Isocyanate Market Leaders Pushing Boundaries

JUL 10, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Isocyanate Evolution

The isocyanate industry has undergone significant evolution since its inception in the 1930s. Initially developed for polyurethane production, isocyanates have become integral to various sectors, including automotive, construction, and electronics. The evolution of isocyanates can be traced through several key phases, each marked by technological advancements and market demands.

In the early stages, the focus was primarily on developing basic isocyanate compounds like toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI). These foundational materials paved the way for the polyurethane revolution, enabling the production of flexible and rigid foams, coatings, and adhesives. As the industry matured, efforts shifted towards improving production efficiency and reducing environmental impact.

The 1970s and 1980s saw a surge in research aimed at enhancing the performance characteristics of isocyanates. This period witnessed the development of modified MDIs and specialized isocyanates tailored for specific applications. Innovations in catalyst technology and processing techniques allowed for better control over reaction kinetics, resulting in improved product quality and consistency.

Environmental concerns became a driving force for innovation in the 1990s and 2000s. The industry responded by developing low-emission isocyanates and exploring bio-based alternatives. Water-based polyurethane systems gained traction, reducing volatile organic compound (VOC) emissions. Simultaneously, efforts to improve worker safety led to the introduction of blocked isocyanates and encapsulation technologies.

Recent years have seen a focus on sustainability and circular economy principles. Market leaders are investing in recycling technologies for polyurethane products, aiming to recover and reuse isocyanates. Additionally, there's growing interest in non-isocyanate polyurethanes (NIPUs) as potential alternatives, though these technologies are still in early stages of development.

The digital revolution has also impacted isocyanate evolution. Advanced modeling and simulation tools now enable rapid prototyping and optimization of isocyanate-based formulations. This has accelerated product development cycles and allowed for more precise tailoring of material properties to meet specific application requirements.

Looking ahead, the isocyanate industry is poised for further transformation. Emerging trends include the development of smart, self-healing polyurethanes, and the integration of nanotechnology to enhance material properties. As market leaders continue to push boundaries, we can expect to see innovations that address global challenges such as energy efficiency, resource conservation, and climate change mitigation.

In the early stages, the focus was primarily on developing basic isocyanate compounds like toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI). These foundational materials paved the way for the polyurethane revolution, enabling the production of flexible and rigid foams, coatings, and adhesives. As the industry matured, efforts shifted towards improving production efficiency and reducing environmental impact.

The 1970s and 1980s saw a surge in research aimed at enhancing the performance characteristics of isocyanates. This period witnessed the development of modified MDIs and specialized isocyanates tailored for specific applications. Innovations in catalyst technology and processing techniques allowed for better control over reaction kinetics, resulting in improved product quality and consistency.

Environmental concerns became a driving force for innovation in the 1990s and 2000s. The industry responded by developing low-emission isocyanates and exploring bio-based alternatives. Water-based polyurethane systems gained traction, reducing volatile organic compound (VOC) emissions. Simultaneously, efforts to improve worker safety led to the introduction of blocked isocyanates and encapsulation technologies.

Recent years have seen a focus on sustainability and circular economy principles. Market leaders are investing in recycling technologies for polyurethane products, aiming to recover and reuse isocyanates. Additionally, there's growing interest in non-isocyanate polyurethanes (NIPUs) as potential alternatives, though these technologies are still in early stages of development.

The digital revolution has also impacted isocyanate evolution. Advanced modeling and simulation tools now enable rapid prototyping and optimization of isocyanate-based formulations. This has accelerated product development cycles and allowed for more precise tailoring of material properties to meet specific application requirements.

Looking ahead, the isocyanate industry is poised for further transformation. Emerging trends include the development of smart, self-healing polyurethanes, and the integration of nanotechnology to enhance material properties. As market leaders continue to push boundaries, we can expect to see innovations that address global challenges such as energy efficiency, resource conservation, and climate change mitigation.

Market Demand Analysis

The isocyanate market has been experiencing significant growth and transformation, driven by increasing demand across various industries. The global isocyanate market size was valued at approximately $30 billion in 2020 and is projected to reach $45 billion by 2026, growing at a CAGR of around 6% during the forecast period. This robust growth is primarily attributed to the rising demand for polyurethane products in construction, automotive, and furniture industries.

In the construction sector, isocyanates are extensively used in the production of rigid foam insulation, which is crucial for energy-efficient buildings. The growing emphasis on sustainable construction practices and stringent energy efficiency regulations are driving the demand for polyurethane-based insulation materials. Additionally, the automotive industry's shift towards lightweight materials to improve fuel efficiency has led to increased adoption of polyurethane components, further boosting isocyanate demand.

