How 5G UC Supports Real-Time Data Analysis in Financial Markets

JUL 18, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

5G UC in Finance: Background and Objectives

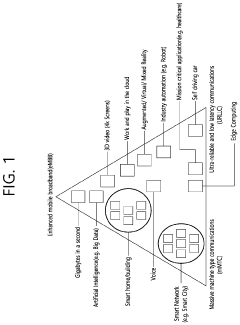

The evolution of financial markets has been characterized by an ever-increasing demand for speed and efficiency in data processing and decision-making. As the volume and complexity of financial data continue to grow exponentially, traditional network infrastructures have struggled to keep pace with the real-time analysis requirements of modern financial institutions. This is where 5G Ultra-Capacity (UC) technology emerges as a game-changing solution, promising to revolutionize the landscape of financial data analysis.

5G UC, the latest iteration of fifth-generation cellular network technology, offers unprecedented capabilities in terms of data transmission speed, low latency, and network capacity. These features are particularly crucial in the context of financial markets, where milliseconds can make the difference between profit and loss. The primary objective of implementing 5G UC in financial data analysis is to enable near-instantaneous processing and transmission of vast amounts of market data, facilitating more accurate and timely decision-making.

The historical trajectory of network technologies in finance has seen a steady progression from 3G to 4G LTE, each generation bringing significant improvements in data handling capabilities. However, the leap to 5G UC represents a quantum shift, with theoretical speeds up to 100 times faster than 4G and latency reduced to mere milliseconds. This technological advancement aligns perfectly with the financial sector's insatiable appetite for faster, more reliable data analysis tools.

In the context of financial markets, the goals of 5G UC implementation are multifaceted. Primarily, it aims to support high-frequency trading systems by minimizing latency in data transmission and order execution. Additionally, 5G UC is expected to enhance risk management processes by enabling real-time monitoring and analysis of market conditions across global financial centers. The technology also holds the promise of democratizing access to financial data, potentially leveling the playing field for smaller institutions and individual investors.

The integration of 5G UC into financial data analysis systems is not without its challenges. Concerns about security, given the sensitive nature of financial data, and the need for significant infrastructure upgrades are among the key issues that need to be addressed. However, the potential benefits in terms of improved market efficiency, reduced transaction costs, and enhanced analytical capabilities are driving the financial industry towards rapid adoption of this transformative technology.

As we delve deeper into the specifics of how 5G UC supports real-time data analysis in financial markets, it becomes clear that this technology is not just an incremental improvement, but a fundamental shift in how financial data is processed, analyzed, and acted upon. The journey towards fully leveraging 5G UC in finance is just beginning, and its impact on the industry promises to be profound and far-reaching.

5G UC, the latest iteration of fifth-generation cellular network technology, offers unprecedented capabilities in terms of data transmission speed, low latency, and network capacity. These features are particularly crucial in the context of financial markets, where milliseconds can make the difference between profit and loss. The primary objective of implementing 5G UC in financial data analysis is to enable near-instantaneous processing and transmission of vast amounts of market data, facilitating more accurate and timely decision-making.

The historical trajectory of network technologies in finance has seen a steady progression from 3G to 4G LTE, each generation bringing significant improvements in data handling capabilities. However, the leap to 5G UC represents a quantum shift, with theoretical speeds up to 100 times faster than 4G and latency reduced to mere milliseconds. This technological advancement aligns perfectly with the financial sector's insatiable appetite for faster, more reliable data analysis tools.

In the context of financial markets, the goals of 5G UC implementation are multifaceted. Primarily, it aims to support high-frequency trading systems by minimizing latency in data transmission and order execution. Additionally, 5G UC is expected to enhance risk management processes by enabling real-time monitoring and analysis of market conditions across global financial centers. The technology also holds the promise of democratizing access to financial data, potentially leveling the playing field for smaller institutions and individual investors.

