to the rapid industrialization in countries like China and India, coupled with the increasing adoption of advanced packaging solutions in the food and retail sectors. North America and Europe, on the other hand, are driven by stringent regulations promoting sustainable packaging and consumer preferences for environmentally friendly products.

Key market trends shaping the advanced cellophane industry include the development of bio-based cellophane, enhanced barrier properties, and smart packaging integration. Bio-based cellophane, derived from renewable resources such as wood pulp or cotton linters, is gaining traction due to its reduced environmental impact. Manufacturers are also focusing on improving the barrier properties of cellophane to extend shelf life and maintain product quality, particularly in the food packaging segment.

The integration of smart packaging technologies with cellophane is another emerging trend. This includes the incorporation of QR codes, NFC tags, and temperature-sensitive indicators, enhancing traceability and consumer engagement. Such innovations are opening new avenues for cellophane applications beyond traditional packaging, including in sectors like pharmaceuticals and electronics.

However, the market faces challenges such as competition from alternative packaging materials like bioplastics and the volatility of raw material prices. To overcome these challenges, industry players are investing in research and development to enhance the performance and cost-effectiveness of advanced cellophane products.

In conclusion, the market analysis for advanced cellophane products reveals a promising future, driven by sustainability trends and technological innovations. As the industry continues to evolve, benchmarking innovations in cellophane design will be crucial for companies to maintain a competitive edge and meet the changing demands of consumers and regulatory bodies.

Current Challenges in Cellophane Design

Cellophane design faces several significant challenges in the current landscape, primarily stemming from the increasing demand for sustainable and high-performance packaging solutions. One of the foremost issues is the need to improve the biodegradability of cellophane without compromising its barrier properties. While cellophane is derived from renewable resources, its disposal and decomposition rates remain concerns in the context of environmental sustainability.

Another critical challenge lies in enhancing the moisture resistance of cellophane. Traditional cellophane is highly sensitive to humidity, which can lead to changes in its physical properties and potentially compromise the integrity of packaged products. This sensitivity limits its application in certain industries, particularly those requiring long-term storage or exposure to varying environmental conditions.

The manufacturing process of cellophane also presents challenges in terms of energy efficiency and chemical usage. The production of cellophane typically involves the use of carbon disulfide, a toxic and flammable compound. Developing alternative, more environmentally friendly production methods without sacrificing the quality and properties of the final product remains a significant hurdle for manufacturers.

Improving the heat-sealing capabilities of cellophane is another area of focus. While cellophane offers excellent clarity and barrier properties, its heat-sealing performance is often inferior to synthetic polymers. This limitation affects its usability in certain packaging applications and can lead to increased reliance on adhesives or additional sealing materials.

The mechanical strength of cellophane, particularly its tear resistance, is another aspect that requires improvement. Enhancing these properties without adding synthetic materials or compromising the film's transparency and biodegradability presents a complex challenge for material scientists and engineers.

Furthermore, the industry faces the challenge of reducing the overall cost of cellophane production while maintaining or improving its performance characteristics. This economic factor is crucial for cellophane to remain competitive against synthetic alternatives, especially in markets where cost is a primary consideration.

Lastly, there is an ongoing challenge to develop cellophane variants with enhanced functionality, such as improved printability, anti-fog properties, or antimicrobial characteristics. These advancements are essential for cellophane to meet the evolving needs of various industries, from food packaging to medical applications.

Another critical challenge lies in enhancing the moisture resistance of cellophane. Traditional cellophane is highly sensitive to humidity, which can lead to changes in its physical properties and potentially compromise the integrity of packaged products. This sensitivity limits its application in certain industries, particularly those requiring long-term storage or exposure to varying environmental conditions.

The manufacturing process of cellophane also presents challenges in terms of energy efficiency and chemical usage. The production of cellophane typically involves the use of carbon disulfide, a toxic and flammable compound. Developing alternative, more environmentally friendly production methods without sacrificing the quality and properties of the final product remains a significant hurdle for manufacturers.

Improving the heat-sealing capabilities of cellophane is another area of focus. While cellophane offers excellent clarity and barrier properties, its heat-sealing performance is often inferior to synthetic polymers. This limitation affects its usability in certain packaging applications and can lead to increased reliance on adhesives or additional sealing materials.

