Key Drivers for Isocyanate Market Expansion

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Market Evolution and Objectives

The isocyanate market has undergone significant evolution over the past decades, driven by increasing demand across various industries. Initially developed in the 1930s, isocyanates gained prominence in the 1950s with the commercialization of polyurethane foams. Since then, the market has experienced steady growth, fueled by advancements in manufacturing processes and expanding applications.

The primary objective of the isocyanate market is to meet the growing demand for versatile and high-performance materials across multiple sectors. Key industries driving this demand include construction, automotive, furniture, and electronics. As these industries continue to evolve, the isocyanate market aims to develop innovative products that offer improved performance, sustainability, and cost-effectiveness.

One of the main goals is to enhance the efficiency of isocyanate production processes. This involves optimizing raw material utilization, reducing energy consumption, and minimizing waste generation. Manufacturers are investing in research and development to create more streamlined production methods that can meet increasing demand while maintaining environmental responsibility.

Another crucial objective is to address environmental and health concerns associated with isocyanates. The industry is focusing on developing safer handling procedures, improving worker protection measures, and exploring alternative formulations that reduce potential health risks. This includes research into low-emission and zero-emission isocyanate products that comply with increasingly stringent regulations.

The market is also targeting the development of bio-based and sustainable isocyanates. With growing emphasis on eco-friendly materials, there is a push to create isocyanates derived from renewable resources. This aligns with the broader trend towards circular economy principles and reduced reliance on fossil-based raw materials.

Expanding the application scope of isocyanates is another key objective. Researchers are exploring new uses in emerging fields such as 3D printing, advanced composites, and medical devices. By diversifying applications, the market aims to reduce dependency on traditional sectors and create new growth opportunities.

Lastly, the isocyanate market is focused on geographical expansion. While mature markets like North America and Europe continue to be significant, there is a strong push to penetrate emerging economies in Asia-Pacific and Latin America. These regions offer substantial growth potential due to rapid industrialization and increasing consumer demand for polyurethane-based products.

The primary objective of the isocyanate market is to meet the growing demand for versatile and high-performance materials across multiple sectors. Key industries driving this demand include construction, automotive, furniture, and electronics. As these industries continue to evolve, the isocyanate market aims to develop innovative products that offer improved performance, sustainability, and cost-effectiveness.

One of the main goals is to enhance the efficiency of isocyanate production processes. This involves optimizing raw material utilization, reducing energy consumption, and minimizing waste generation. Manufacturers are investing in research and development to create more streamlined production methods that can meet increasing demand while maintaining environmental responsibility.

Another crucial objective is to address environmental and health concerns associated with isocyanates. The industry is focusing on developing safer handling procedures, improving worker protection measures, and exploring alternative formulations that reduce potential health risks. This includes research into low-emission and zero-emission isocyanate products that comply with increasingly stringent regulations.

The market is also targeting the development of bio-based and sustainable isocyanates. With growing emphasis on eco-friendly materials, there is a push to create isocyanates derived from renewable resources. This aligns with the broader trend towards circular economy principles and reduced reliance on fossil-based raw materials.

Expanding the application scope of isocyanates is another key objective. Researchers are exploring new uses in emerging fields such as 3D printing, advanced composites, and medical devices. By diversifying applications, the market aims to reduce dependency on traditional sectors and create new growth opportunities.

Lastly, the isocyanate market is focused on geographical expansion. While mature markets like North America and Europe continue to be significant, there is a strong push to penetrate emerging economies in Asia-Pacific and Latin America. These regions offer substantial growth potential due to rapid industrialization and increasing consumer demand for polyurethane-based products.

Global Demand Analysis for Isocyanates

The global demand for isocyanates has been experiencing significant growth, driven by various factors across multiple industries. The construction sector stands out as a primary consumer of isocyanates, particularly in the production of polyurethane foams for insulation and sealants. As urbanization continues to accelerate worldwide, the demand for energy-efficient buildings has surged, leading to increased use of polyurethane-based materials in construction projects.