The furniture industry is another significant consumer of isocyanates, particularly in the production of flexible foams for mattresses, sofas, and other upholstered products. The growing middle-class population in emerging economies and the trend towards urbanization have contributed to the increased demand for furniture, consequently driving isocyanate consumption.

Geographically, Asia-Pacific remains the largest and fastest-growing market for isocyanates, accounting for over 40% of the global demand. This is primarily due to rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe follow as significant markets, with steady growth driven by technological advancements and increasing applications in various end-use industries.

However, the isocyanate market faces challenges related to environmental and health concerns. Isocyanates are known to be potential respiratory sensitizers and can cause occupational asthma. This has led to increased regulatory scrutiny and a push towards developing safer alternatives. Market leaders are investing in research and development to address these concerns and develop more environmentally friendly and sustainable isocyanate-based products.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain disruptions and reduced demand from end-use industries. However, the market has shown resilience and is expected to recover quickly, driven by the resumption of construction activities and the automotive sector's recovery. The pandemic has also created new opportunities, such as increased demand for medical-grade polyurethane products used in healthcare applications.

In conclusion, the isocyanate market is poised for continued growth, driven by expanding applications and technological advancements. Market leaders are focusing on innovation, sustainability, and addressing environmental concerns to maintain their competitive edge and capitalize on emerging opportunities in this dynamic market landscape.

In the construction sector, isocyanates are extensively used in the production of rigid foam insulation, which is crucial for energy-efficient buildings. The growing emphasis on sustainable construction practices and stringent energy efficiency regulations are driving the demand for polyurethane-based insulation materials. Additionally, the automotive industry's shift towards lightweight materials to improve fuel efficiency has led to increased adoption of polyurethane components, further boosting isocyanate demand.

The furniture industry is another significant consumer of isocyanates, particularly in the production of flexible foams for mattresses, sofas, and other upholstered products. The growing middle-class population in emerging economies and the trend towards urbanization have contributed to the increased demand for furniture, consequently driving isocyanate consumption.

Geographically, Asia-Pacific remains the largest and fastest-growing market for isocyanates, accounting for over 40% of the global demand. This is primarily due to rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe follow as significant markets, with steady growth driven by technological advancements and increasing applications in various end-use industries.

However, the isocyanate market faces challenges related to environmental and health concerns. Isocyanates are known to be potential respiratory sensitizers and can cause occupational asthma. This has led to increased regulatory scrutiny and a push towards developing safer alternatives. Market leaders are investing in research and development to address these concerns and develop more environmentally friendly and sustainable isocyanate-based products.

The COVID-19 pandemic initially disrupted the isocyanate market due to supply chain disruptions and reduced demand from end-use industries. However, the market has shown resilience and is expected to recover quickly, driven by the resumption of construction activities and the automotive sector's recovery. The pandemic has also created new opportunities, such as increased demand for medical-grade polyurethane products used in healthcare applications.

In conclusion, the isocyanate market is poised for continued growth, driven by expanding applications and technological advancements. Market leaders are focusing on innovation, sustainability, and addressing environmental concerns to maintain their competitive edge and capitalize on emerging opportunities in this dynamic market landscape.

Technical Challenges

The isocyanate market is currently facing several significant technical challenges that are shaping the industry's landscape and driving innovation. One of the primary obstacles is the ongoing need for more sustainable and environmentally friendly production processes. Traditional isocyanate manufacturing methods often involve the use of toxic and hazardous materials, such as phosgene, which pose risks to both workers and the environment. Market leaders are actively seeking alternative synthesis routes that reduce or eliminate these harmful substances while maintaining product quality and efficiency.

Another major challenge lies in the development of bio-based isocyanates. As the demand for sustainable products grows, there is increasing pressure to move away from petroleum-based raw materials. However, creating bio-based isocyanates that match the performance characteristics of their conventional counterparts remains a complex task. Researchers are exploring various renewable feedstocks and novel chemical pathways to produce isocyanates with comparable properties and cost-effectiveness.

The industry is also grappling with the need for improved energy efficiency in production processes. Isocyanate synthesis typically requires high temperatures and pressures, resulting in significant energy consumption. Developing catalysts and reaction conditions that allow for lower energy inputs without compromising yield or product quality is a key focus area for many market leaders.