The integration of 5G UC into financial data analysis systems is not without its challenges. Concerns about security, given the sensitive nature of financial data, and the need for significant infrastructure upgrades are among the key issues that need to be addressed. However, the potential benefits in terms of improved market efficiency, reduced transaction costs, and enhanced analytical capabilities are driving the financial industry towards rapid adoption of this transformative technology.

As we delve deeper into the specifics of how 5G UC supports real-time data analysis in financial markets, it becomes clear that this technology is not just an incremental improvement, but a fundamental shift in how financial data is processed, analyzed, and acted upon. The journey towards fully leveraging 5G UC in finance is just beginning, and its impact on the industry promises to be profound and far-reaching.

Market Demand for Real-Time Financial Analysis

The demand for real-time financial analysis in today's fast-paced markets has grown exponentially, driven by the need for instant decision-making and competitive advantage. Financial institutions, traders, and investors increasingly rely on up-to-the-second data to execute trades, manage risks, and capitalize on market opportunities. This surge in demand is fueled by the proliferation of high-frequency trading, algorithmic trading strategies, and the growing complexity of financial instruments.

The global financial analytics market, which encompasses real-time analysis tools, is experiencing robust growth. This expansion is attributed to the increasing adoption of data-driven decision-making processes across the financial sector. Banks, hedge funds, and asset management firms are investing heavily in advanced analytics capabilities to gain insights from vast amounts of financial data streaming in real-time.

One of the key drivers of this market demand is the need for improved risk management. Real-time analysis allows financial institutions to monitor market conditions continuously, detect anomalies, and respond swiftly to potential threats. This capability is particularly crucial in volatile market conditions, where rapid fluctuations can significantly impact portfolio values and trading positions.

Another factor contributing to the demand is the rise of regulatory requirements for financial institutions. Compliance with regulations such as Basel III and MiFID II necessitates real-time monitoring and reporting of various financial metrics. This has led to increased investment in technologies that can process and analyze data in real-time to meet these regulatory obligations.

The advent of artificial intelligence and machine learning has further amplified the demand for real-time financial analysis. These technologies enable more sophisticated predictive models and pattern recognition, which can only be fully leveraged with access to real-time data streams. Financial institutions are seeking solutions that can integrate AI-driven insights with real-time market data to enhance their decision-making processes.

Moreover, the increasing interconnectedness of global financial markets has created a need for real-time cross-market analysis. Investors and traders require tools that can simultaneously process data from multiple markets, asset classes, and geographic regions to identify correlations and arbitrage opportunities. This demand is driving innovation in data aggregation and analysis technologies capable of handling diverse and high-volume data streams.

As financial markets continue to evolve, the demand for real-time analysis is expected to grow further. The integration of alternative data sources, such as social media sentiment and satellite imagery, into financial analysis is creating new opportunities and challenges. Market participants are seeking solutions that can incorporate these diverse data streams into their real-time analysis frameworks, further driving the demand for advanced technological capabilities in the financial sector.

The global financial analytics market, which encompasses real-time analysis tools, is experiencing robust growth. This expansion is attributed to the increasing adoption of data-driven decision-making processes across the financial sector. Banks, hedge funds, and asset management firms are investing heavily in advanced analytics capabilities to gain insights from vast amounts of financial data streaming in real-time.

One of the key drivers of this market demand is the need for improved risk management. Real-time analysis allows financial institutions to monitor market conditions continuously, detect anomalies, and respond swiftly to potential threats. This capability is particularly crucial in volatile market conditions, where rapid fluctuations can significantly impact portfolio values and trading positions.

Another factor contributing to the demand is the rise of regulatory requirements for financial institutions. Compliance with regulations such as Basel III and MiFID II necessitates real-time monitoring and reporting of various financial metrics. This has led to increased investment in technologies that can process and analyze data in real-time to meet these regulatory obligations.

The advent of artificial intelligence and machine learning has further amplified the demand for real-time financial analysis. These technologies enable more sophisticated predictive models and pattern recognition, which can only be fully leveraged with access to real-time data streams. Financial institutions are seeking solutions that can integrate AI-driven insights with real-time market data to enhance their decision-making processes.