The automotive industry represents another major market for isocyanates, utilizing these compounds in the manufacture of lightweight components, seat cushions, and coatings. With the ongoing trend towards vehicle weight reduction and improved fuel efficiency, the demand for isocyanate-based materials in automotive applications is expected to rise further.

In the furniture and bedding industry, isocyanates play a crucial role in the production of flexible foams for mattresses, sofas, and other upholstered products. The growing middle class in emerging economies has led to increased consumer spending on home furnishings, thereby boosting the demand for isocyanates in this sector.

The footwear industry has also contributed to the expanding isocyanate market, with these compounds being used in the production of shoe soles and other components. The rising popularity of athletic and casual footwear has further fueled this demand, particularly in developing regions with growing populations and increasing disposable incomes.

The electronics sector has emerged as a promising market for isocyanates, with applications in the production of protective coatings and encapsulants for electronic components. As the demand for consumer electronics and smart devices continues to grow, so does the need for isocyanate-based materials in this industry.

Regionally, Asia-Pacific has been the largest consumer of isocyanates, driven by rapid industrialization, urbanization, and economic growth in countries like China and India. North America and Europe follow, with mature markets that continue to show steady demand across various applications.

The global isocyanate market has also been influenced by environmental regulations and sustainability concerns. This has led to increased research and development efforts focused on bio-based isocyanates and more environmentally friendly production processes, which may shape future demand patterns in the industry.

The automotive industry represents another major market for isocyanates, utilizing these compounds in the manufacture of lightweight components, seat cushions, and coatings. With the ongoing trend towards vehicle weight reduction and improved fuel efficiency, the demand for isocyanate-based materials in automotive applications is expected to rise further.

In the furniture and bedding industry, isocyanates play a crucial role in the production of flexible foams for mattresses, sofas, and other upholstered products. The growing middle class in emerging economies has led to increased consumer spending on home furnishings, thereby boosting the demand for isocyanates in this sector.

The footwear industry has also contributed to the expanding isocyanate market, with these compounds being used in the production of shoe soles and other components. The rising popularity of athletic and casual footwear has further fueled this demand, particularly in developing regions with growing populations and increasing disposable incomes.

The electronics sector has emerged as a promising market for isocyanates, with applications in the production of protective coatings and encapsulants for electronic components. As the demand for consumer electronics and smart devices continues to grow, so does the need for isocyanate-based materials in this industry.

Regionally, Asia-Pacific has been the largest consumer of isocyanates, driven by rapid industrialization, urbanization, and economic growth in countries like China and India. North America and Europe follow, with mature markets that continue to show steady demand across various applications.

The global isocyanate market has also been influenced by environmental regulations and sustainability concerns. This has led to increased research and development efforts focused on bio-based isocyanates and more environmentally friendly production processes, which may shape future demand patterns in the industry.

Technical Challenges in Isocyanate Production

The production of isocyanates faces several technical challenges that impact market expansion and product quality. One of the primary issues is the high reactivity of isocyanates, particularly with water. This reactivity necessitates stringent moisture control throughout the production process, from raw material handling to final product storage. Even trace amounts of moisture can lead to unwanted side reactions, reducing yield and product purity.

Another significant challenge is the control of exothermic reactions during isocyanate synthesis. The reaction between amines and phosgene, a common method for producing isocyanates, is highly exothermic. Inadequate heat management can lead to runaway reactions, compromising safety and product quality. Advanced reactor designs and precise temperature control systems are essential to mitigate this risk.

The use of phosgene in traditional isocyanate production methods presents both safety and environmental concerns. Phosgene is highly toxic and corrosive, requiring specialized handling and safety protocols. This has led to increased interest in phosgene-free production methods, which present their own set of technical challenges in terms of efficiency and scalability.

Catalyst optimization remains an ongoing challenge in isocyanate production. The choice and performance of catalysts significantly impact reaction rates, selectivity, and product purity. Developing catalysts that can withstand the harsh reaction conditions while maintaining high activity and selectivity is crucial for improving process efficiency and reducing costs.