Additionally, there is a growing emphasis on enhancing the safety profile of isocyanate products. While isocyanates are essential in many applications, they can pose health risks if not handled properly. Technical challenges include developing formulations with reduced volatility and improved handling characteristics, as well as creating more effective personal protective equipment for workers in manufacturing and end-use settings.

The push for circular economy principles presents another set of technical hurdles. Recycling and reusing isocyanate-based products, particularly polyurethanes, is complicated by their cross-linked structure. Innovators are working on chemical recycling methods and designing products with end-of-life considerations in mind, but scalable solutions remain elusive.

Furthermore, the industry faces challenges in optimizing isocyanate performance for emerging applications. As new markets open up in areas such as advanced composites, 3D printing, and high-performance coatings, there is a need to tailor isocyanate properties to meet specific requirements. This often involves complex molecular design and formulation work to achieve the desired balance of reactivity, durability, and other performance attributes.

Lastly, the ongoing global regulatory landscape poses technical challenges in terms of compliance and adaptation. As regulations become more stringent, particularly regarding emissions and exposure limits, manufacturers must continuously innovate to meet these standards while maintaining product performance and economic viability.

Another major challenge lies in the development of bio-based isocyanates. As the demand for sustainable products grows, there is increasing pressure to move away from petroleum-based raw materials. However, creating bio-based isocyanates that match the performance characteristics of their conventional counterparts remains a complex task. Researchers are exploring various renewable feedstocks and novel chemical pathways to produce isocyanates with comparable properties and cost-effectiveness.

The industry is also grappling with the need for improved energy efficiency in production processes. Isocyanate synthesis typically requires high temperatures and pressures, resulting in significant energy consumption. Developing catalysts and reaction conditions that allow for lower energy inputs without compromising yield or product quality is a key focus area for many market leaders.

Additionally, there is a growing emphasis on enhancing the safety profile of isocyanate products. While isocyanates are essential in many applications, they can pose health risks if not handled properly. Technical challenges include developing formulations with reduced volatility and improved handling characteristics, as well as creating more effective personal protective equipment for workers in manufacturing and end-use settings.

The push for circular economy principles presents another set of technical hurdles. Recycling and reusing isocyanate-based products, particularly polyurethanes, is complicated by their cross-linked structure. Innovators are working on chemical recycling methods and designing products with end-of-life considerations in mind, but scalable solutions remain elusive.

Furthermore, the industry faces challenges in optimizing isocyanate performance for emerging applications. As new markets open up in areas such as advanced composites, 3D printing, and high-performance coatings, there is a need to tailor isocyanate properties to meet specific requirements. This often involves complex molecular design and formulation work to achieve the desired balance of reactivity, durability, and other performance attributes.

Lastly, the ongoing global regulatory landscape poses technical challenges in terms of compliance and adaptation. As regulations become more stringent, particularly regarding emissions and exposure limits, manufacturers must continuously innovate to meet these standards while maintaining product performance and economic viability.

Current Solutions

01 Synthesis and applications of isocyanates

Isocyanates are versatile compounds used in various industrial applications. They are key ingredients in the production of polyurethanes, coatings, adhesives, and elastomers. The synthesis of isocyanates often involves the reaction of amines with phosgene or alternative routes to avoid the use of toxic phosgene. These compounds play a crucial role in the development of high-performance materials with specific properties.- Synthesis and modification of isocyanates: This category focuses on methods for synthesizing isocyanates and modifying their chemical structure. It includes processes for producing various types of isocyanates, such as aliphatic and aromatic isocyanates, as well as techniques for altering their properties through chemical modifications.

- Isocyanate-based polymers and coatings: This point covers the use of isocyanates in the production of polymers and coatings. It includes the development of polyurethanes, polyureas, and other isocyanate-based materials used in various applications such as adhesives, sealants, and protective coatings.

- Isocyanate formulations for specific applications: This category deals with specialized isocyanate formulations designed for specific industrial or commercial applications. It includes tailored isocyanate compositions for use in areas such as automotive, construction, and electronics industries.

- Isocyanate handling and safety measures: This point addresses the safe handling and use of isocyanates in industrial settings. It covers methods for reducing exposure risks, proper storage techniques, and safety protocols for working with these reactive compounds.

- Environmental and health considerations of isocyanates: This category focuses on the environmental impact and health effects of isocyanates. It includes research on biodegradable isocyanates, methods for reducing emissions, and studies on the potential health risks associated with isocyanate exposure.

