Systems and methods for determining loan opportunities

a technology of system and opportunity, applied in the field of system and opportunity determination, can solve the problems of limited response, borrowers that respond to mass marketing materials that may not qualify for advertised loan rates, and may be completely unqualified for a refinance loan

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0018]Embodiments of the invention will now be described with reference to the accompanying Figures, wherein like numerals refer to like elements throughout. The terminology used in the description presented herein is not intended to be interpreted in any limited or restrictive manner, simply because it is being utilized in conjunction with a detailed description of certain specific embodiments of the invention. Furthermore, embodiments of the invention may include several novel features, no single one of which is solely responsible for its desirable attributes or which is essential to practicing the inventions herein described.

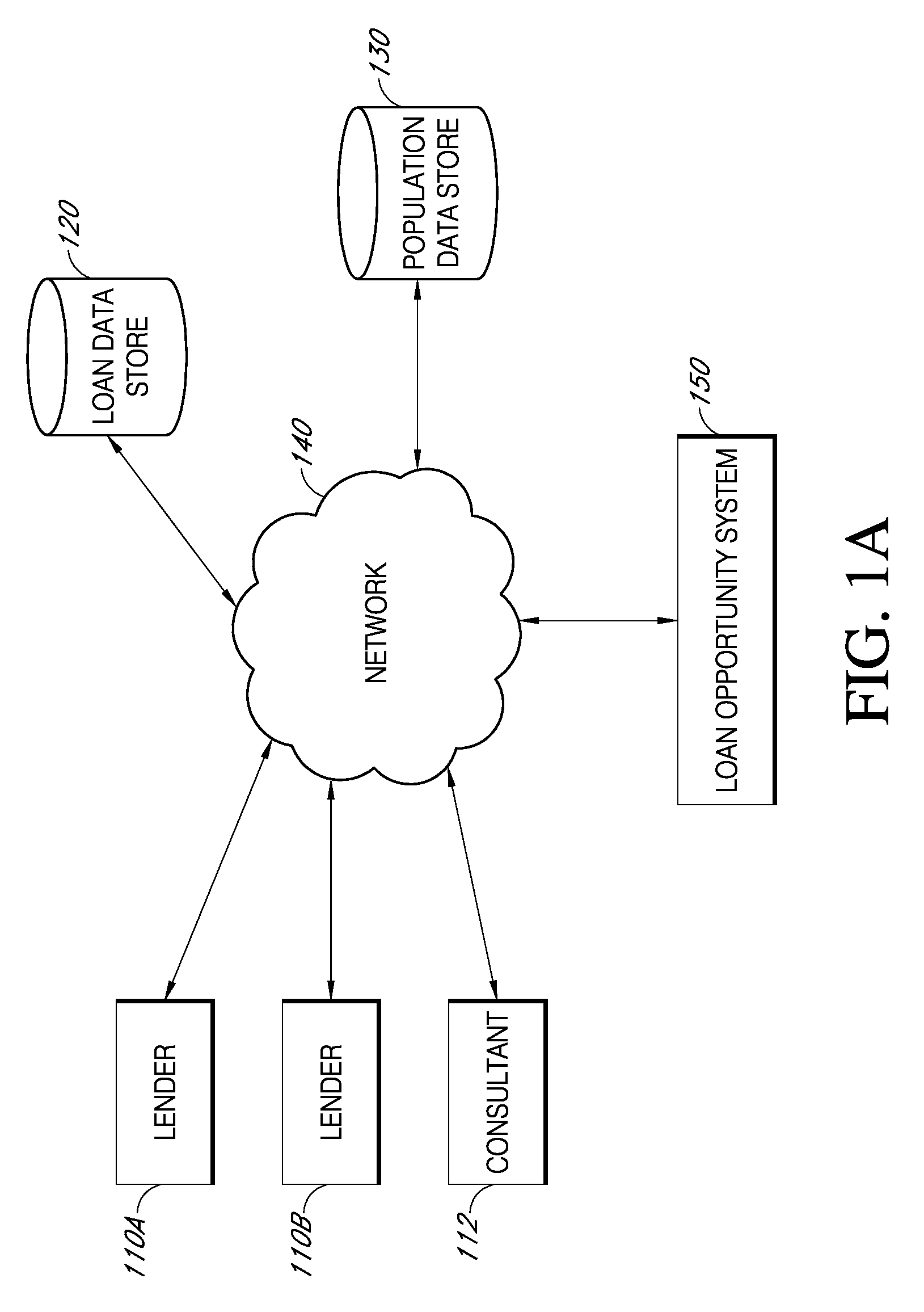

[0019]FIG. 1A is a block diagram illustrating one embodiment of a loan opportunity system 150 that is operated and / or controlled by a loan opportunity provider. The loan opportunity provider generally controls operations of the loan opportunity system 150, such as to provide loan opportunities to customers of the loan provider. Depending on the embodiment, th...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com