Method and system for macrofinancial analysis

A macro and financial technology, applied in the fields of finance, securities and market investment research, which can solve the problems of ignoring evaluation indicators, isolating analysis results, and paying too much attention to historical trends.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

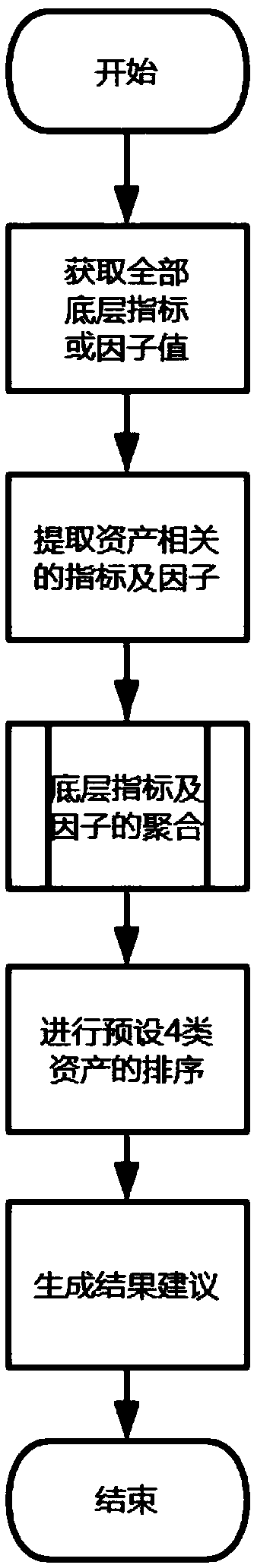

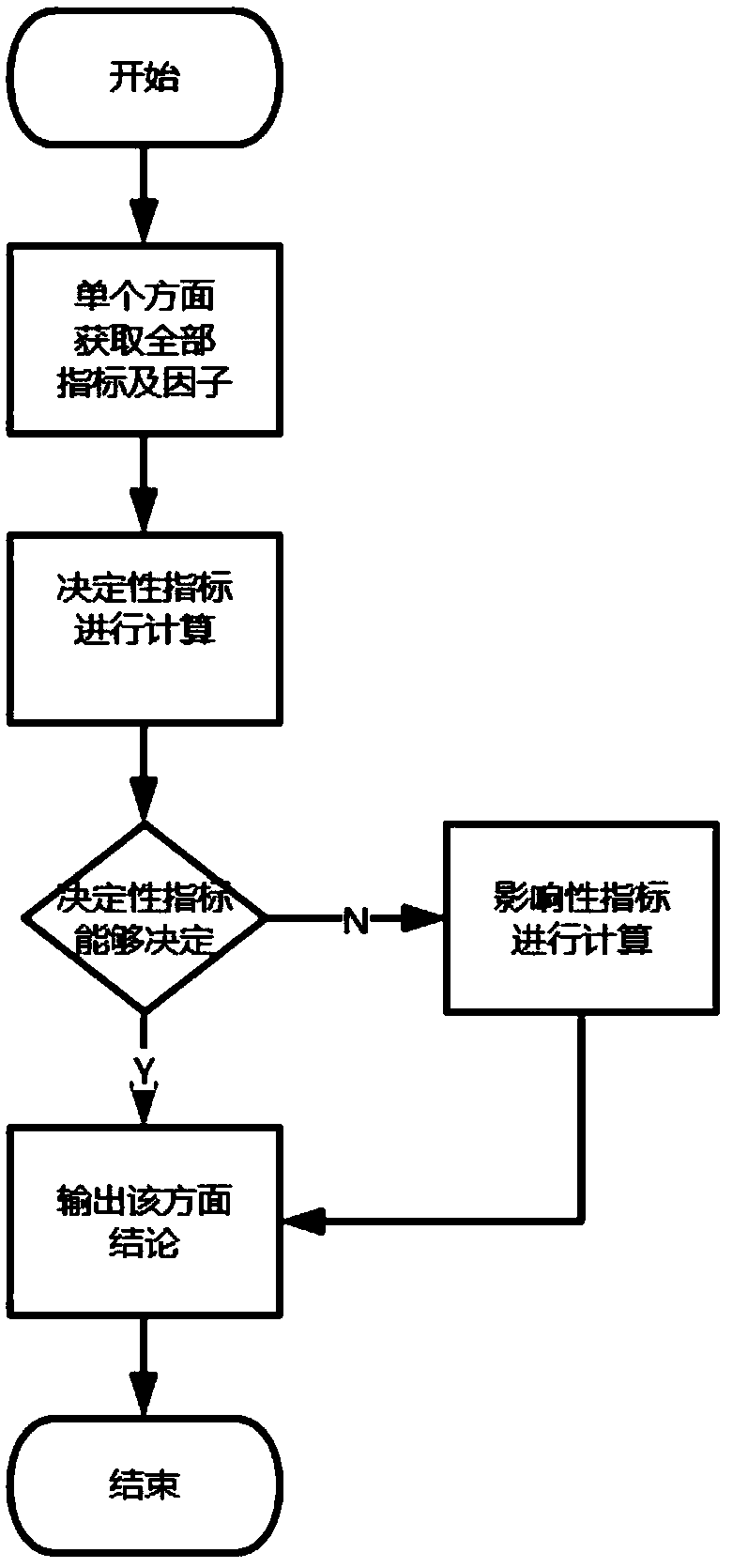

[0124] Reference attached Figure 1-2 , a method for macro financial analysis is specifically disclosed in this embodiment, which includes the following steps:

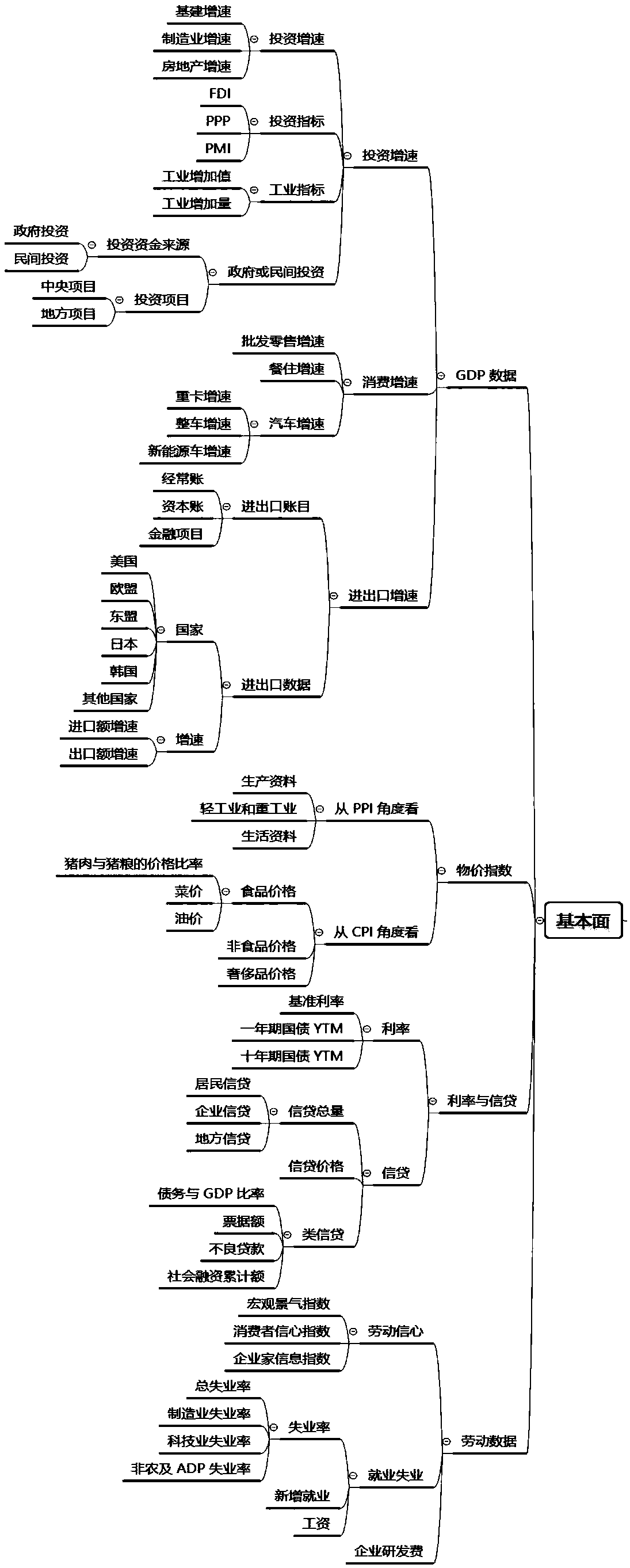

[0125] S1: Obtain all the evaluation indicators and the evaluation factors corresponding to the evaluation indicators from the fundamentals, policies, international, historical, expected and industry perspectives; the value mechanism of the evaluation indicators refers to PESTEL, MV=PQ, IS-LM And the ideas of macro analysis models such as AS-AD-BP, DSGE, RBC, NK, etc., combined with the endogenous system in actual transactions. The value range of each type of evaluation index depends on the type of evaluation index. The value of the ratio-type evaluation index is between 0 and 1, the value of the amount-type evaluation index depends on the actual situation, and the quantitative evaluation index depends on different quantity units.

[0126] S2: Extract the evaluation indicators related to stocks, bonds, commodities, a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com