02 Isocyanate-based polyurethane formulations

Polyurethane formulations using isocyanates are widely used in various industries. These formulations typically involve the reaction of isocyanates with polyols to create polymers with specific characteristics. The choice of isocyanates and polyols, along with additives and catalysts, allows for the tailoring of properties such as flexibility, durability, and chemical resistance. Applications include foams, coatings, and adhesives.Expand Specific Solutions03 Isocyanate-free alternatives and environmentally friendly approaches

Due to health and environmental concerns associated with isocyanates, there is growing interest in developing isocyanate-free alternatives. These approaches focus on creating materials with similar properties to traditional isocyanate-based products but using less hazardous chemicals. Research in this area includes the development of bio-based materials, non-isocyanate polyurethanes, and alternative crosslinking chemistries.Expand Specific Solutions04 Isocyanate handling and safety measures

Proper handling and safety measures are crucial when working with isocyanates due to their potential health hazards. This includes the use of personal protective equipment, proper ventilation systems, and specialized storage and disposal procedures. Training programs and safety protocols are implemented to minimize exposure risks and ensure safe handling in industrial settings.Expand Specific Solutions05 Isocyanate modifications and derivatives

Modifications and derivatives of isocyanates are developed to enhance their properties or create specialized compounds. These modifications can include the creation of blocked isocyanates, isocyanate prepolymers, or the incorporation of additional functional groups. Such modifications aim to improve reactivity, reduce volatility, or introduce specific characteristics for targeted applications in various industries.Expand Specific Solutions

Key Industry Players

The isocyanate market is in a mature growth phase, characterized by steady demand and established players pushing technological boundaries. The global market size is substantial, driven by diverse applications in polyurethanes, coatings, and adhesives. Technologically, the industry is advancing, with key players like Wanhua Chemical, Bayer AG, and Mitsui Chemicals leading innovation. These companies are focusing on developing eco-friendly alternatives and improving production efficiency. Other significant contributors include BASF, Covestro, and Huntsman Corporation, all investing in R&D to maintain competitive edges. The market's maturity is evident in the consolidation of major players and their emphasis on sustainability and product diversification to meet evolving customer needs.

Wanhua Chemical Group Co., Ltd.

Technical Solution: Wanhua Chemical Group is a global leader in isocyanate production, particularly MDI (methylene diphenyl diisocyanate). They have developed innovative technologies for isocyanate synthesis, including a proprietary continuous flow process that improves efficiency and reduces environmental impact[1]. Their advanced catalysts and reactor designs allow for higher yields and purity of isocyanates[2]. Wanhua has also invested in bio-based isocyanates, using renewable feedstocks to create more sustainable products[3]. Their research focuses on improving the performance of isocyanate-based materials, such as polyurethanes, with enhanced thermal and mechanical properties[4].

Strengths: Large-scale production capacity, advanced technology, and a strong focus on sustainability. Weaknesses: Heavy reliance on petrochemical feedstocks for most products, potential vulnerability to raw material price fluctuations.

Bayer AG

Technical Solution: Bayer AG, through its MaterialScience division (now Covestro), has been a pioneer in isocyanate technology. They have developed novel aliphatic isocyanates with improved UV stability and weathering resistance[5]. Bayer's research has led to the creation of high-performance polyisocyanates for automotive and industrial coatings[6]. They have also made significant advancements in waterborne polyurethane dispersions, reducing VOC emissions in various applications[7]. Bayer's isocyanate portfolio includes specialized products for adhesives, sealants, and elastomers, with a focus on enhancing durability and chemical resistance[8].

Strengths: Diverse product portfolio, strong R&D capabilities, and a global presence. Weaknesses: Increasing competition from emerging markets, regulatory challenges in some regions.

Breakthrough Patents

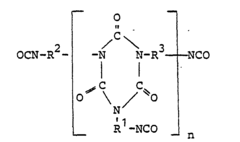

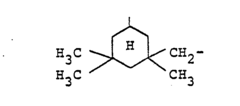

Process for the preparation of isocyanurates containing isocyanate groups the products obtained by the process and their application as isocyanate component in polyurethane lacquers

PatentInactiveEP0047452A1

Innovation

- A process involving the catalytic trimerization of a mixture of hexamethylene diisocyanate and 1-isocyanato-3,3,5-trimethyl-5-isocyanatomethyl-cyclohexane (IPDI) to produce isocyanato-isocyanurates with a specific molar ratio, which allows for clear, low-viscosity solutions in weakly polar solvents and enhanced hardness and elasticity, even at low temperatures.

