Method and system for insuring longer than expected lifetime

a technology of life assurance and life insurance, applied in the field of methods and systems for insuring life longer than expected, can solve problems such as difficulty in planning in advance the form of need, and achieve the effect of favorable tax effects of receiving survival benefits

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

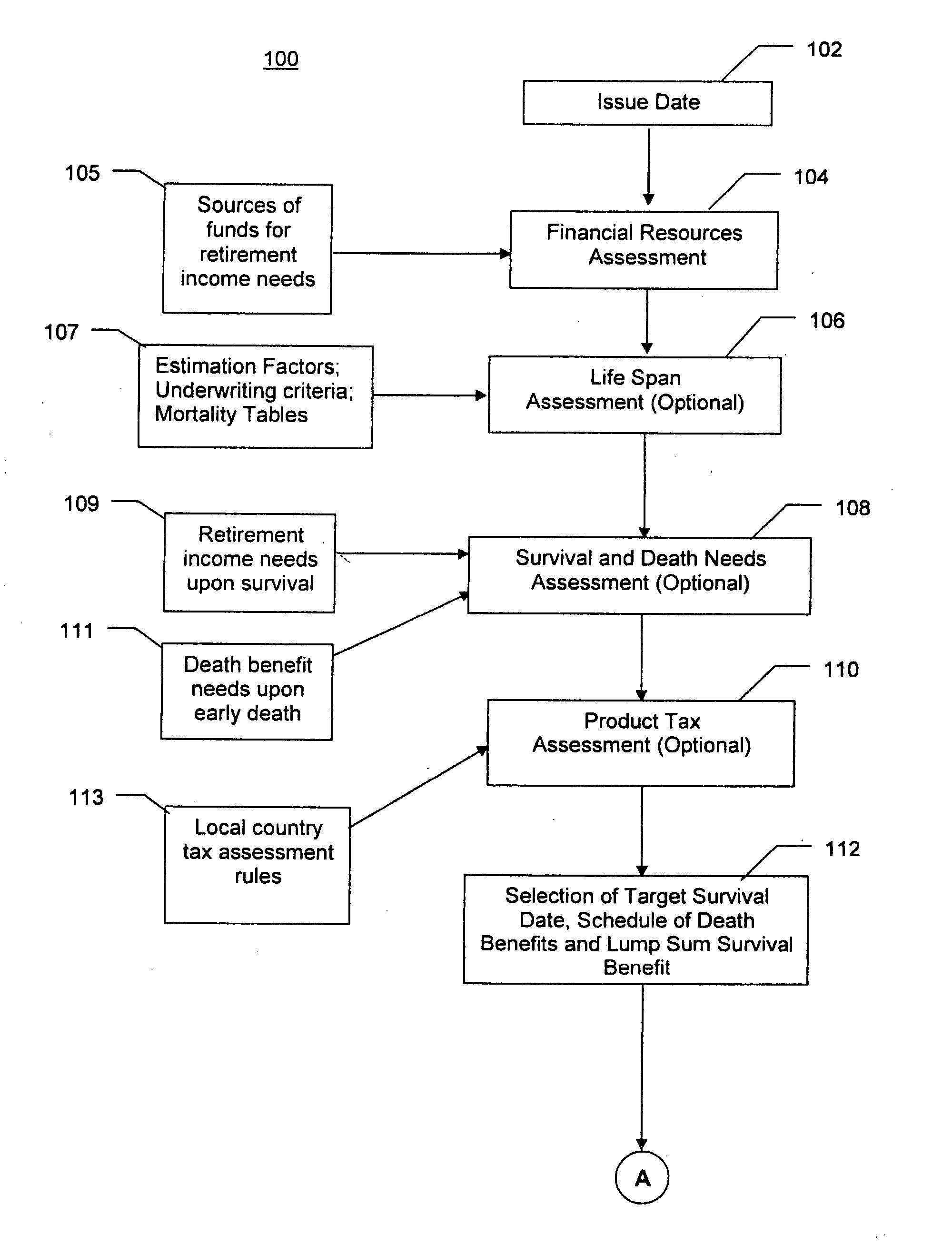

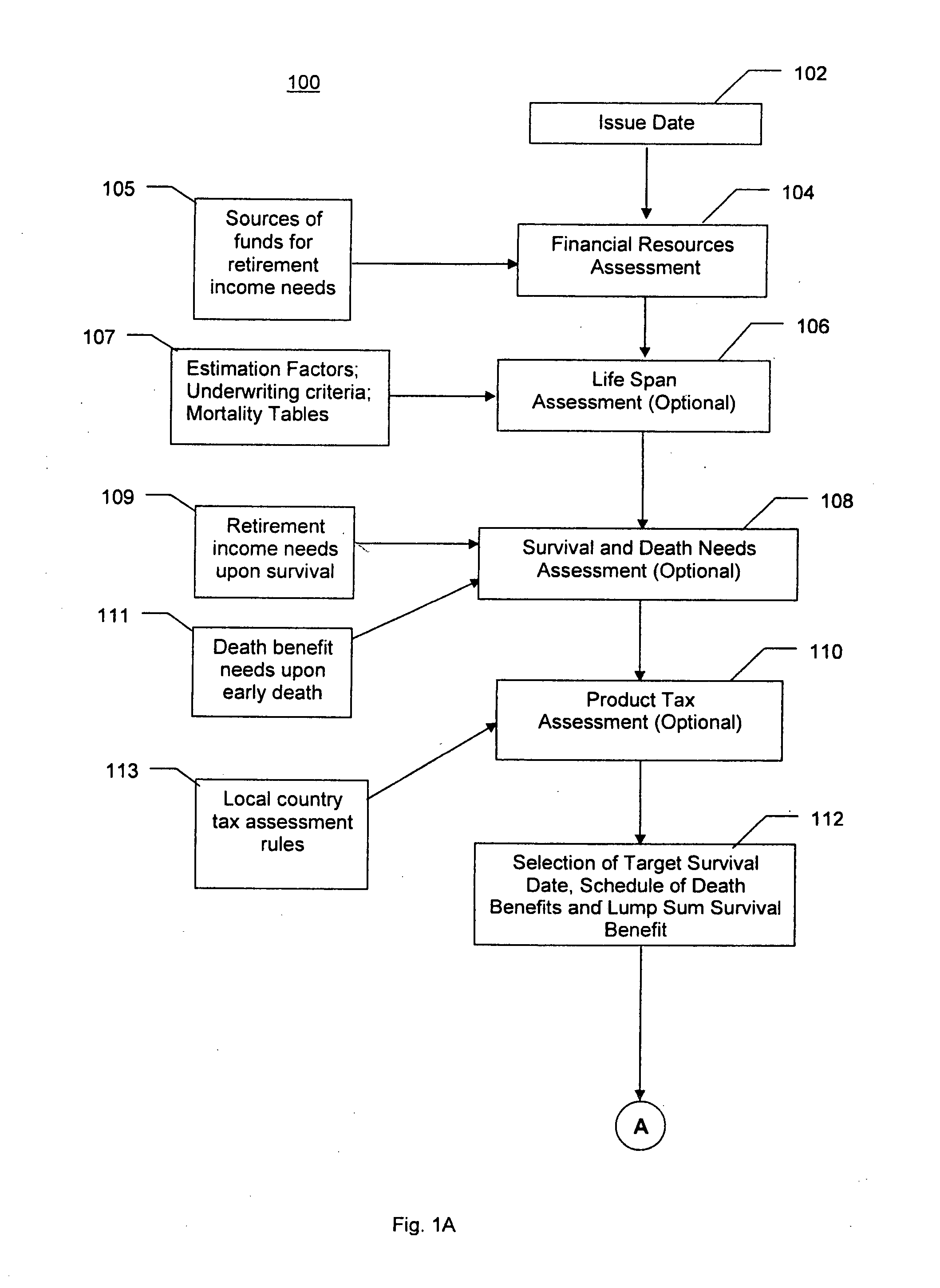

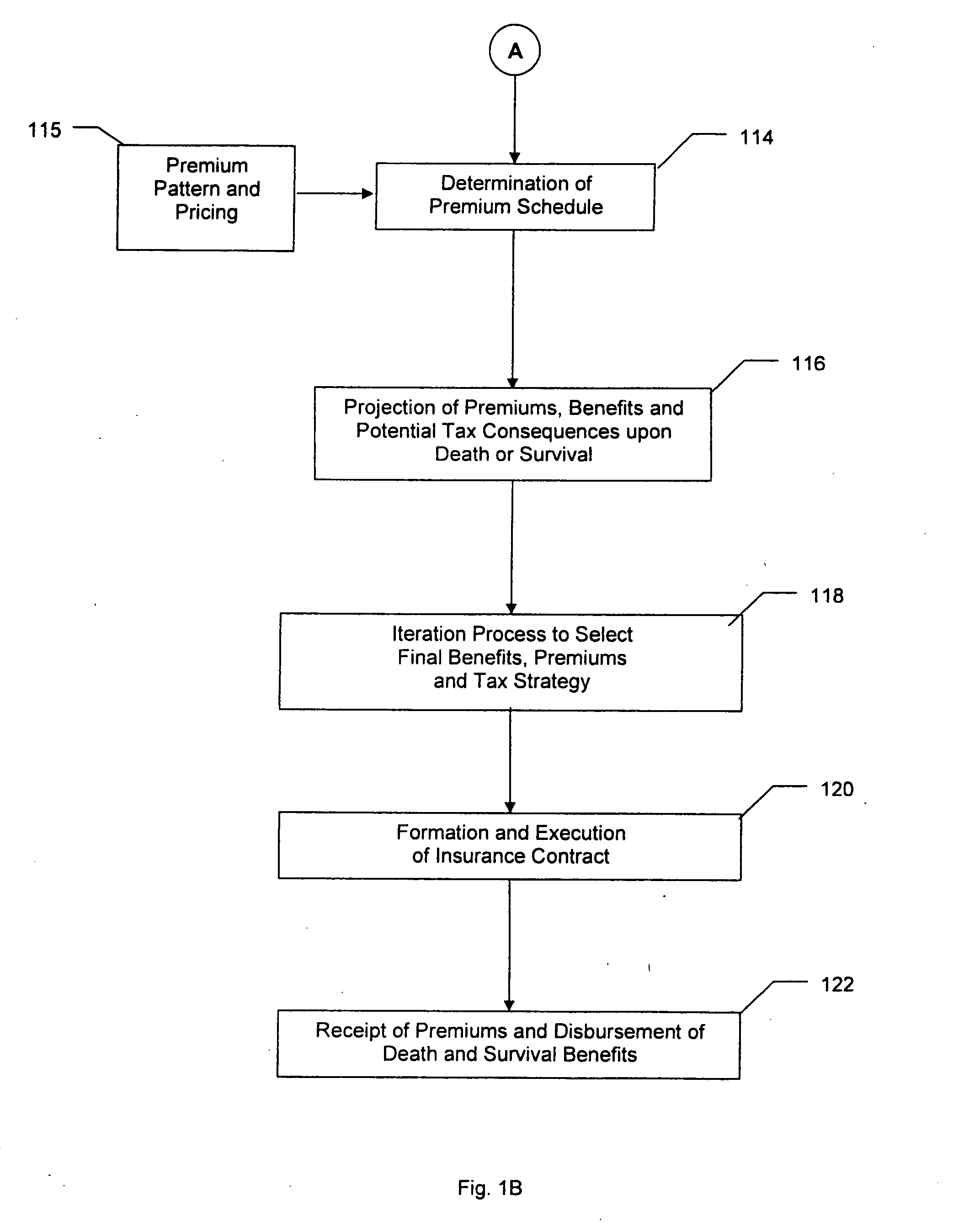

Method used

Image

Examples

Embodiment Construction

[0036] The method described herein contemplates that an insurance provider or insurer, such as a life insurance company, implements a program whereby longevity insurance policies will be sold on an ongoing basis to different policy owners. Under each policy a policy owner will make predetermined premium payments to the insurance company over a period of time in exchange for the insurance company paying predetermined lump sum survival benefits at a predetermined future date (target date) to the policy's survival beneficiary if the policy's survival insured is still alive on the target date. It is expected, though not required, that the policy owner, survival-insured and survival beneficiary all be the same person as normally the product will be purchased by elderly persons who wish to protect themselves against the risk of longer than expected lifetime. Alternatively, the interested party may be a child of the elderly person who would be the policy owner and who would pay the premium...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com