Moreover, the increasing interconnectedness of global financial markets has created a need for real-time cross-market analysis. Investors and traders require tools that can simultaneously process data from multiple markets, asset classes, and geographic regions to identify correlations and arbitrage opportunities. This demand is driving innovation in data aggregation and analysis technologies capable of handling diverse and high-volume data streams.

As financial markets continue to evolve, the demand for real-time analysis is expected to grow further. The integration of alternative data sources, such as social media sentiment and satellite imagery, into financial analysis is creating new opportunities and challenges. Market participants are seeking solutions that can incorporate these diverse data streams into their real-time analysis frameworks, further driving the demand for advanced technological capabilities in the financial sector.

5G UC Technology: Current State and Challenges

The current state of 5G UC (Ultra-Capacity) technology in supporting real-time data analysis for financial markets is characterized by significant advancements, yet it also faces several challenges. 5G UC, with its enhanced capabilities, has the potential to revolutionize data processing and analysis in the financial sector.

One of the primary advantages of 5G UC is its ultra-low latency, which is crucial for real-time data analysis in financial markets. This technology can reduce latency to as low as 1 millisecond, enabling near-instantaneous data transmission and processing. Such speed is vital for high-frequency trading, risk management, and real-time market analysis.

The increased bandwidth of 5G UC also allows for the transmission of larger volumes of data at higher speeds. This capability is particularly beneficial for financial institutions dealing with massive datasets, complex financial models, and high-resolution market visualizations. It enables more comprehensive and timely analysis of market trends and patterns.

However, the implementation of 5G UC in financial markets faces several challenges. One significant hurdle is the need for extensive infrastructure upgrades. Financial institutions and market centers must invest heavily in 5G-compatible hardware and software, which can be costly and time-consuming.

Security concerns also pose a challenge. As 5G UC enables more devices to connect and transmit sensitive financial data, it increases the potential attack surface for cybercriminals. Ensuring robust security measures without compromising the speed and efficiency of data transmission is a complex task.

Another challenge lies in the regulatory landscape. Financial markets are heavily regulated, and the adoption of 5G UC technology must comply with existing regulations while also addressing new concerns that may arise from its implementation. This includes issues related to data privacy, cross-border data transmission, and fair market access.

The reliability and consistency of 5G UC networks in dense urban environments, where many financial centers are located, is another area of concern. Ensuring uninterrupted service and consistent performance across all areas is crucial for financial operations that rely on real-time data analysis.

Lastly, the integration of 5G UC with existing financial systems and legacy infrastructure presents a significant technical challenge. Many financial institutions operate on complex, long-standing systems that may not be easily compatible with 5G technology. Seamless integration without disrupting ongoing operations is a delicate balancing act.

Despite these challenges, the potential benefits of 5G UC for real-time data analysis in financial markets are substantial. As the technology matures and solutions to these challenges are developed, 5G UC is poised to play a transformative role in shaping the future of financial data analysis and market operations.

One of the primary advantages of 5G UC is its ultra-low latency, which is crucial for real-time data analysis in financial markets. This technology can reduce latency to as low as 1 millisecond, enabling near-instantaneous data transmission and processing. Such speed is vital for high-frequency trading, risk management, and real-time market analysis.

The increased bandwidth of 5G UC also allows for the transmission of larger volumes of data at higher speeds. This capability is particularly beneficial for financial institutions dealing with massive datasets, complex financial models, and high-resolution market visualizations. It enables more comprehensive and timely analysis of market trends and patterns.

However, the implementation of 5G UC in financial markets faces several challenges. One significant hurdle is the need for extensive infrastructure upgrades. Financial institutions and market centers must invest heavily in 5G-compatible hardware and software, which can be costly and time-consuming.

Security concerns also pose a challenge. As 5G UC enables more devices to connect and transmit sensitive financial data, it increases the potential attack surface for cybercriminals. Ensuring robust security measures without compromising the speed and efficiency of data transmission is a complex task.