Purification and separation of isocyanates from reaction mixtures pose additional technical hurdles. The sensitivity of isocyanates to heat and their tendency to form dimers or trimers complicate distillation processes. Advanced separation techniques, such as membrane technology or reactive distillation, are being explored to enhance purification efficiency and reduce energy consumption.

The production of specialty isocyanates, particularly those used in high-performance coatings and adhesives, faces unique challenges in achieving consistent product quality and specific molecular structures. These challenges often require the development of novel synthetic routes and precise process control to meet stringent product specifications.

Lastly, the drive towards more sustainable production methods introduces new technical challenges. This includes the development of bio-based feedstocks for isocyanate production, which requires overcoming issues related to feedstock variability and purification. Additionally, efforts to reduce the carbon footprint of isocyanate production through process intensification and energy efficiency improvements present ongoing technical challenges for manufacturers.

Another significant challenge is the control of exothermic reactions during isocyanate synthesis. The reaction between amines and phosgene, a common method for producing isocyanates, is highly exothermic. Inadequate heat management can lead to runaway reactions, compromising safety and product quality. Advanced reactor designs and precise temperature control systems are essential to mitigate this risk.

The use of phosgene in traditional isocyanate production methods presents both safety and environmental concerns. Phosgene is highly toxic and corrosive, requiring specialized handling and safety protocols. This has led to increased interest in phosgene-free production methods, which present their own set of technical challenges in terms of efficiency and scalability.

Catalyst optimization remains an ongoing challenge in isocyanate production. The choice and performance of catalysts significantly impact reaction rates, selectivity, and product purity. Developing catalysts that can withstand the harsh reaction conditions while maintaining high activity and selectivity is crucial for improving process efficiency and reducing costs.

Purification and separation of isocyanates from reaction mixtures pose additional technical hurdles. The sensitivity of isocyanates to heat and their tendency to form dimers or trimers complicate distillation processes. Advanced separation techniques, such as membrane technology or reactive distillation, are being explored to enhance purification efficiency and reduce energy consumption.

The production of specialty isocyanates, particularly those used in high-performance coatings and adhesives, faces unique challenges in achieving consistent product quality and specific molecular structures. These challenges often require the development of novel synthetic routes and precise process control to meet stringent product specifications.

Lastly, the drive towards more sustainable production methods introduces new technical challenges. This includes the development of bio-based feedstocks for isocyanate production, which requires overcoming issues related to feedstock variability and purification. Additionally, efforts to reduce the carbon footprint of isocyanate production through process intensification and energy efficiency improvements present ongoing technical challenges for manufacturers.

Current Isocyanate Production Methodologies

01 Market analysis and forecasting

Utilizing data analytics and forecasting techniques to analyze the isocyanate market trends, predict future demand, and identify growth opportunities. This approach helps businesses make informed decisions about market expansion strategies and resource allocation.- Market analysis and forecasting: Utilizing data analytics and forecasting techniques to analyze the isocyanate market trends, predict future demand, and identify growth opportunities. This approach helps businesses make informed decisions about market expansion strategies and resource allocation.

- Product innovation and diversification: Developing new isocyanate-based products or improving existing ones to meet evolving market demands. This includes exploring novel applications, enhancing product performance, and addressing environmental concerns to expand market reach and attract new customers.

- Supply chain optimization: Streamlining the isocyanate supply chain through improved logistics, inventory management, and distribution networks. This approach aims to reduce costs, increase efficiency, and enhance market responsiveness, ultimately supporting market expansion efforts.

- Strategic partnerships and collaborations: Forming alliances with other companies, research institutions, or industry stakeholders to leverage complementary strengths, share resources, and access new markets. This strategy can accelerate innovation, reduce risks, and facilitate market expansion in the isocyanate industry.

- Sustainable and eco-friendly solutions: Developing and promoting environmentally friendly isocyanate products and production processes to address growing sustainability concerns. This approach can help capture new market segments, comply with regulations, and improve brand reputation, contributing to overall market expansion.