The mechanical strength of cellophane, particularly its tear resistance, is another aspect that requires improvement. Enhancing these properties without adding synthetic materials or compromising the film's transparency and biodegradability presents a complex challenge for material scientists and engineers.

Furthermore, the industry faces the challenge of reducing the overall cost of cellophane production while maintaining or improving its performance characteristics. This economic factor is crucial for cellophane to remain competitive against synthetic alternatives, especially in markets where cost is a primary consideration.

Lastly, there is an ongoing challenge to develop cellophane variants with enhanced functionality, such as improved printability, anti-fog properties, or antimicrobial characteristics. These advancements are essential for cellophane to meet the evolving needs of various industries, from food packaging to medical applications.

Existing Benchmarking Methods for Cellophane

01 Biodegradable cellophane innovations

Recent innovations focus on developing biodegradable cellophane materials to address environmental concerns. These new formulations incorporate natural polymers and additives to enhance the material's biodegradability while maintaining its desirable properties such as transparency and barrier functions.- Biodegradable cellophane innovations: Recent innovations focus on developing biodegradable cellophane materials to address environmental concerns. These advancements involve using renewable resources and modifying the production process to create cellophane that can decompose naturally, reducing plastic waste and environmental impact.

- Improved barrier properties in cellophane: Innovations in cellophane technology aim to enhance its barrier properties against moisture, gases, and other external factors. These improvements involve incorporating new additives or modifying the cellulose structure to create more effective packaging solutions for various industries, including food and pharmaceuticals.

- Cellophane-based smart packaging: Advancements in cellophane technology include the development of smart packaging solutions. These innovations integrate sensors, indicators, or responsive elements into cellophane materials, allowing for real-time monitoring of product freshness, temperature, or other relevant factors.

- Nanocellulose-enhanced cellophane: Researchers are exploring the incorporation of nanocellulose into cellophane production to enhance its mechanical, thermal, and barrier properties. This innovation aims to create stronger, more versatile cellophane materials with improved performance characteristics for various applications.

- Cellophane-based electronic components: Innovations in cellophane technology extend to the development of flexible electronic components. These advancements involve creating conductive or semi-conductive cellophane materials that can be used in flexible displays, sensors, or other electronic applications, combining the benefits of cellophane with electronic functionality.

02 Cellophane-based packaging solutions

Advancements in cellophane-based packaging include improved barrier properties, enhanced printability, and novel designs for various industries. These innovations aim to provide sustainable alternatives to traditional plastic packaging while ensuring product protection and shelf-life extension.Expand Specific Solutions03 Cellophane modifications for specific applications

Researchers are developing specialized cellophane materials tailored for specific applications such as food packaging, medical devices, and electronic components. These modifications involve incorporating functional additives or surface treatments to enhance properties like antimicrobial activity, conductivity, or heat resistance.Expand Specific Solutions04 Manufacturing process improvements

Innovations in cellophane manufacturing processes focus on increasing efficiency, reducing energy consumption, and improving product quality. These advancements include novel extrusion techniques, process control systems, and the integration of sustainable raw materials.Expand Specific Solutions05 Cellophane-based composite materials

Research is being conducted on developing composite materials that incorporate cellophane with other materials to create hybrid products with enhanced properties. These composites aim to combine the benefits of cellophane with those of other materials, resulting in improved strength, flexibility, or functionality.Expand Specific Solutions

Key Players in Cellophane Industry

The cellophane design innovation landscape is characterized by a mature market with steady growth, driven by demand in packaging and industrial applications. The global market size is estimated to be in the billions, with moderate annual growth. Technologically, the field is well-established but continues to evolve, focusing on improving sustainability and performance. Key players like Corning, Inc. and AGC, Inc. lead in material science innovations, while companies such as Taiwan Semiconductor Manufacturing Co., Ltd. and SK hynix, Inc. contribute to advanced manufacturing processes. Emerging technologies in nano-materials and bio-based alternatives are pushing the boundaries of traditional cellophane design, with companies like Ginkgo Bioworks, Inc. exploring novel approaches to enhance functionality and eco-friendliness.