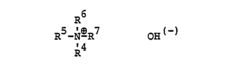

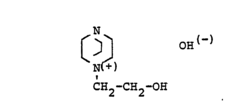

Measurement of total reactive isocyanate groups in samples using bifunctional nucleophiles such as 1,8-diaminonaphthalene (DAN)

PatentInactiveEP1579207A2

Innovation

- A method using 1,8-diaminonaphthalene (DAN) as a bifunctional nucleophilic isocyanate derivatizing agent that reacts with isocyanates to form a cyclic reaction product, allowing for the detection and quantification of total isocyanate groups regardless of the specific species present, using a two-step process of derivatization and cyclization.

Environmental Impact

The isocyanate industry's environmental impact has become a critical concern as market leaders push boundaries in production and application. The manufacturing process of isocyanates involves the use of hazardous chemicals and energy-intensive operations, leading to significant environmental challenges. Air emissions from isocyanate production facilities can include volatile organic compounds (VOCs), particulate matter, and greenhouse gases, contributing to air pollution and climate change.

Water pollution is another major environmental issue associated with isocyanate production. Wastewater from manufacturing processes may contain toxic chemicals, requiring extensive treatment before discharge. Improper handling or disposal of isocyanate-containing materials can lead to soil contamination, potentially affecting ecosystems and groundwater quality.

As market leaders strive for innovation and increased production, they are also focusing on developing more sustainable practices. Many companies are investing in cleaner production technologies, such as closed-loop systems and advanced catalysts, to reduce emissions and improve energy efficiency. Some manufacturers are exploring bio-based alternatives to traditional petroleum-derived isocyanates, aiming to decrease their carbon footprint and reliance on non-renewable resources.

Waste reduction and recycling initiatives are gaining traction within the industry. Companies are implementing strategies to minimize waste generation during production and exploring ways to recycle or repurpose byproducts. Additionally, there is a growing emphasis on product stewardship, with manufacturers taking responsibility for the entire lifecycle of their isocyanate products, from production to disposal.

The environmental impact of isocyanates extends beyond production to their use in various applications. In the construction and automotive industries, for example, isocyanate-based products like polyurethane foams can contribute to improved energy efficiency in buildings and vehicles. However, concerns about off-gassing and indoor air quality have led to increased scrutiny and the development of low-emission formulations.

As regulatory pressures mount and consumer awareness grows, isocyanate market leaders are increasingly prioritizing environmental sustainability. This shift is driving research into greener chemistries and more eco-friendly production methods. Some companies are adopting life cycle assessment (LCA) approaches to comprehensively evaluate the environmental impact of their products and processes, enabling more informed decision-making and targeted improvements.

The industry's efforts to address environmental concerns are not without challenges. Balancing the demand for high-performance isocyanate products with environmental sustainability requires significant investment in research and development, as well as potential trade-offs in product performance or cost. Nevertheless, the ongoing push towards more sustainable practices is reshaping the competitive landscape and driving innovation in the isocyanate market.

Water pollution is another major environmental issue associated with isocyanate production. Wastewater from manufacturing processes may contain toxic chemicals, requiring extensive treatment before discharge. Improper handling or disposal of isocyanate-containing materials can lead to soil contamination, potentially affecting ecosystems and groundwater quality.

As market leaders strive for innovation and increased production, they are also focusing on developing more sustainable practices. Many companies are investing in cleaner production technologies, such as closed-loop systems and advanced catalysts, to reduce emissions and improve energy efficiency. Some manufacturers are exploring bio-based alternatives to traditional petroleum-derived isocyanates, aiming to decrease their carbon footprint and reliance on non-renewable resources.

Waste reduction and recycling initiatives are gaining traction within the industry. Companies are implementing strategies to minimize waste generation during production and exploring ways to recycle or repurpose byproducts. Additionally, there is a growing emphasis on product stewardship, with manufacturers taking responsibility for the entire lifecycle of their isocyanate products, from production to disposal.

The environmental impact of isocyanates extends beyond production to their use in various applications. In the construction and automotive industries, for example, isocyanate-based products like polyurethane foams can contribute to improved energy efficiency in buildings and vehicles. However, concerns about off-gassing and indoor air quality have led to increased scrutiny and the development of low-emission formulations.

As regulatory pressures mount and consumer awareness grows, isocyanate market leaders are increasingly prioritizing environmental sustainability. This shift is driving research into greener chemistries and more eco-friendly production methods. Some companies are adopting life cycle assessment (LCA) approaches to comprehensively evaluate the environmental impact of their products and processes, enabling more informed decision-making and targeted improvements.