02 Product innovation and diversification

Developing new isocyanate-based products or improving existing ones to meet evolving market needs. This includes exploring novel applications, enhancing product performance, and addressing environmental concerns to expand market share and enter new segments.Expand Specific Solutions03 Supply chain optimization

Streamlining the isocyanate supply chain through improved logistics, inventory management, and distribution networks. This approach aims to reduce costs, increase efficiency, and enhance market responsiveness, facilitating expansion into new geographical areas.Expand Specific Solutions04 Strategic partnerships and collaborations

Forming alliances with other companies, research institutions, or industry stakeholders to leverage complementary strengths, share resources, and accelerate market expansion. This strategy can help in accessing new technologies, markets, or distribution channels.Expand Specific Solutions05 Sustainable and eco-friendly solutions

Developing environmentally friendly isocyanate products and production processes to address growing sustainability concerns. This approach can help expand market share by appealing to environmentally conscious consumers and meeting stricter regulatory requirements.Expand Specific Solutions

Major Isocyanate Manufacturers and Competitors

The isocyanate market is experiencing significant expansion driven by growing demand across various industries. Currently in a growth phase, the market is characterized by increasing applications in polyurethane production, construction, automotive, and electronics sectors. The global isocyanate market size is projected to reach substantial figures in the coming years, fueled by urbanization and industrialization trends. Technologically, the field is advancing rapidly, with key players like Wanhua Chemical, BASF, Covestro, and Mitsui Chemicals leading innovation. These companies are focusing on developing eco-friendly alternatives and improving production efficiency to meet stringent environmental regulations and market demands. Emerging players and research institutions are also contributing to technological advancements, indicating a dynamic and competitive landscape.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group is a leading player in the isocyanate market, particularly in MDI (Methylene Diphenyl Diisocyanate) production. They have developed advanced technologies for isocyanate synthesis, including a proprietary continuous flow process that improves efficiency and reduces environmental impact. Their innovative approach involves using novel catalysts and optimized reaction conditions to achieve higher yields and purity levels. Wanhua has also invested in bio-based isocyanates, developing processes to produce isocyanates from renewable resources, potentially reducing reliance on fossil fuels[1][3]. Their research extends to improving the performance of isocyanate-based products, such as enhancing the durability and insulation properties of polyurethane foams.

Strengths: Strong R&D capabilities, vertically integrated production, and a global market presence. Weaknesses: Dependence on petrochemical feedstocks for traditional isocyanates and potential regulatory challenges related to environmental concerns.

Asahi Kasei Corp.

Technical Solution: Asahi Kasei has been focusing on developing eco-friendly isocyanate technologies. They have made significant progress in non-phosgene routes for isocyanate production, which reduces the use of toxic materials and improves safety. Their innovative approach includes the development of novel catalysts that enable more efficient isocyanate synthesis with lower energy consumption. Asahi Kasei has also been working on bio-based polyols for use in isocyanate reactions, aiming to increase the sustainability of polyurethane products[2]. Additionally, they have developed specialized isocyanates for high-performance applications, such as automotive and electronics, focusing on improving heat resistance and durability[4].

Strengths: Strong focus on sustainable technologies and specialized high-performance products. Weaknesses: Relatively smaller market share compared to some competitors and potential challenges in scaling up new technologies.

Innovative Patents in Isocyanate Synthesis

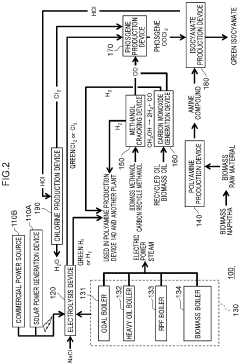

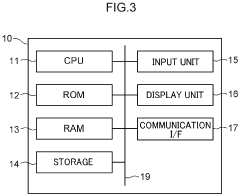

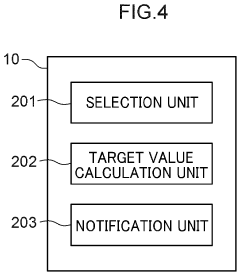

Isocyanate production system, isocyanate composition, polymerizable composition, resin, and molded article

PatentPendingEP4371974A1

Innovation

- An isocyanate production system that utilizes biomass-based energy sources, recycled materials, and carbon monoxide and hydrogen generated from renewable sources to produce phosgene and polyamine compounds, with a control device optimizing energy and material usage to minimize environmental load and carbon dioxide emissions.