Corning, Inc.

Technical Solution: Corning has developed advanced cellophane benchmarking techniques using their proprietary optical and materials science expertise. Their approach involves high-precision surface analysis tools to measure nanoscale variations in cellophane thickness and uniformity. They employ automated optical inspection systems capable of detecting defects as small as 100 nanometers[1]. Corning's benchmarking process also includes accelerated aging tests to evaluate long-term performance and durability of cellophane innovations. They utilize spectroscopic methods to analyze chemical composition and molecular structure changes in cellophane samples before and after stress testing[2].

Strengths: Extensive materials science expertise, advanced analytical tools, and comprehensive testing protocols. Weaknesses: Potentially high equipment costs and complexity of analysis may limit widespread adoption.

AGC, Inc. (Japan)

Technical Solution: AGC has developed a multi-faceted approach to benchmarking cellophane innovations. Their method combines physical, chemical, and performance testing. They use advanced microscopy techniques, including atomic force microscopy, to analyze surface topography and mechanical properties at the nanoscale[3]. AGC's benchmarking process also incorporates gas permeability tests to evaluate barrier properties, which is crucial for packaging applications. They have developed a proprietary accelerated weathering chamber to simulate various environmental conditions and assess cellophane durability[4]. Additionally, AGC employs machine learning algorithms to analyze large datasets from their tests, enabling more accurate predictions of long-term cellophane performance.

Strengths: Comprehensive testing approach, advanced analytical techniques, and integration of AI for data analysis. Weaknesses: Potentially time-consuming process due to extensive testing protocols.

Core Innovations in Cellophane Design

Method of determining colorability of a semiconductor device and system for implementing the same

PatentActiveUS20200117848A1

Innovation

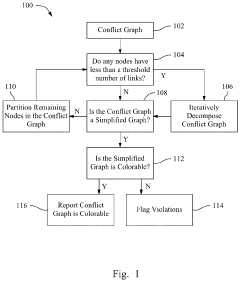

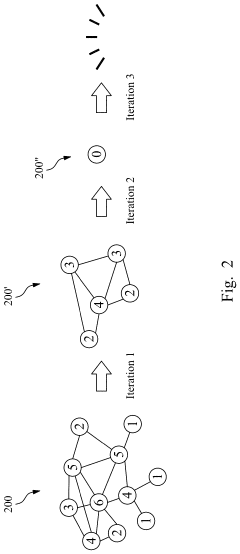

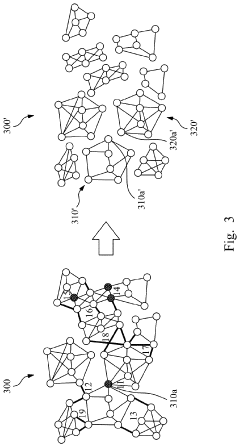

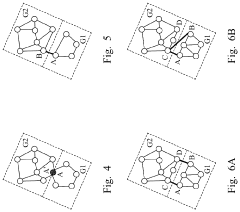

- A method that involves decomposing and partitioning the conflict graph by removing nodes with fewer than a threshold number of links, iteratively reducing links to meet the threshold, and analyzing the simplified graph for colorability, using specific processing devices to execute instructions and apply partition rules based on the number of masks used for patterning.

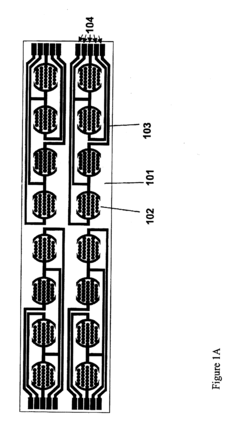

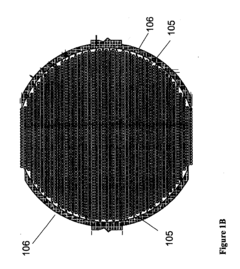

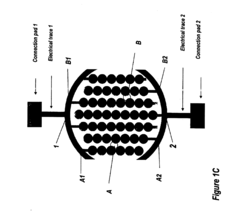

Real time electronic cell sensing system and applications for cytotoxicity profiling and compound assays

PatentInactiveUS20110117542A1

Innovation

- A real-time cell-substrate impedance measurement system using electrode arrays on a nonconducting substrate, connected to an impedance analyzer and controlled by software, allows for continuous monitoring of cell-substrate impedance changes, enabling the calculation of Cell Change Index and providing insights into cellular responses to compounds over time.