Another challenge lies in the regulatory landscape. Financial markets are heavily regulated, and the adoption of 5G UC technology must comply with existing regulations while also addressing new concerns that may arise from its implementation. This includes issues related to data privacy, cross-border data transmission, and fair market access.

The reliability and consistency of 5G UC networks in dense urban environments, where many financial centers are located, is another area of concern. Ensuring uninterrupted service and consistent performance across all areas is crucial for financial operations that rely on real-time data analysis.

Lastly, the integration of 5G UC with existing financial systems and legacy infrastructure presents a significant technical challenge. Many financial institutions operate on complex, long-standing systems that may not be easily compatible with 5G technology. Seamless integration without disrupting ongoing operations is a delicate balancing act.

Despite these challenges, the potential benefits of 5G UC for real-time data analysis in financial markets are substantial. As the technology matures and solutions to these challenges are developed, 5G UC is poised to play a transformative role in shaping the future of financial data analysis and market operations.

Existing 5G UC Implementations in Finance

01 Real-time data processing and analysis in 5G networks

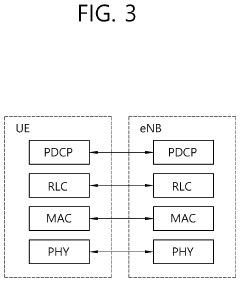

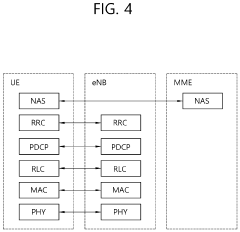

5G Ultra-Capacity networks enable real-time processing and analysis of large volumes of data. This capability allows for rapid decision-making and immediate responses to network conditions. Advanced algorithms and machine learning techniques are employed to analyze data streams, optimize network performance, and enhance user experience in real-time.- Real-time data processing and analysis in 5G networks: 5G Ultra-Capacity networks enable real-time processing and analysis of large volumes of data. This capability allows for immediate insights and decision-making based on current network conditions and user behavior. Advanced algorithms and machine learning techniques are employed to handle the high-speed data streams, providing valuable information for network optimization and service improvement.

- Network resource allocation and optimization: 5G UC systems utilize real-time data analysis to dynamically allocate and optimize network resources. This includes adjusting bandwidth, managing spectrum efficiency, and load balancing across network nodes. The analysis helps in predicting traffic patterns and user demands, allowing for proactive resource management and improved quality of service.

- Edge computing for low-latency data processing: Edge computing is leveraged in 5G UC networks to process data closer to the source, reducing latency and improving response times. This approach is particularly beneficial for applications requiring real-time analysis, such as autonomous vehicles, industrial automation, and augmented reality. Edge nodes can perform initial data processing and filtering, sending only relevant information to the core network.

- AI-driven predictive analytics for network performance: Artificial Intelligence and Machine Learning algorithms are employed to analyze real-time data from 5G UC networks, enabling predictive analytics for network performance. These systems can forecast potential issues, optimize network configurations, and enhance overall reliability. The AI-driven approach allows for continuous learning and adaptation to changing network conditions and user behaviors.

- Security and privacy in real-time data analysis: Real-time data analysis in 5G UC networks incorporates advanced security and privacy measures. This includes encryption of data in transit, anonymization techniques for user data, and real-time threat detection and mitigation. The analysis systems are designed to comply with data protection regulations while providing valuable insights for network operations and service improvements.