Flow chemistry synthesis of isocyanates

PatentWO2021119606A1

Innovation

- A continuous flow process involving the mixing of acyl hydrazides with nitrous acid to form acyl azides, followed by heating in the presence of an organic solvent to produce isocyanates through Curtius rearrangement, offering a safer and more scalable method for isocyanate synthesis.

Environmental Impact of Isocyanate Manufacturing

The environmental impact of isocyanate manufacturing is a critical consideration in the expansion of the isocyanate market. The production process involves several stages that can potentially harm the environment if not properly managed. One of the primary concerns is the release of volatile organic compounds (VOCs) during the manufacturing process. These emissions can contribute to air pollution and the formation of ground-level ozone, which has adverse effects on human health and ecosystems.

Water pollution is another significant environmental issue associated with isocyanate production. The manufacturing process generates wastewater containing various chemical compounds, including unreacted raw materials and byproducts. If not adequately treated, these effluents can contaminate water bodies, affecting aquatic life and potentially entering the food chain.

Energy consumption is a notable factor in the environmental footprint of isocyanate manufacturing. The production process requires substantial amounts of energy, often derived from fossil fuels, contributing to greenhouse gas emissions and climate change. As the isocyanate market expands, the cumulative energy demand and associated carbon emissions become increasingly significant.

Solid waste generation is also a concern in isocyanate production. The process creates various waste materials, including spent catalysts, filter cakes, and off-specification products. Proper disposal or recycling of these wastes is essential to minimize environmental impact and comply with regulations.

The transportation and storage of raw materials and finished isocyanate products present additional environmental risks. Accidental spills or leaks during transport or storage can lead to soil and water contamination, potentially causing long-term ecological damage.

As the isocyanate market expands, there is growing pressure on manufacturers to adopt more sustainable practices. This includes implementing cleaner production technologies, improving energy efficiency, and developing closed-loop systems to minimize waste and emissions. Some companies are exploring alternative raw materials and production methods to reduce their environmental footprint.

Regulatory bodies worldwide are increasingly focusing on the environmental aspects of isocyanate manufacturing. Stricter emissions standards, waste management regulations, and requirements for environmental impact assessments are being implemented in many countries. These regulations aim to mitigate the negative environmental effects of isocyanate production while supporting sustainable market growth.

Water pollution is another significant environmental issue associated with isocyanate production. The manufacturing process generates wastewater containing various chemical compounds, including unreacted raw materials and byproducts. If not adequately treated, these effluents can contaminate water bodies, affecting aquatic life and potentially entering the food chain.

Energy consumption is a notable factor in the environmental footprint of isocyanate manufacturing. The production process requires substantial amounts of energy, often derived from fossil fuels, contributing to greenhouse gas emissions and climate change. As the isocyanate market expands, the cumulative energy demand and associated carbon emissions become increasingly significant.

Solid waste generation is also a concern in isocyanate production. The process creates various waste materials, including spent catalysts, filter cakes, and off-specification products. Proper disposal or recycling of these wastes is essential to minimize environmental impact and comply with regulations.

The transportation and storage of raw materials and finished isocyanate products present additional environmental risks. Accidental spills or leaks during transport or storage can lead to soil and water contamination, potentially causing long-term ecological damage.

As the isocyanate market expands, there is growing pressure on manufacturers to adopt more sustainable practices. This includes implementing cleaner production technologies, improving energy efficiency, and developing closed-loop systems to minimize waste and emissions. Some companies are exploring alternative raw materials and production methods to reduce their environmental footprint.

Regulatory bodies worldwide are increasingly focusing on the environmental aspects of isocyanate manufacturing. Stricter emissions standards, waste management regulations, and requirements for environmental impact assessments are being implemented in many countries. These regulations aim to mitigate the negative environmental effects of isocyanate production while supporting sustainable market growth.