Environmental Impact of Cellophane Production

The environmental impact of cellophane production is a critical consideration in the benchmarking of innovations in cellophane design. Cellophane, a thin, transparent sheet made from regenerated cellulose, has been widely used in packaging and other applications for decades. However, its production process has significant environmental implications that need to be addressed.

The primary raw material for cellophane production is wood pulp, which raises concerns about deforestation and habitat destruction. The harvesting of trees for wood pulp can lead to loss of biodiversity and disruption of ecosystems if not managed sustainably. Additionally, the transportation of raw materials to production facilities contributes to carbon emissions and air pollution.

The manufacturing process of cellophane involves the use of various chemicals, including carbon disulfide, sodium hydroxide, and sulfuric acid. These chemicals can pose risks to both human health and the environment if not properly handled and disposed of. Wastewater from cellophane production often contains high levels of dissolved solids, organic compounds, and potentially toxic substances, requiring extensive treatment before release.

Energy consumption is another significant environmental factor in cellophane production. The process requires substantial amounts of heat and electricity, often derived from fossil fuels, contributing to greenhouse gas emissions and climate change. The energy-intensive nature of cellophane manufacturing highlights the need for more efficient production methods and the adoption of renewable energy sources.

Waste generation is a notable concern in cellophane production. Off-cuts, trimmings, and defective products contribute to solid waste, while chemical residues and byproducts require proper disposal or recycling. The challenge of recycling cellophane further compounds its environmental impact, as it is not widely accepted in most recycling programs due to contamination issues and the difficulty in separating it from other materials.

Water usage is another environmental consideration in cellophane production. The manufacturing process requires significant amounts of water for various stages, including washing and cooling. In regions where water scarcity is a concern, this high water demand can strain local resources and ecosystems.

Innovations in cellophane design must address these environmental challenges to improve the sustainability of the product. Potential areas for improvement include developing more eco-friendly production processes, utilizing sustainable raw materials, implementing closed-loop systems for water and chemical recycling, and enhancing the recyclability and biodegradability of the final product. Benchmarking these innovations should consider metrics such as carbon footprint, water usage, waste generation, and overall lifecycle assessment to evaluate their environmental performance effectively.

The primary raw material for cellophane production is wood pulp, which raises concerns about deforestation and habitat destruction. The harvesting of trees for wood pulp can lead to loss of biodiversity and disruption of ecosystems if not managed sustainably. Additionally, the transportation of raw materials to production facilities contributes to carbon emissions and air pollution.

The manufacturing process of cellophane involves the use of various chemicals, including carbon disulfide, sodium hydroxide, and sulfuric acid. These chemicals can pose risks to both human health and the environment if not properly handled and disposed of. Wastewater from cellophane production often contains high levels of dissolved solids, organic compounds, and potentially toxic substances, requiring extensive treatment before release.

Energy consumption is another significant environmental factor in cellophane production. The process requires substantial amounts of heat and electricity, often derived from fossil fuels, contributing to greenhouse gas emissions and climate change. The energy-intensive nature of cellophane manufacturing highlights the need for more efficient production methods and the adoption of renewable energy sources.

Waste generation is a notable concern in cellophane production. Off-cuts, trimmings, and defective products contribute to solid waste, while chemical residues and byproducts require proper disposal or recycling. The challenge of recycling cellophane further compounds its environmental impact, as it is not widely accepted in most recycling programs due to contamination issues and the difficulty in separating it from other materials.

Water usage is another environmental consideration in cellophane production. The manufacturing process requires significant amounts of water for various stages, including washing and cooling. In regions where water scarcity is a concern, this high water demand can strain local resources and ecosystems.

Innovations in cellophane design must address these environmental challenges to improve the sustainability of the product. Potential areas for improvement include developing more eco-friendly production processes, utilizing sustainable raw materials, implementing closed-loop systems for water and chemical recycling, and enhancing the recyclability and biodegradability of the final product. Benchmarking these innovations should consider metrics such as carbon footprint, water usage, waste generation, and overall lifecycle assessment to evaluate their environmental performance effectively.