02 Network resource allocation and optimization

5G UC systems utilize real-time data analysis to dynamically allocate and optimize network resources. This includes intelligent spectrum management, load balancing, and adaptive resource allocation based on current network conditions and user demands. The system can predict and respond to traffic patterns, ensuring efficient use of available bandwidth and minimizing latency.Expand Specific Solutions03 Edge computing for low-latency data processing

Edge computing is leveraged in 5G UC networks to process data closer to the source, reducing latency and improving response times. This approach enables real-time analysis of sensor data, IoT devices, and user applications, supporting time-critical services and enhancing overall network performance.Expand Specific Solutions04 AI-driven predictive analytics for network management

Artificial intelligence and machine learning algorithms are employed to analyze historical and real-time data in 5G UC networks. These technologies enable predictive analytics for proactive network management, fault detection, and performance optimization. By anticipating network issues and user behavior, the system can preemptively adjust resources and maintain high quality of service.Expand Specific Solutions05 Multi-dimensional data analysis for enhanced user experience

5G UC networks perform multi-dimensional data analysis, considering factors such as user location, device capabilities, application requirements, and network conditions. This comprehensive approach allows for personalized service delivery, adaptive content streaming, and optimized quality of experience for individual users across various use cases and scenarios.Expand Specific Solutions

Key Players in 5G UC Financial Solutions

The 5G UC (Ultra Capacity) technology in financial markets is in a growth phase, with increasing market size and advancing technical maturity. Major players like Samsung, Ericsson, Huawei, and Nokia are driving innovation in this space. The market is characterized by intense competition among established telecom equipment providers and emerging tech companies. As 5G UC enables faster data processing and lower latency, financial institutions are exploring its potential for real-time analytics, high-frequency trading, and improved risk management. The technology's adoption is accelerating, but full implementation across the financial sector is still evolving, with ongoing efforts to address security and regulatory challenges.

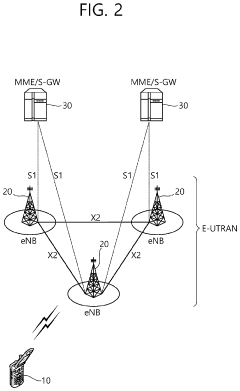

Telefonaktiebolaget LM Ericsson

Technical Solution: Ericsson's 5G UC solution for financial markets emphasizes end-to-end network performance optimization. Their system utilizes advanced beamforming and massive MIMO technologies to enhance signal quality and capacity in dense urban environments where financial centers are often located[7]. Ericsson has developed specialized network slicing configurations tailored for financial services, allowing for the creation of isolated, high-priority network segments for critical trading and analysis functions[8]. Their solution also incorporates machine learning algorithms that continuously optimize network performance based on real-time traffic patterns and application demands, ensuring consistent low-latency performance for financial data analysis[9].

Strengths: Strong radio technology expertise, advanced network optimization capabilities. Weaknesses: May need to strengthen partnerships in the financial sector for deeper industry-specific insights.

Huawei Technologies Co., Ltd.

Technical Solution: Huawei's 5G UC solution for financial markets leverages ultra-reliable low-latency communication (URLLC) to enable real-time data analysis. Their system utilizes network slicing technology to create dedicated virtual networks for financial institutions, ensuring prioritized bandwidth and minimal latency[1]. Huawei's 5G core network supports edge computing capabilities, allowing for distributed processing of financial data closer to the source, reducing round-trip time for critical transactions[2]. The company has also developed AI-powered predictive algorithms that work in conjunction with 5G networks to anticipate market trends and optimize data routing, further enhancing real-time analysis capabilities[3].

Strengths: Advanced network slicing technology, strong edge computing capabilities, and AI integration. Weaknesses: Potential security concerns in some markets, reliance on partnerships for full ecosystem integration.

Core Innovations in 5G UC for Financial Data

Method and device for performing power control in NR v2x

PatentActiveUS20210120564A1

Innovation

- A method for determining the priority of a carrier with multiple BWPs and allocating transmission power based on this priority to efficiently perform sidelink transmissions, ensuring that power is distributed effectively across overlapping BWPs to maintain communication reliability and latency requirements.

Method and apparatus for performing carrier (re)selection in NR V2X

PatentActiveUS11924868B2

Innovation

- A method for a user equipment (UE) to perform CBR measurement across multiple BWPs and determine a representative CBR value for a carrier, allowing for intelligent carrier selection and resource allocation to optimize sidelink transmission, including selecting a BWP based on measured CBR values to avoid congested channels.