The industry's efforts to address environmental concerns are not without challenges. Balancing the demand for high-performance isocyanate products with environmental sustainability requires significant investment in research and development, as well as potential trade-offs in product performance or cost. Nevertheless, the ongoing push towards more sustainable practices is reshaping the competitive landscape and driving innovation in the isocyanate market.

Regulatory Framework

The regulatory framework surrounding isocyanates plays a crucial role in shaping the market dynamics and driving innovation among industry leaders. As environmental and health concerns gain prominence, regulatory bodies worldwide have implemented stringent guidelines to govern the production, handling, and use of isocyanates.

In the United States, the Occupational Safety and Health Administration (OSHA) has established comprehensive standards for occupational exposure to isocyanates. These regulations mandate strict workplace safety measures, including personal protective equipment, ventilation systems, and regular health monitoring for workers. The Environmental Protection Agency (EPA) also enforces regulations under the Toxic Substances Control Act (TSCA) to control the environmental impact of isocyanate production and disposal.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers to register and assess the risks associated with isocyanates. This framework has prompted companies to invest in developing safer alternatives and improving existing formulations to comply with regulatory requirements.

In Asia, countries like China and Japan have also tightened their regulatory oversight of isocyanates. China's Ministry of Ecology and Environment has introduced stricter emission standards for isocyanate production facilities, while Japan's Ministry of Health, Labour and Welfare has set occupational exposure limits and mandated risk assessments for isocyanate-related industries.

These regulatory pressures have spurred market leaders to push boundaries in developing innovative solutions. Companies are investing in research and development to create low-emission and low-toxicity isocyanate formulations that meet or exceed regulatory standards. This has led to the emergence of new product lines, such as water-based polyurethanes and bio-based isocyanates, which offer improved environmental and safety profiles.

Furthermore, the regulatory landscape has fostered collaboration between industry players and regulatory bodies. Many leading isocyanate manufacturers are actively participating in voluntary stewardship programs and industry initiatives to promote best practices in isocyanate handling and use. These efforts not only ensure compliance but also contribute to shaping future regulations through informed dialogue with policymakers.

As regulations continue to evolve, market leaders are adopting proactive approaches to stay ahead of compliance requirements. This includes implementing advanced monitoring systems, developing comprehensive product stewardship programs, and investing in employee training and education. By embracing these challenges, industry leaders are not only meeting regulatory demands but also gaining competitive advantages through enhanced product safety and sustainability.

In the United States, the Occupational Safety and Health Administration (OSHA) has established comprehensive standards for occupational exposure to isocyanates. These regulations mandate strict workplace safety measures, including personal protective equipment, ventilation systems, and regular health monitoring for workers. The Environmental Protection Agency (EPA) also enforces regulations under the Toxic Substances Control Act (TSCA) to control the environmental impact of isocyanate production and disposal.

The European Union has implemented the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which requires manufacturers and importers to register and assess the risks associated with isocyanates. This framework has prompted companies to invest in developing safer alternatives and improving existing formulations to comply with regulatory requirements.

In Asia, countries like China and Japan have also tightened their regulatory oversight of isocyanates. China's Ministry of Ecology and Environment has introduced stricter emission standards for isocyanate production facilities, while Japan's Ministry of Health, Labour and Welfare has set occupational exposure limits and mandated risk assessments for isocyanate-related industries.

These regulatory pressures have spurred market leaders to push boundaries in developing innovative solutions. Companies are investing in research and development to create low-emission and low-toxicity isocyanate formulations that meet or exceed regulatory standards. This has led to the emergence of new product lines, such as water-based polyurethanes and bio-based isocyanates, which offer improved environmental and safety profiles.

Furthermore, the regulatory landscape has fostered collaboration between industry players and regulatory bodies. Many leading isocyanate manufacturers are actively participating in voluntary stewardship programs and industry initiatives to promote best practices in isocyanate handling and use. These efforts not only ensure compliance but also contribute to shaping future regulations through informed dialogue with policymakers.

As regulations continue to evolve, market leaders are adopting proactive approaches to stay ahead of compliance requirements. This includes implementing advanced monitoring systems, developing comprehensive product stewardship programs, and investing in employee training and education. By embracing these challenges, industry leaders are not only meeting regulatory demands but also gaining competitive advantages through enhanced product safety and sustainability.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!