Regulatory Framework for Packaging Materials

The regulatory framework for packaging materials plays a crucial role in benchmarking innovations in cellophane design. As cellophane is widely used in food packaging and other consumer goods, it is subject to stringent regulations to ensure safety and environmental compliance. In the United States, the Food and Drug Administration (FDA) oversees the regulation of food contact materials, including cellophane. The FDA's Code of Federal Regulations Title 21, Part 177, Subpart B specifically addresses cellophane, detailing the permitted raw materials and manufacturing processes.

In the European Union, the European Food Safety Authority (EFSA) is responsible for evaluating the safety of food contact materials. The EU Regulation No 1935/2004 provides the general framework for materials intended to come into contact with food, while specific measures for cellophane are outlined in Commission Directive 2007/42/EC. These regulations set limits on migration of substances from cellophane to food and specify the authorized substances that can be used in its production.

Japan's regulatory framework for food packaging materials is governed by the Food Sanitation Act, which includes specific provisions for cellophane. The Japanese Ministry of Health, Labour and Welfare has established positive lists of substances that can be used in food packaging materials, including cellophane, to ensure consumer safety.

Environmental regulations also significantly impact cellophane design innovations. Many countries have implemented regulations to reduce plastic waste and promote sustainable packaging solutions. For instance, the EU's Packaging and Packaging Waste Directive (94/62/EC) sets targets for the recovery and recycling of packaging materials, including cellophane. This directive has been instrumental in driving innovations towards more environmentally friendly cellophane designs.

The regulatory landscape for packaging materials is continuously evolving, with increasing focus on sustainability and circular economy principles. Recent initiatives, such as the EU's Circular Economy Action Plan, are likely to influence future cellophane design innovations by promoting recyclability, reusability, and biodegradability. As a result, manufacturers are increasingly investing in research and development to create cellophane products that not only meet current regulatory requirements but also anticipate future regulatory trends.

Compliance with these diverse regulatory frameworks is essential for any innovation in cellophane design. Manufacturers must navigate a complex web of national and international regulations, ensuring that their products meet the highest standards of safety and environmental responsibility. This regulatory environment serves as both a challenge and an opportunity for innovation, driving the development of advanced cellophane designs that are safer, more sustainable, and compliant with global standards.

In the European Union, the European Food Safety Authority (EFSA) is responsible for evaluating the safety of food contact materials. The EU Regulation No 1935/2004 provides the general framework for materials intended to come into contact with food, while specific measures for cellophane are outlined in Commission Directive 2007/42/EC. These regulations set limits on migration of substances from cellophane to food and specify the authorized substances that can be used in its production.

Japan's regulatory framework for food packaging materials is governed by the Food Sanitation Act, which includes specific provisions for cellophane. The Japanese Ministry of Health, Labour and Welfare has established positive lists of substances that can be used in food packaging materials, including cellophane, to ensure consumer safety.

Environmental regulations also significantly impact cellophane design innovations. Many countries have implemented regulations to reduce plastic waste and promote sustainable packaging solutions. For instance, the EU's Packaging and Packaging Waste Directive (94/62/EC) sets targets for the recovery and recycling of packaging materials, including cellophane. This directive has been instrumental in driving innovations towards more environmentally friendly cellophane designs.

The regulatory landscape for packaging materials is continuously evolving, with increasing focus on sustainability and circular economy principles. Recent initiatives, such as the EU's Circular Economy Action Plan, are likely to influence future cellophane design innovations by promoting recyclability, reusability, and biodegradability. As a result, manufacturers are increasingly investing in research and development to create cellophane products that not only meet current regulatory requirements but also anticipate future regulatory trends.

Compliance with these diverse regulatory frameworks is essential for any innovation in cellophane design. Manufacturers must navigate a complex web of national and international regulations, ensuring that their products meet the highest standards of safety and environmental responsibility. This regulatory environment serves as both a challenge and an opportunity for innovation, driving the development of advanced cellophane designs that are safer, more sustainable, and compliant with global standards.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!