Regulatory Compliance and Data Security

The integration of 5G UC technology in financial markets for real-time data analysis brings forth significant regulatory and security considerations. Financial institutions must adhere to strict compliance standards while leveraging the benefits of advanced connectivity. Regulatory bodies worldwide are adapting their frameworks to address the unique challenges posed by 5G-enabled financial services.

Data protection regulations, such as GDPR in Europe and CCPA in California, require financial institutions to implement robust security measures when handling sensitive customer information. The high-speed, low-latency nature of 5G UC necessitates enhanced encryption protocols and secure data transmission methods to prevent unauthorized access and data breaches.

Financial regulators are particularly concerned with the potential for market manipulation and insider trading facilitated by ultra-fast data analysis. As a result, they are implementing more stringent monitoring and reporting requirements for high-frequency trading activities enabled by 5G networks. Firms must demonstrate their ability to maintain audit trails and transaction records in real-time to comply with these regulations.

Cybersecurity standards for 5G networks in financial services are evolving rapidly. The increased network complexity and the proliferation of connected devices introduce new vulnerabilities that must be addressed. Financial institutions are required to conduct regular security assessments, implement multi-factor authentication, and maintain up-to-date intrusion detection systems to safeguard against cyber threats.

Data residency and sovereignty issues also come into play with 5G UC implementations. Many jurisdictions mandate that financial data be stored and processed within national borders. This requirement poses challenges for global financial institutions leveraging cloud-based 5G infrastructure, necessitating careful planning of data center locations and network architectures.

The use of artificial intelligence and machine learning algorithms for real-time data analysis in 5G-enabled financial systems raises questions about algorithmic transparency and fairness. Regulators are increasingly demanding explainable AI models and unbiased decision-making processes to ensure consumer protection and market integrity.

As 5G UC technology continues to reshape the financial landscape, regulatory bodies and industry stakeholders are collaborating to develop comprehensive frameworks that balance innovation with security and compliance. Financial institutions must remain vigilant and adaptable, continuously updating their regulatory compliance and data security strategies to keep pace with technological advancements and evolving regulatory requirements in the 5G era.

Data protection regulations, such as GDPR in Europe and CCPA in California, require financial institutions to implement robust security measures when handling sensitive customer information. The high-speed, low-latency nature of 5G UC necessitates enhanced encryption protocols and secure data transmission methods to prevent unauthorized access and data breaches.

Financial regulators are particularly concerned with the potential for market manipulation and insider trading facilitated by ultra-fast data analysis. As a result, they are implementing more stringent monitoring and reporting requirements for high-frequency trading activities enabled by 5G networks. Firms must demonstrate their ability to maintain audit trails and transaction records in real-time to comply with these regulations.

Cybersecurity standards for 5G networks in financial services are evolving rapidly. The increased network complexity and the proliferation of connected devices introduce new vulnerabilities that must be addressed. Financial institutions are required to conduct regular security assessments, implement multi-factor authentication, and maintain up-to-date intrusion detection systems to safeguard against cyber threats.

Data residency and sovereignty issues also come into play with 5G UC implementations. Many jurisdictions mandate that financial data be stored and processed within national borders. This requirement poses challenges for global financial institutions leveraging cloud-based 5G infrastructure, necessitating careful planning of data center locations and network architectures.

The use of artificial intelligence and machine learning algorithms for real-time data analysis in 5G-enabled financial systems raises questions about algorithmic transparency and fairness. Regulators are increasingly demanding explainable AI models and unbiased decision-making processes to ensure consumer protection and market integrity.

As 5G UC technology continues to reshape the financial landscape, regulatory bodies and industry stakeholders are collaborating to develop comprehensive frameworks that balance innovation with security and compliance. Financial institutions must remain vigilant and adaptable, continuously updating their regulatory compliance and data security strategies to keep pace with technological advancements and evolving regulatory requirements in the 5G era.