Regulatory Framework for Isocyanate Industry

The regulatory framework for the isocyanate industry plays a crucial role in shaping market dynamics and driving expansion. Governments worldwide have implemented stringent regulations to ensure the safe production, handling, and use of isocyanates, given their potential health and environmental risks. These regulations have a significant impact on market growth, product development, and industry practices.

In the United States, the Occupational Safety and Health Administration (OSHA) has established comprehensive standards for isocyanate exposure in the workplace. These standards set permissible exposure limits (PELs) and require employers to implement engineering controls, work practices, and personal protective equipment to minimize worker exposure. The Environmental Protection Agency (EPA) also regulates isocyanates under the Toxic Substances Control Act (TSCA), which mandates reporting, record-keeping, and testing requirements.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which applies to isocyanates and their derivatives. REACH requires manufacturers and importers to register chemicals and provide safety information, promoting the responsible use of these substances. Additionally, the Classification, Labeling, and Packaging (CLP) regulation ensures that hazards associated with isocyanates are clearly communicated to workers and consumers.

In Asia, countries like China and Japan have also strengthened their regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose strict requirements on the production, import, and use of isocyanates. These regulations aim to protect human health and the environment while promoting sustainable industry practices.

The global regulatory landscape for isocyanates is continuously evolving, with a trend towards harmonization of standards across regions. This harmonization facilitates international trade and ensures consistent safety practices worldwide. However, it also presents challenges for manufacturers and suppliers who must adapt to varying regulatory requirements in different markets.

Compliance with these regulations drives innovation in the isocyanate industry, encouraging the development of safer alternatives and improved production processes. Companies investing in research and development to create low-emission or non-isocyanate products gain a competitive advantage in the market. Furthermore, the regulatory framework promotes transparency and accountability, fostering trust among consumers and stakeholders.

As sustainability becomes increasingly important, regulations are expanding to address environmental concerns associated with isocyanates. This includes measures to reduce emissions, improve energy efficiency in production processes, and promote the use of bio-based raw materials. These evolving regulations are shaping the future of the isocyanate market, driving expansion through innovation and sustainable practices.

In the United States, the Occupational Safety and Health Administration (OSHA) has established comprehensive standards for isocyanate exposure in the workplace. These standards set permissible exposure limits (PELs) and require employers to implement engineering controls, work practices, and personal protective equipment to minimize worker exposure. The Environmental Protection Agency (EPA) also regulates isocyanates under the Toxic Substances Control Act (TSCA), which mandates reporting, record-keeping, and testing requirements.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which applies to isocyanates and their derivatives. REACH requires manufacturers and importers to register chemicals and provide safety information, promoting the responsible use of these substances. Additionally, the Classification, Labeling, and Packaging (CLP) regulation ensures that hazards associated with isocyanates are clearly communicated to workers and consumers.

In Asia, countries like China and Japan have also strengthened their regulatory frameworks. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose strict requirements on the production, import, and use of isocyanates. These regulations aim to protect human health and the environment while promoting sustainable industry practices.

The global regulatory landscape for isocyanates is continuously evolving, with a trend towards harmonization of standards across regions. This harmonization facilitates international trade and ensures consistent safety practices worldwide. However, it also presents challenges for manufacturers and suppliers who must adapt to varying regulatory requirements in different markets.

Compliance with these regulations drives innovation in the isocyanate industry, encouraging the development of safer alternatives and improved production processes. Companies investing in research and development to create low-emission or non-isocyanate products gain a competitive advantage in the market. Furthermore, the regulatory framework promotes transparency and accountability, fostering trust among consumers and stakeholders.

As sustainability becomes increasingly important, regulations are expanding to address environmental concerns associated with isocyanates. This includes measures to reduce emissions, improve energy efficiency in production processes, and promote the use of bio-based raw materials. These evolving regulations are shaping the future of the isocyanate market, driving expansion through innovation and sustainable practices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!