Economic Impact of 5G UC in Finance

The integration of 5G Ultra-Capacity (UC) technology in financial markets is poised to revolutionize real-time data analysis, bringing about significant economic impacts across the sector. The enhanced speed, capacity, and low latency of 5G UC networks enable financial institutions to process and analyze vast amounts of data in real-time, leading to more informed decision-making and improved market efficiency.

One of the primary economic benefits of 5G UC in finance is the potential for increased trading volumes and liquidity. With faster data transmission and analysis capabilities, high-frequency trading algorithms can execute trades at unprecedented speeds, potentially leading to higher transaction volumes and narrower bid-ask spreads. This increased liquidity can result in more efficient price discovery and potentially lower transaction costs for market participants.

The implementation of 5G UC also has the potential to democratize access to financial markets. By reducing latency and improving connectivity, retail investors and smaller financial institutions can compete more effectively with larger players, potentially leveling the playing field and fostering greater market participation. This increased inclusivity could lead to a more diverse and robust financial ecosystem, potentially stimulating economic growth and innovation.

Furthermore, the enhanced real-time data analysis capabilities enabled by 5G UC can significantly improve risk management practices. Financial institutions can more effectively monitor market conditions, detect anomalies, and respond to potential threats in real-time. This improved risk management can lead to greater financial stability and reduced systemic risks, potentially mitigating the economic impact of market shocks and crises.

The adoption of 5G UC in finance is also expected to drive innovation in financial products and services. With the ability to process and analyze complex data sets in real-time, financial institutions can develop more sophisticated and personalized financial products, tailored to individual customer needs. This innovation could lead to new revenue streams and business models, potentially stimulating economic growth in the financial sector and beyond.

Moreover, the implementation of 5G UC can lead to significant cost savings for financial institutions. By enabling more efficient data processing and analysis, firms can reduce their reliance on expensive hardware and infrastructure, potentially lowering operational costs. These cost savings could be passed on to consumers in the form of lower fees or improved services, further stimulating economic activity.

In conclusion, the economic impact of 5G UC in finance is expected to be substantial and far-reaching. From increased market efficiency and liquidity to improved risk management and innovation, the technology has the potential to transform the financial landscape and drive economic growth across various sectors.

One of the primary economic benefits of 5G UC in finance is the potential for increased trading volumes and liquidity. With faster data transmission and analysis capabilities, high-frequency trading algorithms can execute trades at unprecedented speeds, potentially leading to higher transaction volumes and narrower bid-ask spreads. This increased liquidity can result in more efficient price discovery and potentially lower transaction costs for market participants.

The implementation of 5G UC also has the potential to democratize access to financial markets. By reducing latency and improving connectivity, retail investors and smaller financial institutions can compete more effectively with larger players, potentially leveling the playing field and fostering greater market participation. This increased inclusivity could lead to a more diverse and robust financial ecosystem, potentially stimulating economic growth and innovation.

Furthermore, the enhanced real-time data analysis capabilities enabled by 5G UC can significantly improve risk management practices. Financial institutions can more effectively monitor market conditions, detect anomalies, and respond to potential threats in real-time. This improved risk management can lead to greater financial stability and reduced systemic risks, potentially mitigating the economic impact of market shocks and crises.

The adoption of 5G UC in finance is also expected to drive innovation in financial products and services. With the ability to process and analyze complex data sets in real-time, financial institutions can develop more sophisticated and personalized financial products, tailored to individual customer needs. This innovation could lead to new revenue streams and business models, potentially stimulating economic growth in the financial sector and beyond.

Moreover, the implementation of 5G UC can lead to significant cost savings for financial institutions. By enabling more efficient data processing and analysis, firms can reduce their reliance on expensive hardware and infrastructure, potentially lowering operational costs. These cost savings could be passed on to consumers in the form of lower fees or improved services, further stimulating economic activity.

In conclusion, the economic impact of 5G UC in finance is expected to be substantial and far-reaching. From increased market efficiency and liquidity to improved risk management and innovation, the technology has the potential to transform the financial landscape and drive economic growth across various sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!